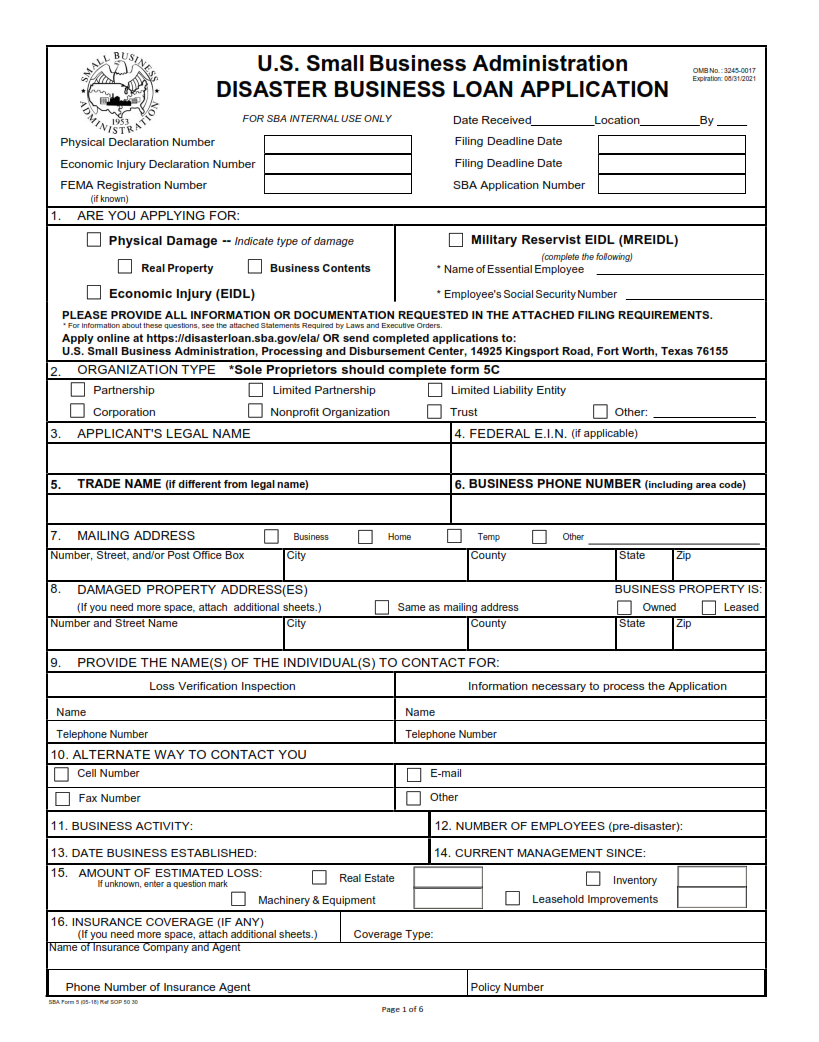

ORIGINFORMSTUDIO.COM – SBA Form 5 – Disaster Business Loan Application – The Small Business Administration (SBA) offers disaster loans for businesses that have experienced a major disruption due to natural disasters or other severe events. SBA Form 5, the Disaster Loan Application, is the form used to apply for these loans and can be found on the official SBA website. This article will provide an overview of what information is needed in order to complete this application, as well as giving an explanation of the different steps involved in submitting it and following up on your application status. Additionally, it will provide resources for further assistance if needed.

Download SBA Form 5 – Disaster Business Loan Application

| Form Number | SBA Form 5 |

| Form Title | Disaster Business Loan Application |

| File Size | 607 KB |

| Form By | SBA Forms |

What is an SBA Form 5?

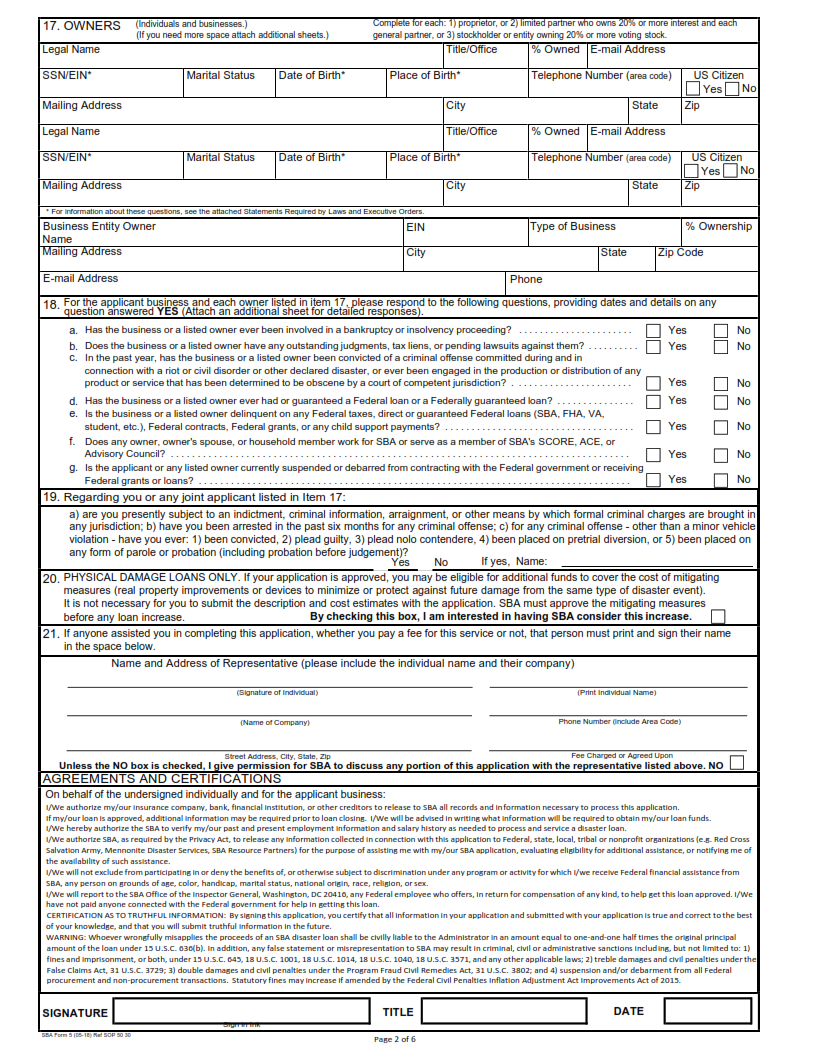

SBA Form 5 is a critical document for businesses looking to apply for disaster relief loans from the Small Business Administration (SBA). This form helps assess the amount and scope of assistance that applicants need, so it’s important that businesses fill out as much information accurately as possible. The form includes questions about loan terms, contact information, business history and other financial data.

To complete SBA Form 5, applicants must answer several questions about their company’s operations such as past sales figures and current inventory levels. Additionally, they are required to provide proof of their ability to repay the loan with tax returns or audited financial statements. This form also requires detailed information regarding any collateral used to secure the loan in addition to some personal demographic data on owners and employees of the business.

What is the Purpose of SBA Form 5?

The SBA Form 5, or the Disaster Business Loan Application, is an important form used by businesses to apply for economic injury disaster loans provided through the Small Business Association (SBA). This form helps the SBA decide which businesses are eligible for various loan programs and how much funding they will receive.

The purpose of this form is to provide a comprehensive overview of a business’s financial situation including the amount of money it needs to stay in business and any other information that may be relevant. It also helps determine a business’s eligibility for an SBA loan, as well as its ability to repay it. The form requires applicants to provide detailed information about their business’s operations, financial health, and history in order to help assess their creditworthiness and the likelihood of repayment.

Where Can I Find an SBA Form 5?

The U.S. Small Business Administration (SBA) provides a variety of loan programs to help small businesses recover from declared disasters, including the SBA Form 5 – Disaster Business Loan Application. This form is designed to assist the SBA in determining eligibility and qualifications for a disaster loan assistance and must be completed by an applicant seeking an SBA-backed loan.

Form 5 can be found on the official website of the SBA’s Office of Disaster Assistance, located at www.sba.gov/disaster. The application requires detailed information about your business’s financial standing, including income statements, balance sheets and tax returns for up to three years prior to the disaster that caused damage or economic injury to your business.

SBA Form 5 – Disaster Business Loan Application

The Small Business Administration (SBA) Form 5 is an essential document for businesses seeking disaster-related loans. This form serves as an application, which must be completed accurately in order to receive funding. It’s important that business owners understand what information they need to provide and how the process works. In this article, we will explain the criteria for SBA Form 5 loan eligibility, detail the required documents and information needed, and outline the steps of submitting a complete application.

SBA Form 5 Example