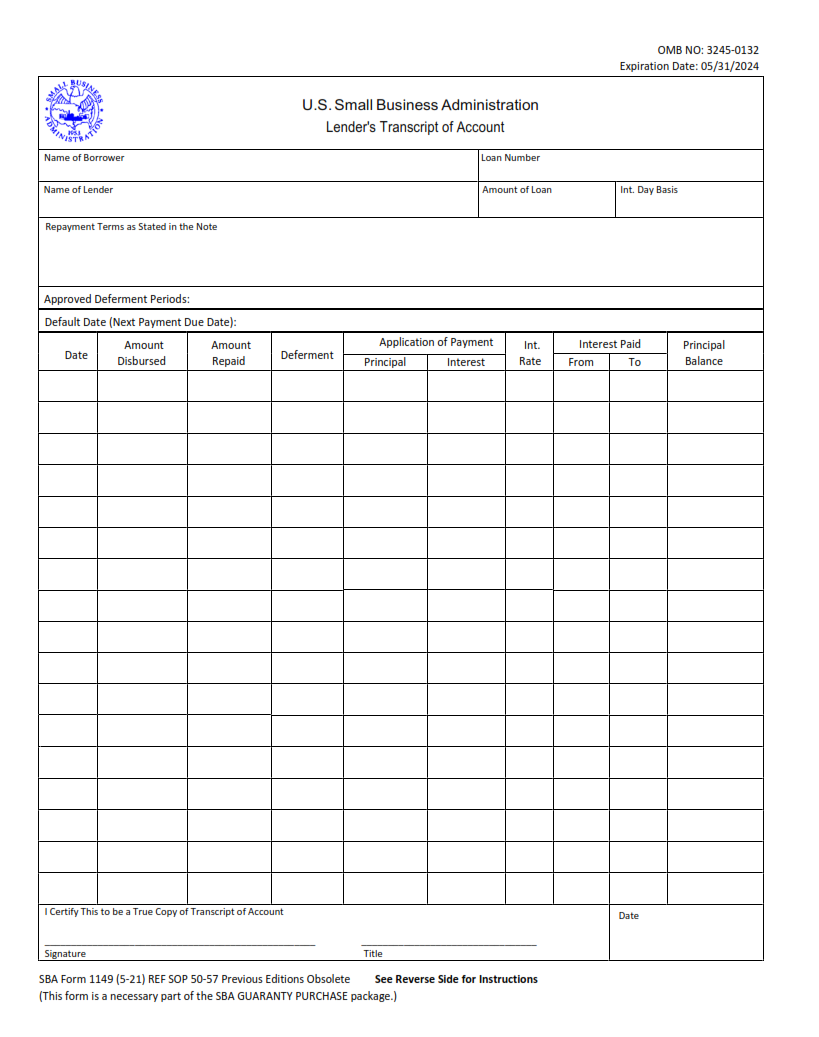

ORIGINFORMSTUDIO.COM – SBA Form 1149 – Lender’s Transcript of Account – SBA Form 1149, or the Lender’s Transcript of Account, is an important document for all businesses seeking a loan from the U.S. Small Business Administration (SBA). The form provides lenders with information on the past and current account balances of a borrower in order to determine if they are a viable candidate for a loan. It also serves as proof to lenders that the borrower is financially responsible and able to pay back the loan amount in full.

Download SBA Form 1149 – Lender’s Transcript of Account

| Form Number | SBA Form 1149 |

| Form Title | Lender’s Transcript of Account |

| File Size | 208 KB |

| Form By | SBA Forms |

What is an SBA Form 1149?

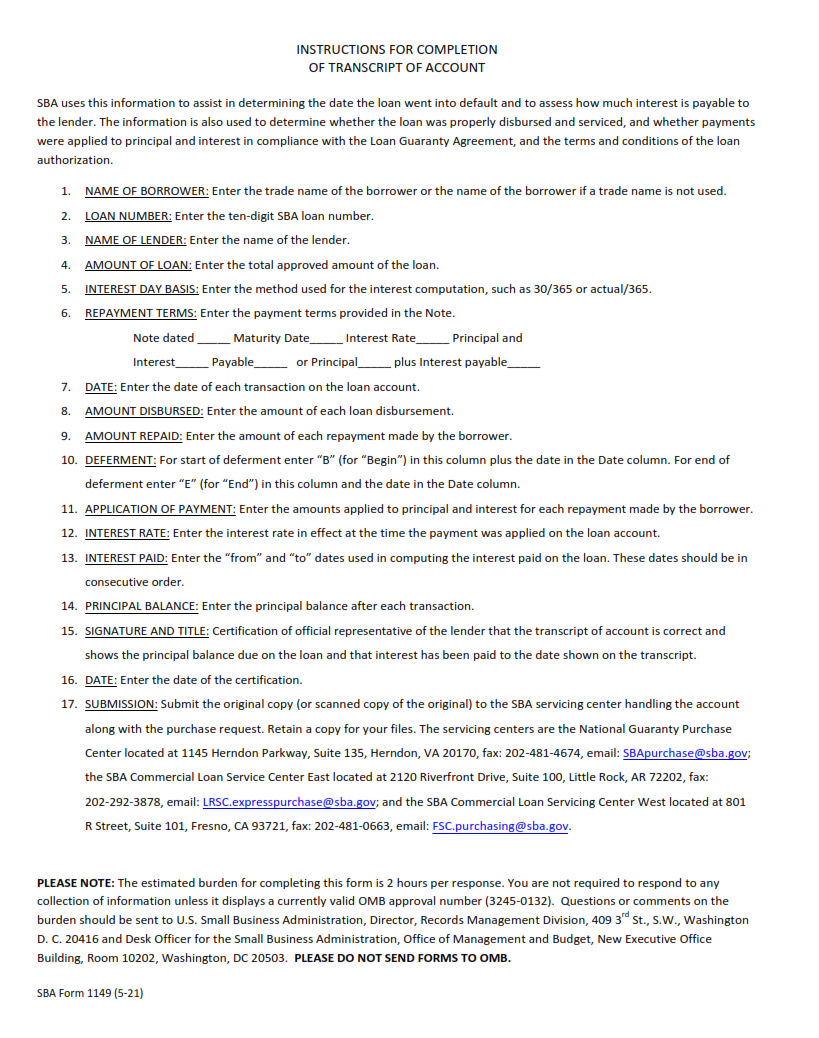

An SBA Form 1149 is a lender’s transcript of account form issued by the U.S. Small Business Administration (SBA). This form is used to document the financial status of an applicant for loan approval or to provide information on a borrower’s existing loan. The SBA Form 1149 includes the amount borrowed, assets that have been pledged as collateral, and other related details such as interest rate and payment history.

The SBA Form 1149 must be completed in full by both parties involved – the lender and borrower – and filed with either the lender or SBA office. It also contains important information regarding repayment terms, late fees, penalties, any defaults on payments, etc., which can help lenders make better decisions when evaluating an applicant’s creditworthiness.

What is the Purpose of SBA Form 1149?

The SBA Form 1149 is a transcript of the account that serves as a record of loan repayment history for lenders when processing and evaluating loan applications. It is used by the Small Business Administration (SBA) as proof of timely payments made on existing loans submitted by borrowers. This form provides an overview of the borrower’s payment history, creditworthiness, and financial stability in order to determine if they are eligible for any additional financing from the SBA.

The purpose of this form is to provide lenders with an accurate snapshot of a borrower’s past financial behavior so they can make informed decisions about future lending opportunities. It includes information such as the names and addresses of all lenders who have previously extended loans to the borrower, their current outstanding balances, total payments made over time, interest rates charged, previous late payments or defaults, and other related data points.

Where Can I Find an SBA Form 1149?

The Small Business Administration (SBA) Form 1149 is an important document that lenders use to verify customer creditworthiness. It provides a comprehensive overview of a borrower’s financial history and is used to help determine whether the borrower is eligible for an SBA loan. The form can be obtained from the lender or from the SBA website at https://www.sba.gov/document-library/forms/form-1149-lenders-transcript-account.

When filling out the form, borrowers will need to provide basic information about their finances, including income, debt obligations, payment history and other financial data. The form must also be signed by both the borrower and lender in order for it to be valid. Additionally, borrowers may need to provide additional documentation such as bank statements or tax returns when submitting this form.

SBA Form 1149 – Lender’s Transcript of Account

SBA Form 1149, also known as the Lender’s Transcript of Account, helps a borrower and lender document the repayment status of an SBA loan. This form is used to provide support when a borrower requests a loan modification or extension. It includes important information such as the total account balance at the time of closure, all payments made on the loan during that time frame, and other relevant details.

The form must be completed by both parties involved in the transaction and signed off by both before being submitted to the Small Business Administration (SBA). The information provided on this form is verified by SBA officials to ensure accuracy and reliability in order to make an informed decision regarding any requested changes or modifications. The Lender’s Transcript of Account can help lenders and borrowers reach agreements more quickly as well as provide transparency into how their accounts are managed over time.

SBA Form 1149 Example