W2 Form 2023 Printable – The W2 form is an important document used to report an employee’s annual wages and taxes withheld. This document is issued by an employer to each employee and is used to file taxes with the IRS. In this post, we will discuss the importance of the W2 form, who needs one, and why it is important.

What is the New W2 Form 2023?

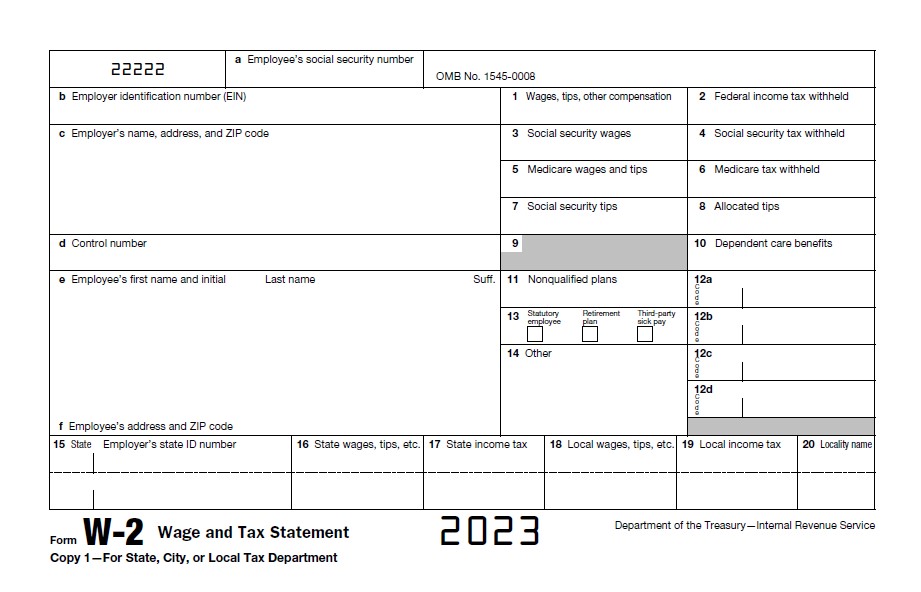

The W2 form includes important information such as the employee’s wages, tips, and other compensation received throughout the year and federal, state, and other taxes withheld. When reading a W2 form, it’s important to understand what each section means and how to interpret the information. Some common mistakes to avoid include incorrect social security numbers, wrong tax withheld amounts, and missing information.

Don’t Let Tax Season Stress You Out: Master Filling Out Your W2 Form

Tax season can be stressful, especially when filling out important forms like the W2. But don’t let the complexity of the process get you down! With a little guidance, you can master the art of filling out your W2 form with ease. This post will provide tips and tricks to help you navigate this important tax document like a pro. Say goodbye to tax season stress and hello to confident W2 form completion.

To fill out the W2 form, you will need to follow these steps:

- Enter the employer’s information in box a-c, including their name, address, and Employer Identification Number (EIN).

- Fill out the employee’s information in boxes d-f, including their name, address, and social security number.

- Enter the total wages, tips, and other compensation received in box 1.

- Report federal income tax withheld in box 2.

- Report the total Social Security wages and the Social Security tax withheld in boxes 3 and 4.

- Report the total Medicare wages and the Medicare tax withheld in boxes 5 and 6.

- Report any additional taxes withheld in box 7.

- Enter any tips received in box 8.

- Report any allocated tips in box 9.

- If applicable, enter any dependent care benefits provided by the employer in box 10.

- Report the total amount of any deferred compensation in box 11.

- If applicable, enter the amount of state and local income taxes withheld in boxes 15-17.

- If applicable, enter any state disability insurance taxes withheld in box 14.

- Double-check all information for accuracy and completeness.

- Provide copies of the W2 form to the employee and the Social Security Administration.

Don’t let simple mistakes cost you big time during tax season. Ensuring the accuracy of your W2 form is crucial to avoid any headaches down the road. Remember these essential tips to breeze through the process like a pro. With a little attention to detail, you can submit an error-free W2 form and file your taxes with confidence. So grab a cup of coffee and dive into the tips and tricks for filling out your W2 form accurately and efficiently. Here are the tips:

- Double-check all information before submitting the form.

- Use the correct tax year for the form.

- Be sure to include all necessary information, such as the employer’s EIN and the employee’s social security number.

- Report all wages and taxes withheld accurately.

Save yourself from tax season mishaps by avoiding these common errors when filling out your W2 form. Common errors to avoid include:

- Entering incorrect social security numbers.

- Entering incorrect amounts for wages and taxes withheld.

- Failing to include all necessary information.

Don’t Miss the Deadline: Submit Your W2 Form with Confidence

The deadline for submitting the W2 form to the employee is January 31st of the following year. Employers must also submit the W2 form to the Social Security Administration by the end of February. Failure to submit the W2 form on time can result in penalties.

To submit the W2 form, employers can do so electronically through the Social Security Administration’s Business Services Online (BSO) website. Alternatively, employers can submit paper copies of the form to the Social Security Administration.

Penalties for not submitting the W2 form on time can be costly, so it’s important to ensure it is submitted accurately and on time.

Get Ready for Tax Season with Printable W2 Form 2023

Print The Recent: W-2 Form 2023 [PDF].