ORIGINFORMSTUDIO.COM – SBA Form 147 – SBA Standard Loan Note (Form 147) – Small business owners who are borrowing money from the Small Business Administration (SBA) will need to be familiar with the SBA Form 147. The form is an important part of the loan process and serves as a legally binding agreement between the borrower and lender. It outlines key terms such as repayment schedule, interest rate, maturity date, collateral requirements, and other related information that must be agreed upon. With the standard format provided by the SBA Form 147, both parties can save time in negotiating a loan agreement.

Download SBA Form 147 – SBA Standard Loan Note (Form 147)

| Form Number | SBA Form 147 |

| Form Title | SBA Standard Loan Note (Form 147) |

| File Size | 87 KB |

| Form By | SBA Forms |

What is an SBA Form 147?

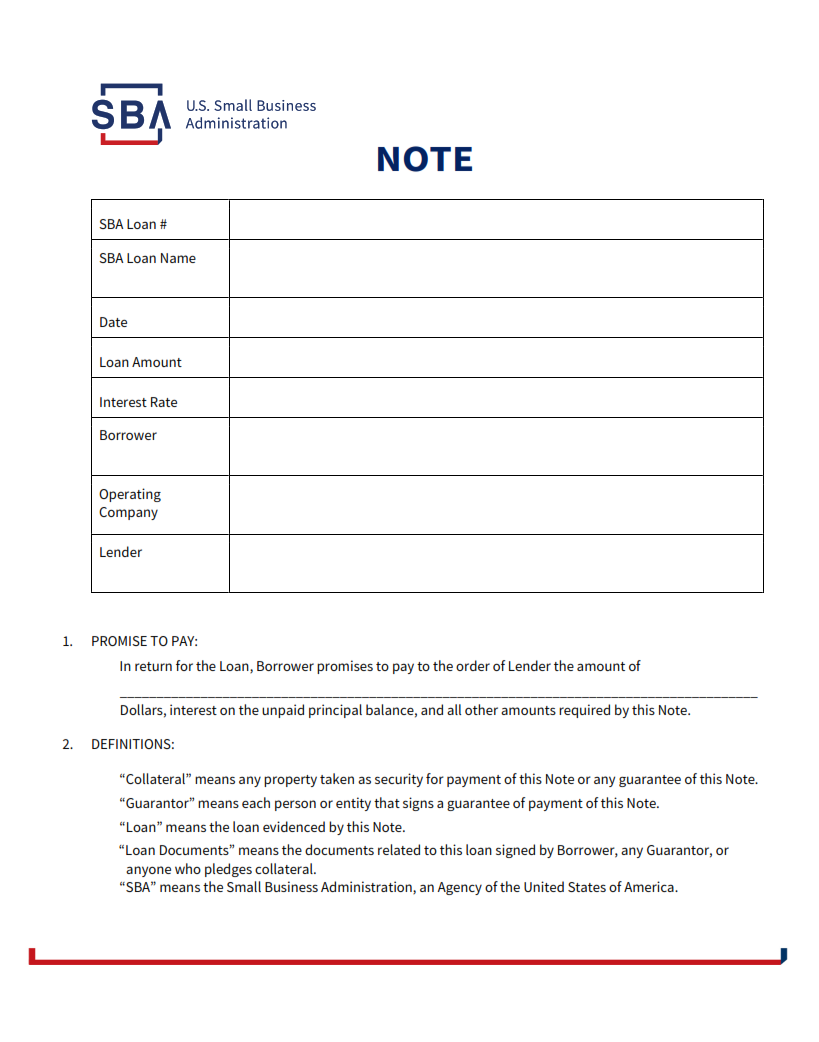

SBA Form 147, also known as the SBA Standard Loan Note, is an official document from the U.S. Small Business Administration (SBA) that outlines the terms and conditions of a loan agreement between a borrower and a lender. This form must be signed by both parties in order to make the loan legally binding. The form includes information such as the total amount of money being borrowed, interest rate, repayment schedule, and security for repayment of the loan if required. Additionally, this form may include other terms such as late fees or penalties for early repayment of any loan balances due.

The SBA Form 147 is typically used when a business owner applies for a loan with an approved SBA lender or financial institution using one of their guaranteed lending programs such as 7(a), 504/CDC, or Microloan.

What is the Purpose of SBA Form 147?

The Small Business Administration (SBA) Form 147 is a standardized loan note that lenders must use when issuing SBA-guaranteed loans. This form serves as evidence of the loan agreement between the borrower and lender, outlining the details of the loan, including its interest rate, repayment terms, and collateral requirements. It also includes an acknowledgement by both parties that all necessary disclosures have been made regarding the loan.

The purpose of SBA Form 147 is to ensure uniformity among all SBA loans. This document helps lend credibility to the transaction by providing an official record of it for both parties involved in it. It also ensures that borrowers understand their rights and responsibilities under the loan agreement they are entering into with their lender. Additionally, this form serves as a source of information for lenders so they can accurately assess and manage risk associated with loans they issue.

Where Can I Find an SBA Form 147?

The Small Business Administration (SBA) Form 147, also known as the SBA Standard Loan Note, is a document used to record information about a loan between a borrower and lender. The form is available in both electronic and paper formats.

The electronic version of the SBA Form 147 can be found on the official website of the Small Business Administration. The form can be accessed by selecting the “Forms” link at the top of their homepage, then choosing “Loan Forms” from the drop-down menu. Once you have located this page, simply click on “SBA Form 147 – Standard Loan Note (Form 147).” Printing instructions are included with each download for those who prefer to complete a paper version instead.

SBA Form 147 – SBA Standard Loan Note (Form 147)

Form 147, also known as the SBA Standard Loan Note (Form 147), is a document used by the Small Business Administration (SBA) to provide lenders with information regarding loans made to small business owners. The form outlines all of the terms and conditions relevant to the loan, including repayment amount, interest rate, and collateral requirements. It also serves as proof that a loan has been issued and serves as an agreement between both parties involved in the transaction.

The form requires detailed information from both borrowers and lenders including personal information such as names and contact details, business details like the name of the company and tax ID number, financials such as credit scores or outstanding debts, and other specifications related to collateral. After being completed by both parties it needs to be signed and dated before becoming legally binding.

SBA Form 147 Example