ORIGINFORMSTUDIO.COM – SBA Form1244 – Application for Section 504 Loans – Starting a small business can be daunting, especially when it comes to finances. It is important to understand the available options and how they can help your business succeed. The U.S. Small Business Administration (SBA) offers several programs that provide financial assistance to businesses in need of capital. One such program is the Section 504 Loan Program, which provides long-term fixed-rate financing for major fixed assets such as real estate or equipment. To apply for this loan, businesses must fill out the SBA Form 1244 application and meet certain requirements in order to qualify.

Download SBA Form1244 – Application for Section 504 Loans

| Form Number | SBA Form1244 |

| Form Title | Application for Section 504 Loans |

| File Size | 671 KB |

| Form By | SBA Forms |

What is an SBA Form 1244?

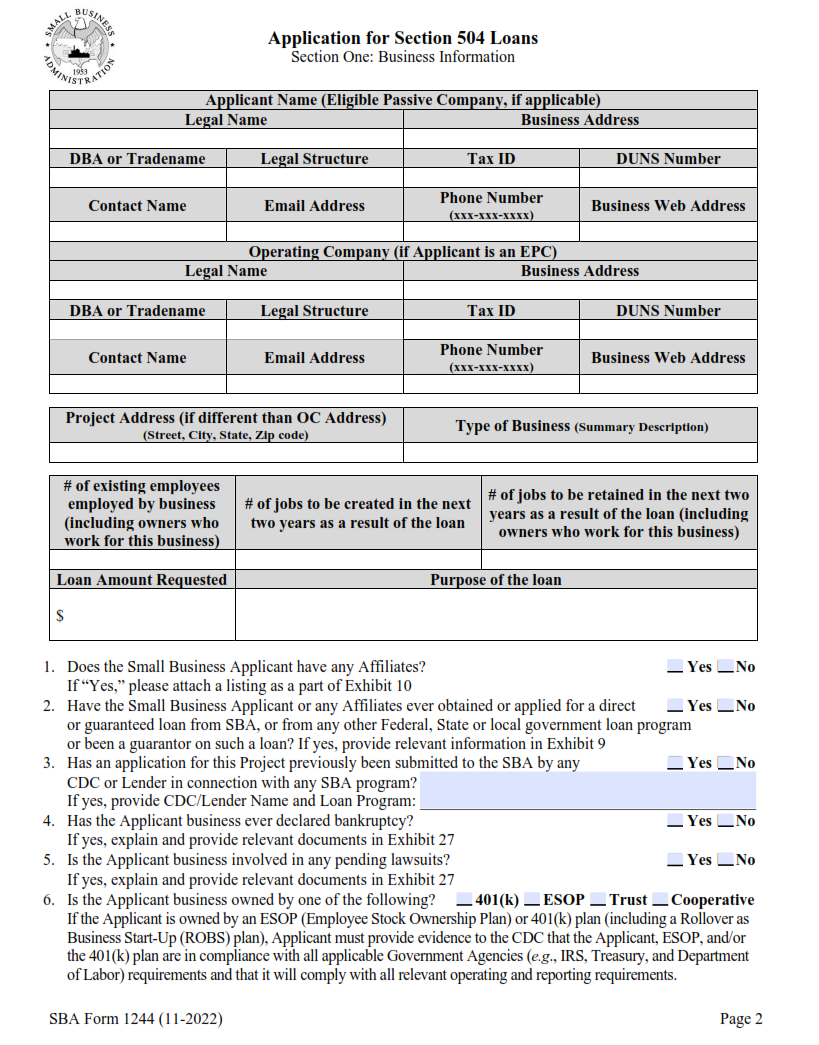

SBA Form 1244, also known as the application for Section 504 loans, is a document that borrowers must complete when applying for funding from the U.S. Small Business Administration (SBA). This form provides information to the SBA about a borrower’s business size, loan purpose and amount requested. It also asks applicants to provide documentation of their credit history and financial records in order to determine eligibility and loan approval.

Applicants must fill out Sections 1-8 of the form in order to be considered for a Section 504 loan. In addition to providing information about their business size and other qualifications, applicants must also outline how they plan on using the funds once they receive them.

What is the Purpose of SBA Form 1244?

SBA Form 1244 is an application for Section 504 loans, a program administered by the Small Business Administration (SBA). This form is used to apply for long-term, fixed-rate financing for business property acquisitions and renovations. The purpose of this form is to help small businesses obtain financing that is secured by their own assets such as real estate or equipment.

This type of loan allows small businesses to purchase or renovate property without having to pay out of pocket. In addition, it can provide more favorable terms than traditional bank loans. For example, Section 504 loans often have lower interest rates and longer repayment periods than other types of commercial lending products. Additionally, these loans are backed by the full faith and credit of the U.S. government, providing borrowers with additional security and assurance that they will be able to repay the loan on time.

Where Can I Find an SBA Form1244?

The Small Business Administration (SBA) Form 1244 is an important document when applying for Section 504 Loans. It includes information about the applicant’s credit history, business plan and the loan amount being requested.

Form 1244 can be accessed on the SBA website free of charge. Applicants should allow several days to complete the application process as it requires submission of supporting documents such as financial statements and copies of tax returns for both the business and its owners. Additionally, applicants will need to provide detailed descriptions of their use of funds, which must be approved by a local SBA District Office before being considered for loan approval.

Applicants seeking assistance in completing Form 1244 can locate a nearby Small Business Development Center or SCORE office that provides counseling services related to SBA funding programs.

SBA Form1244 – Application for Section 504 Loans

SBA Form 1244 is an application for Section 504 Loans administered by the Small Business Administration (SBA). This type of loan program offers long-term, fixed-rate financing to small businesses and certain non-profit organizations in order to assist with their expansion or development. The loans are used to purchase real estate, equipment and machinery, as well as provide working capital.

The SBA Form 1244 must be completed in full before a loan will be considered. The form requires basic information such as the name and address of the applicant organization, its purpose, list of collateral provided and financial statements. It also includes questions related to any current or past loan agreements that may exist between the applicant and other lenders. In addition, the application must include an explanation of how the loan would be used and a detailed business plan outlining future goals for success.

SBA Form1244 Example