ORIGINFORMSTUDIO.COM – SBA Form 3508EZ – PPP EZ Loan Forgiveness Application + Instructions – The Small Business Administration (SBA) has created an easy-to-use tool for small business owners to apply for Paycheck Protection Program (PPP) loan forgiveness through their Form 3508EZ. This form is a simplified version of the original PPP loan forgiveness application and offers streamlined instructions that make it easier to understand the process and complete the required documents. The SBA continues to provide guidance and resources regarding PPP loan forgiveness as well as detailed instructions on how to fill out Form 3508EZ correctly.

Download SBA Form 3508EZ – PPP EZ Loan Forgiveness Application + Instructions

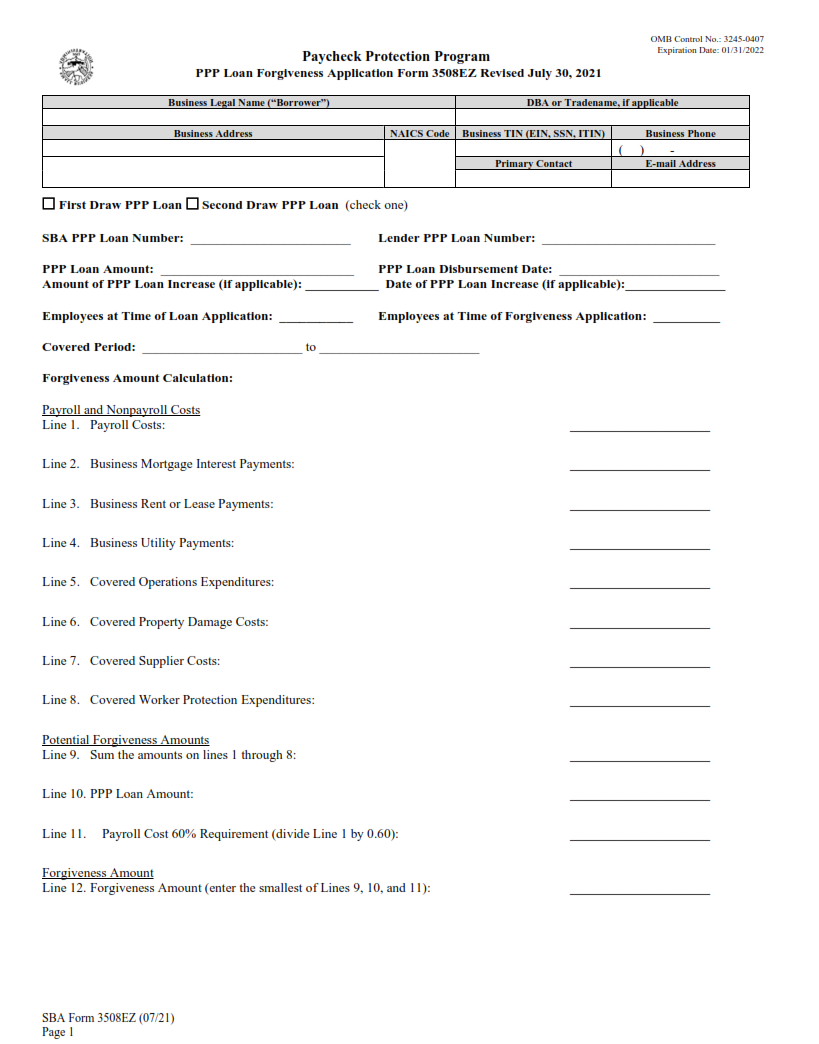

| Form Number | SBA Form 3508EZ |

| Form Title | PPP EZ Loan Forgiveness Application + Instructions |

| File Size | 357 KB |

| Form By | SBA Forms |

What is an SBA Form 3508EZ?

The SBA Form 3508EZ is an application for loan forgiveness under the Paycheck Protection Program (PPP). It was created by the U.S. Small Business Administration (SBA) and is used to apply for loan forgiveness on PPP loans of $50,000 or less. The form includes information about how much you borrowed, as well as details about how you used the money to help keep your business running during COVID-19. You must provide documentation that shows you’ve spent at least 60% of your PPP loan on payroll costs in order to have your loan forgiven.

The key difference between this form and the traditional SBA Form 3508 is that it requires fewer calculations and documents to qualify for loan forgiveness than the original form does.

What is the Purpose of SBA Form 3508EZ?

The Small Business Administration (SBA) Form 3508EZ is an easy-to-use form designed to help small businesses apply for Paycheck Protection Program (PPP) loan forgiveness. The purpose of the form is to provide borrowers with a simplified application process that requires less documentation.

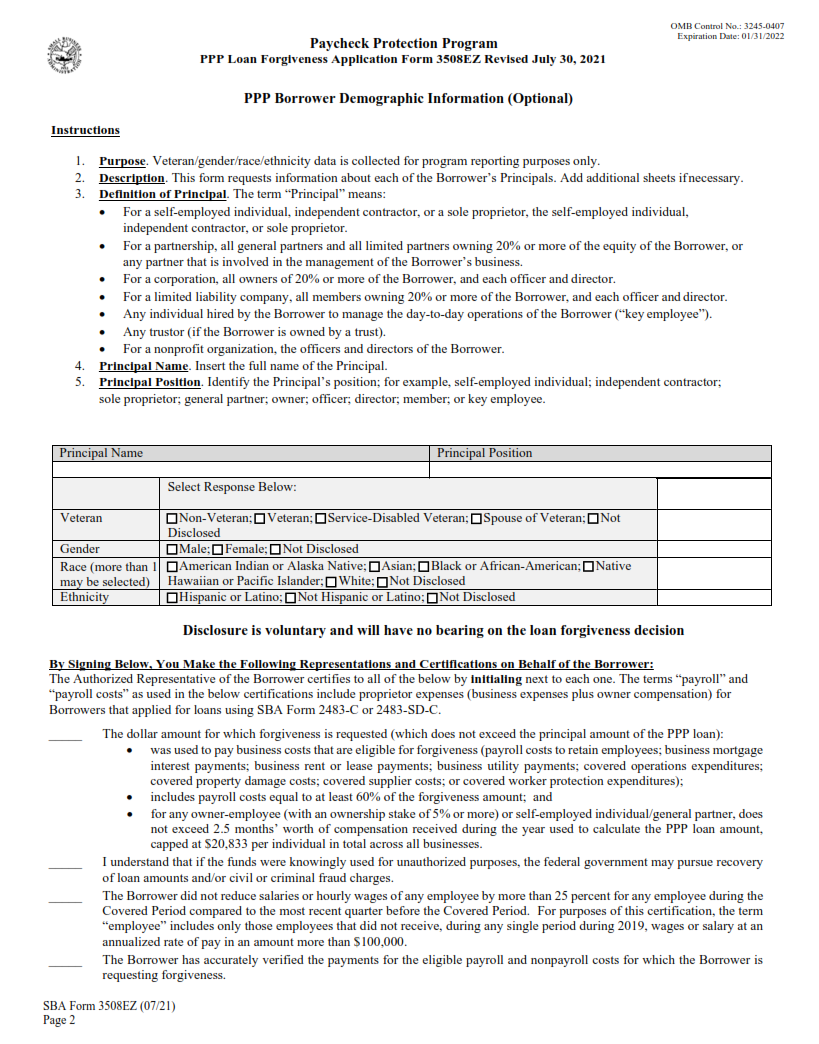

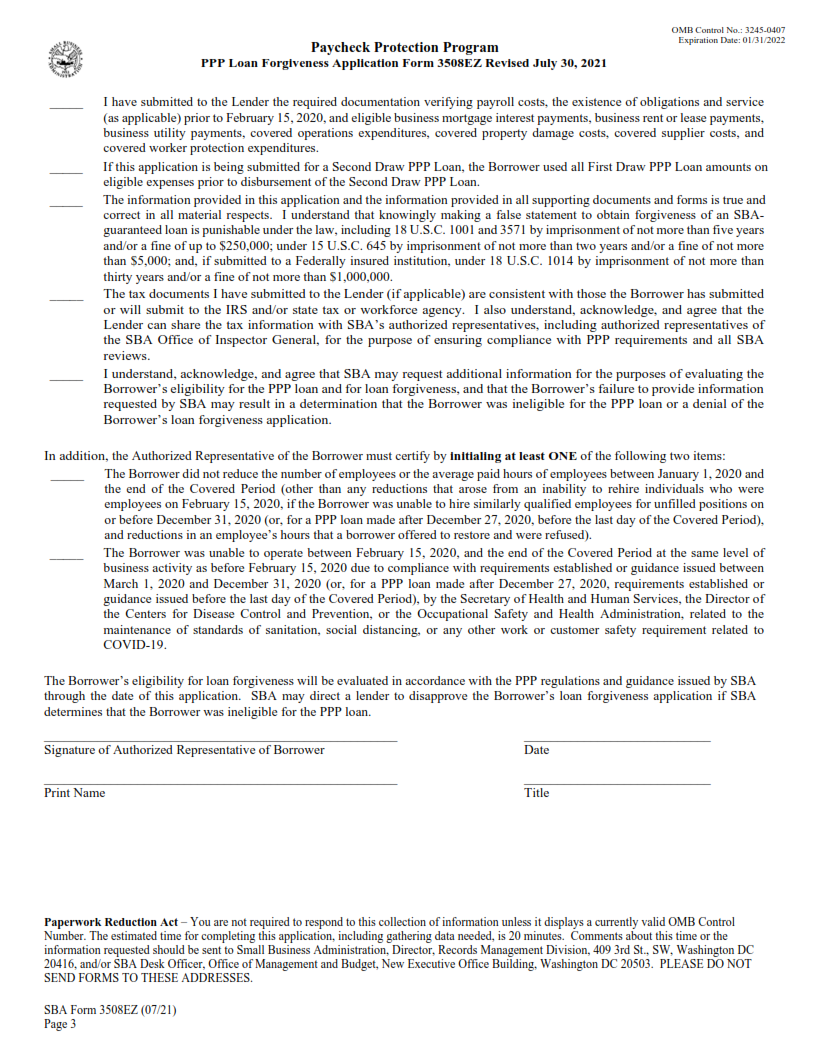

The SBA Form 3508EZ is intended for borrowers who meet certain criteria, including those who are self-employed or have no employees and did not reduce salaries or wages by more than 25%. It also applies to borrowers who experienced reductions in business activity due to health directives related to COVID-19 and did not reduce salaries or wages by more than 25%. Borrowers that do not meet these criteria must use the traditional SBA Form 3508.

Where Can I Find an SBA Form 3508EZ?

The SBA Form 3508EZ is the form used for businesses seeking loan forgiveness under the Paycheck Protection Program (PPP). This form can be found on the Small Business Administration (SBA) website. The SBA offers a wide range of forms and resources that can help business owners apply for loan forgiveness with ease.

The 3508EZ form is straightforward and easy to complete. It requires basic information such as business name, address, contact information, number of employees, and costs associated with maintaining employee payroll during the covered period. It also requires a certification from the borrower that all of the information provided is accurate and complete. Once completed, borrowers must submit their application along with supporting documents to their lenders or creditors for review.

SBA Form 3508EZ – PPP EZ Loan Forgiveness Application + Instructions

Small business owners who took out a Paycheck Protection Program (PPP) loan may be eligible for loan forgiveness using SBA Form 3508EZ. This form is the EZ version of the standard PPP Loan Forgiveness Application and allows businesses with fewer than 500 employees to apply for forgiveness on their loan. The instructions outlined here will help small business owners complete the form correctly.

The first step in completing SBA Form 3508EZ is to provide basic information, such as borrower contact information, lender name and address, number of employees, and total payroll costs during the covered period. After providing this information, borrowers must then calculate their maximum loan amount by entering their eligible payroll costs into the appropriate fields on the form. Borrowers must then enter their actual loan amount and any other source of funds used during this period.

SBA Form 3508EZ Example