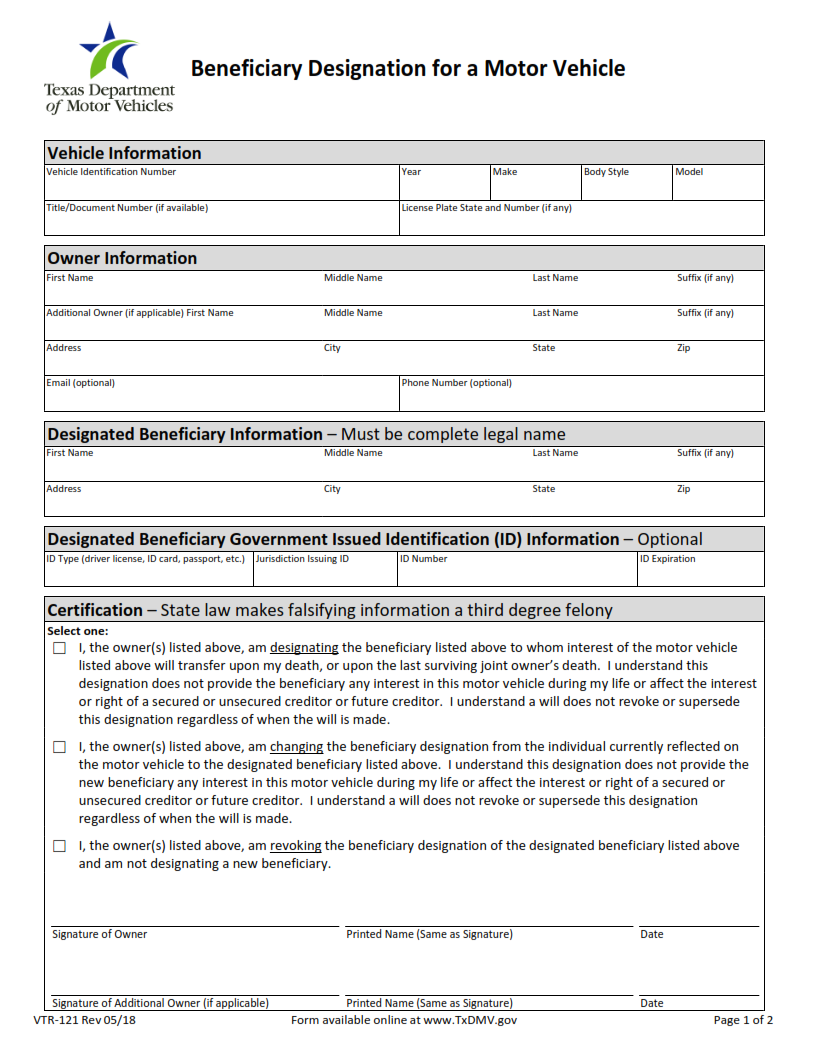

ORIGINFORMSTUDIO.COM – VTR-121 – Beneficiary Designation for a Motor Vehicle – The VTR-121 Beneficiary Designation for a Motor Vehicle is an important document that all motor vehicle owners should be aware of. It allows individuals to designate a beneficiary who will receive the ownership rights of their motor vehicle in the event of death or incapacity. This document is required when transferring title and registration on a motor vehicle, such as when selling or gifting it. By having this form completed and on file with the Department of Motor Vehicles (DMV), it can provide peace of mind knowing that your wishes have been recorded and respected in case something happens to you.

Download VTR-121 – Beneficiary Designation for a Motor Vehicle

| Form Number | VTR-121 |

| Form Title | Beneficiary Designation for a Motor Vehicle |

| File Size | 1 MB |

| Form By | Texas DMV Form |

What is a VTR-121 Form?

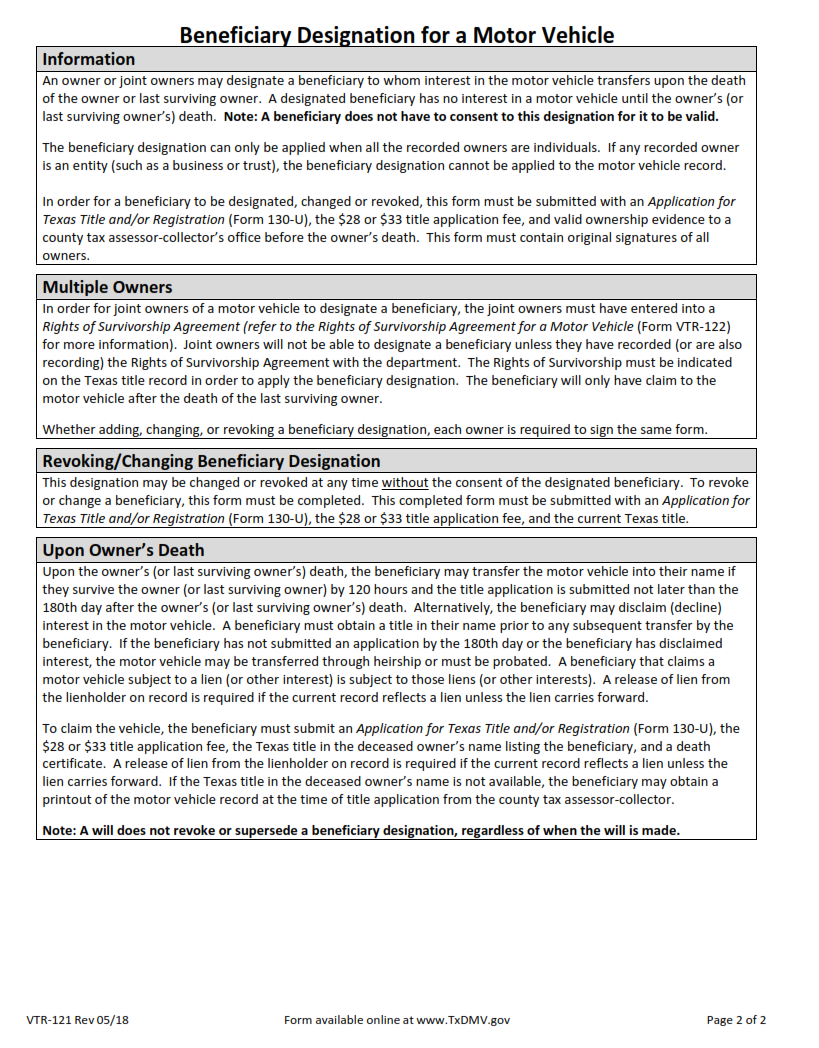

A VTR-121 is a form used to designate a beneficiary of a motor vehicle in the event of its owner’s death. This document must be completed and filed with the state’s Department of Motor Vehicles in order to ensure that the designated person receives ownership rights to the vehicle upon their death. The VTR-121 form includes information such as: the name and address of both parties, contact information for each, details of the motor vehicle being transferred, and other necessary information pertaining to its transfer.

The purpose of this form is to provide clear instructions regarding who should receive title to a motor vehicle after its owner dies. Without filing this document, there may be delays or confusion about who should take over ownership rights. Filing a VTR-121 can therefore ensure that your wishes are respected when it comes time for your beneficiaries to receive your car upon your passing.

What is the Purpose of the VTR-121 Form?

The VTR-121 form is a document used to designate who will receive ownership of an automobile after the owner passes away. This form allows for the transfer of vehicle ownership to be documented and filed with the proper state agency, such as the Department of Motor Vehicles. The purpose of this document is to ensure that the deceased’s wishes are honored and that their property is passed on in accordance with their wishes.

Filling out a VTR-121 form can help streamline the process of transferring ownership after a death by providing proof that the beneficiary named has been officially designated as such in writing. Additionally, using this form can help avoid potential disputes among family members or other heirs who may have conflicting claims over who should receive ownership of a vehicle. Having an official record proving designated beneficiaries and their relationship to the deceased provides clarity and prevents confusion during estate settlement proceedings.

Where Can I Find a VTR-121 Form?

If you own a motor vehicle in the state of Texas, you need to fill out and file a VTR-121 form. The VTR-121 is an official document used by the Texas Department of Motor Vehicles (TxDMV) to designate who will receive ownership of your vehicle upon your death.

The easiest way to find the VTR-121 form is online on the TxDMV website. You can also pick up a copy in person at any local county tax assessor collector’s office or any TxDMV regional service center. In addition, many auto dealerships have copies of this form available for customers as well. Once you have filled out and signed your VTR-121, make sure to file it with your local county tax assessor collector’s office for processing.

VTR-121 – Beneficiary Designation for a Motor Vehicle

The VTR-121 Beneficiary Designation for a Motor Vehicle Form is an official document designed by the Texas Department of Motor Vehicles. It allows individuals to designate a beneficiary who will be entitled to possession of a motor vehicle in the event of their death. The form must be completed and signed by both the owner and designated beneficiary, or it can be notarized, in order to be valid.

In addition to providing contact information for both parties, the form requires that certain details about the motor vehicle are included. This includes its make, model and year as well as its serial number or Vehicle Identification Number (VIN). Once completed, it must be filed with the county tax assessor-collector office where either party resides before it can take effect.

VTR-121 Form Example