ORIGINFORMSTUDIO.COM – VTR-903 – Casual Sales Record – The VTR-903 is an essential tool for businesses that want to keep track of their sales. The record is a crucial part of the sales process and helps businesses to organize, analyze, and understand their customer data. This article will provide an in-depth look at the features and benefits of the VTR-903 Casual Sales Record. It will discuss how this record can be used to improve customer experience, increase efficiency, and drive revenue growth. Additionally, it will cover tips on how business owners can make the most out of their records and maximize its potential.

Download VTR-903 – Casual Sales Record

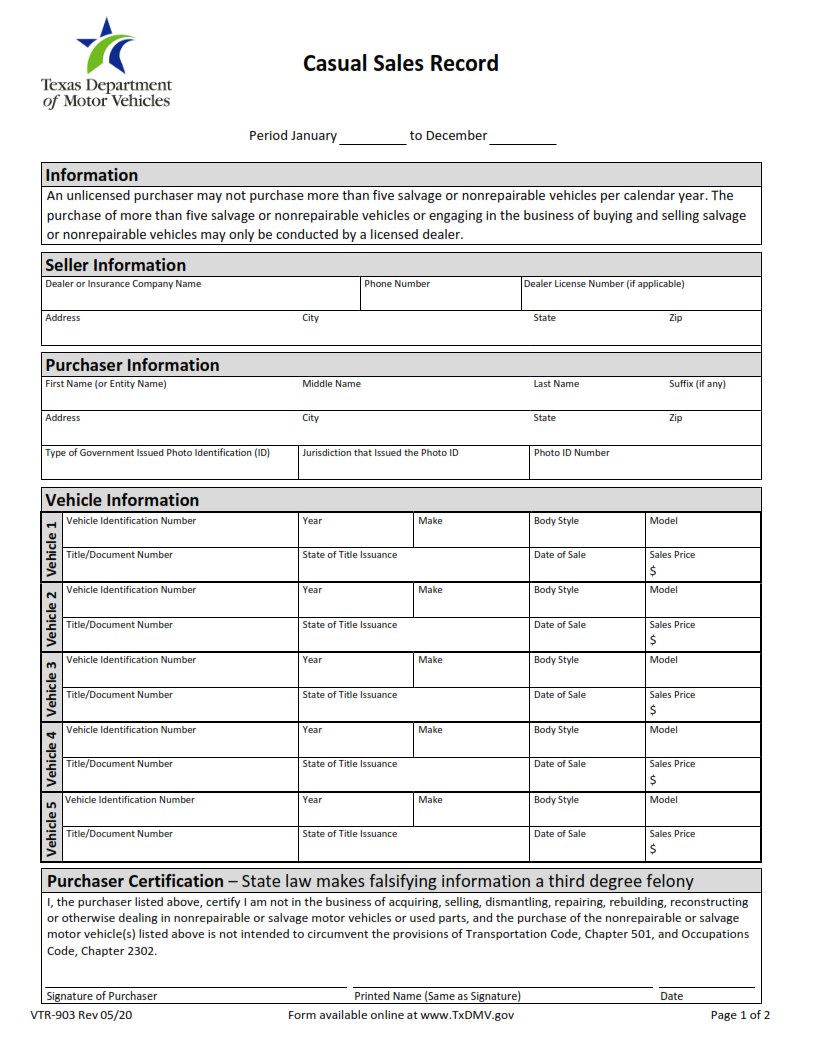

| Form Number | VTR-903 |

| Form Title | Casual Sales Record |

| File Size | 2 MB |

| Form By | Texas DMV Form |

What is a VTR-903 Form?

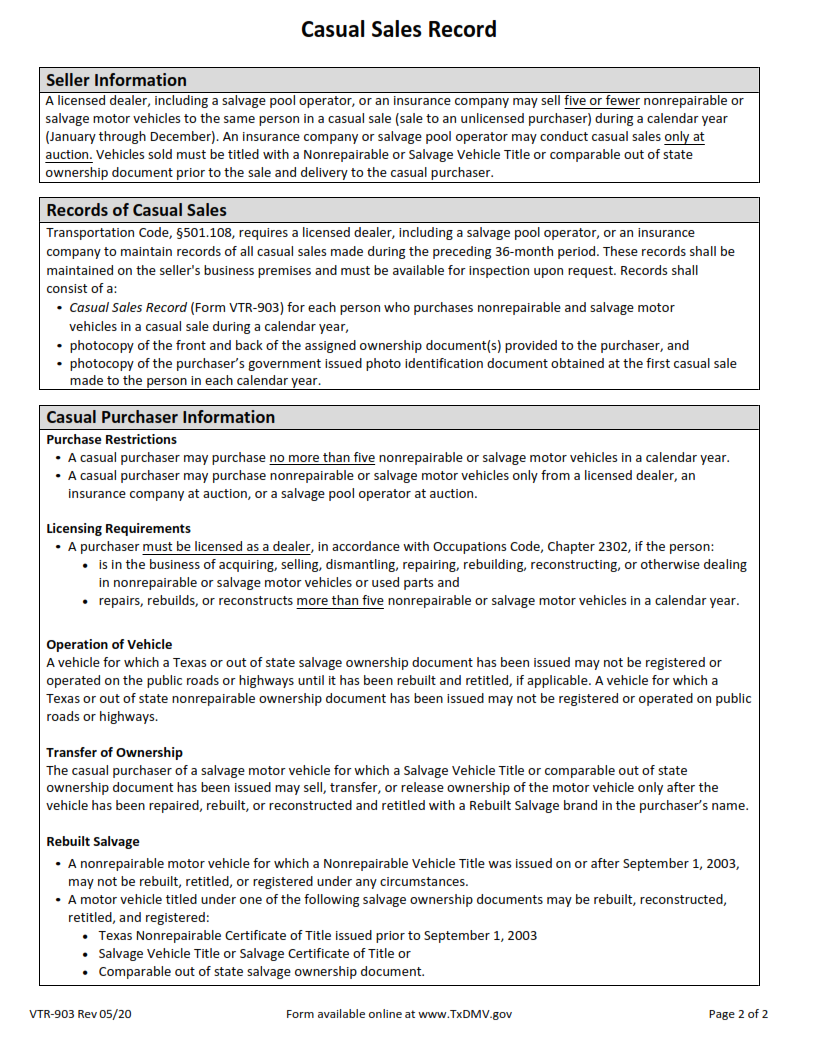

The VTR-903 form is a document used by the Texas Department of Motor Vehicles to record information from casual vehicle sales. This form serves as proof that taxes were paid on a vehicle sold in a private sale or other non-dealership transaction. The form must be filled out and signed by both the buyer and seller at the time of purchase.

The VTR-903 includes space for details such as the buyer’s name, address, and driver’s license number; the seller’s name, address, driver’s license number, and Social Security Number; and information about the vehicle being sold including make, model year, body type, odometer reading at time of sale, sales price and date of sale.

What is the Purpose of the VTR-903 Form?

The VTR-903 form is a document used in the state of Texas for tax reporting purposes. It is also known as the Casual Sales Record and serves as a record of all sales for vehicles that are sold with six or fewer transactions in a 12-month period. The purpose of the VTR-903 form is to help ensure that appropriate taxes are collected on each sale.

When selling an automobile, the seller must report certain information including the date of sale, buyer’s name, buyer’s address, vehicle type and model year along with other relevant data such as odometer reading. This information allows the Texas Comptroller’s Office to identify any potential unpaid taxes or fees due on these sales.

Where Can I Find a VTR-903 Form?

The VTR-903 is a form required to record all casual sales of motor vehicles in the state of Texas. This includes used vehicles as well as new ones, and it must be completed by a dealer before any transaction can take place. The form is available from both physical and online sources, making it easy to access no matter where you are located.

If you’re looking for a physical copy of the VTR-903 form, your local county tax office or vehicle registration office should be able to provide you with one. Additionally, copies of the document can often be found at the dealership where you plan to purchase your vehicle.

You can also find copies of the VTR-903 online at several websites dedicated to providing legal forms and documents for Texas residents.

VTR-903 – Casual Sales Record

The VTR-903 Casual Sales Record is a powerful asset management tool that allows companies to track and manage their casual sales performance. This system is designed to help businesses make educated decisions about the products they are selling, as well as the resources they need to get them sold. With this system, companies can quickly analyze trends in the market and make necessary changes accordingly. Additionally, with the customizable features of VTR-903, businesses can tailor reports for specific purposes or timeframes.

The valuable data collected by VTR-903 helps companies understand which items have been most successful and which have not been getting any attention from customers. This data can also be used for inventory management purposes, so businesses know what stock needs to be replenished on a regular basis.

VTR-903 Form Example