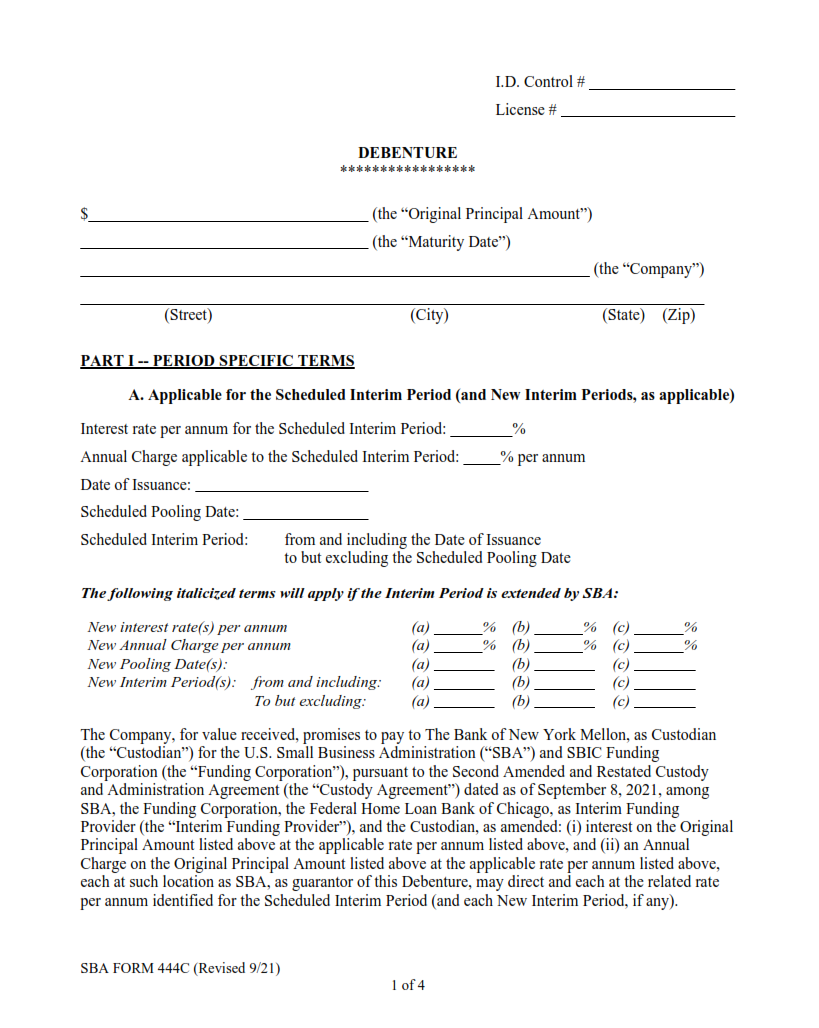

ORIGINFORMSTUDIO.COM – SBA Form 444C – Debenture Certification Form – The SBA Form 444C or the Debenture Certification Form is an essential document for those in need of Small Business Administration (SBA) assistance. It certifies that a debenture has been issued, which is a type of loan that allows businesses to borrow money from private investors and banks. This form is necessary for both the issuer and holder of the debentures as it helps protect both parties involved by providing information about the nature of the loan and its repayment terms.

Download SBA Form 444C – Debenture Certification Form

| Form Number | SBA Form 444C |

| Form Title | Debenture Certification Form |

| File Size | 212 KB |

| Form By | SBA Forms |

What is an SBA Form 444C?

SBA Form 444C, also known as the Debenture Certification Form, is a document issued and accepted by the U.S. Small Business Administration (SBA) to certify that an individual has been approved for an SBA-guaranteed loan. This form must be signed by both the borrower and lender in order to receive funding from the SBA. It is important for potential borrowers to understand what is included in this form in order to ensure that their application is complete and accurate when submitting it for approval.

The main purpose of SBA Form 444C is to provide assurance that all of the information provided by both parties on the loan application has been verified and found accurate by the SBA before they approve or deny a loan request.

What is the Purpose of SBA Form 444C?

SBA Form 444C is an important document used to certify the debentures issued by the Small Business Administration (SBA) and provide evidence of their validity. The form acts as a recordkeeping tool for both lenders and the SBA, ensuring that all obligations between them are properly fulfilled. By signing this form, lenders confirm that they have complied with SBA requirements concerning loan guarantees and other related matters.

The purpose of this document is twofold: first, it certifies that all documents required for loan approval have been reviewed and approved; second, it states that lenders are in compliance with SBA regulations regarding interest rates, repayment terms, fees, etc. Additionally, if a borrower fails to make timely payments on their loans or defaults on them entirely, Form 444C allows lenders to submit claims to the SBA for reimbursement under certain circumstances.

Where Can I Find an SBA Form 444C?

The Small Business Administration (SBA) Form 444C is a Debenture Certification form that must be completed and submitted to the SBA when applying for certain types of loans. It helps to ensure that an applicant has fully disclosed any previous debt or liabilities associated with their business. Fortunately, this form can easily be found online.

The official SBA website provides free access to all of its available forms, including Form 444C. The site also includes instructions on how to complete the form correctly and submit it electronically or by mail. Additionally, some lenders may offer the form directly on their websites as well.

SBA Form 444C – Debenture Certification Form

SBA Form 444C – Debenture Certification Form is an important document for any business that wishes to secure a Small Business Administration (SBA) loan. This form is used to certify that the debenture, which is a type of debt instrument, meets all SBA requirements. The form must be signed and notarized by the borrower before the loan can be approved.

The Debenture Certification Form contains detailed instructions on how to properly complete it, including information on who should sign it and where it should be filed. It also includes a declaration stating that the borrower understands the terms and conditions of the loan agreement with SBA and agrees to abide by them. Additionally, this form outlines several potential risks associated with taking out an SBA loan such as higher interest rates or fees than other forms of financing may offer.

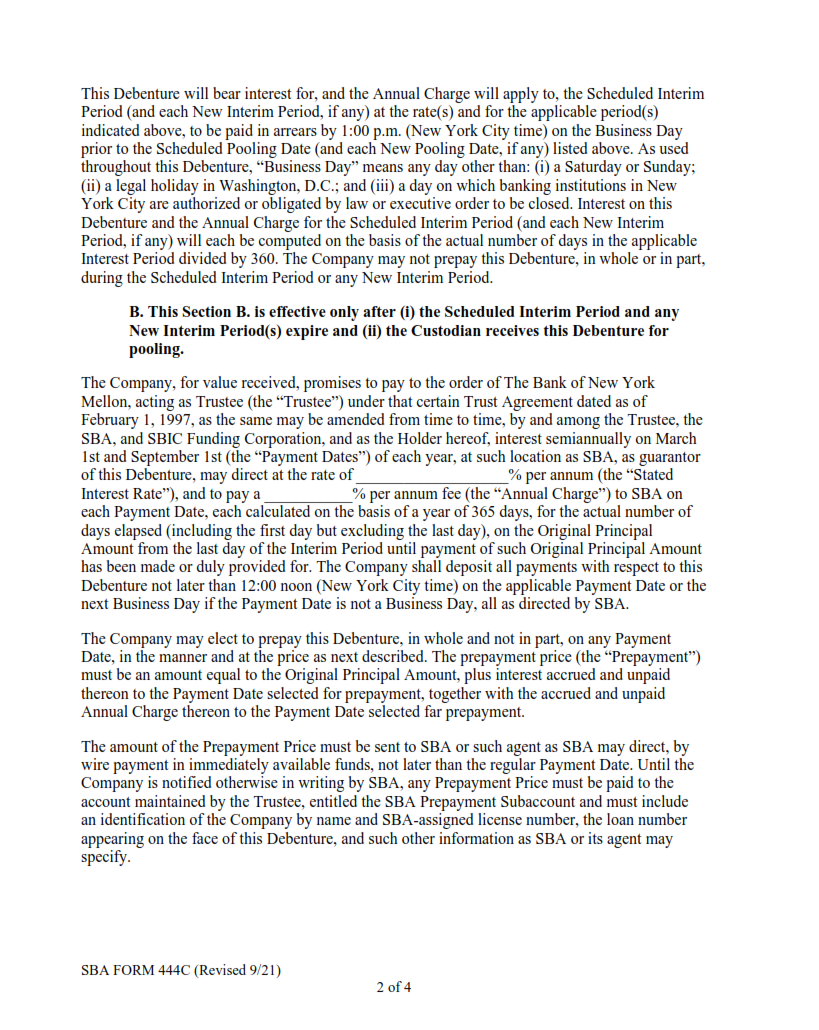

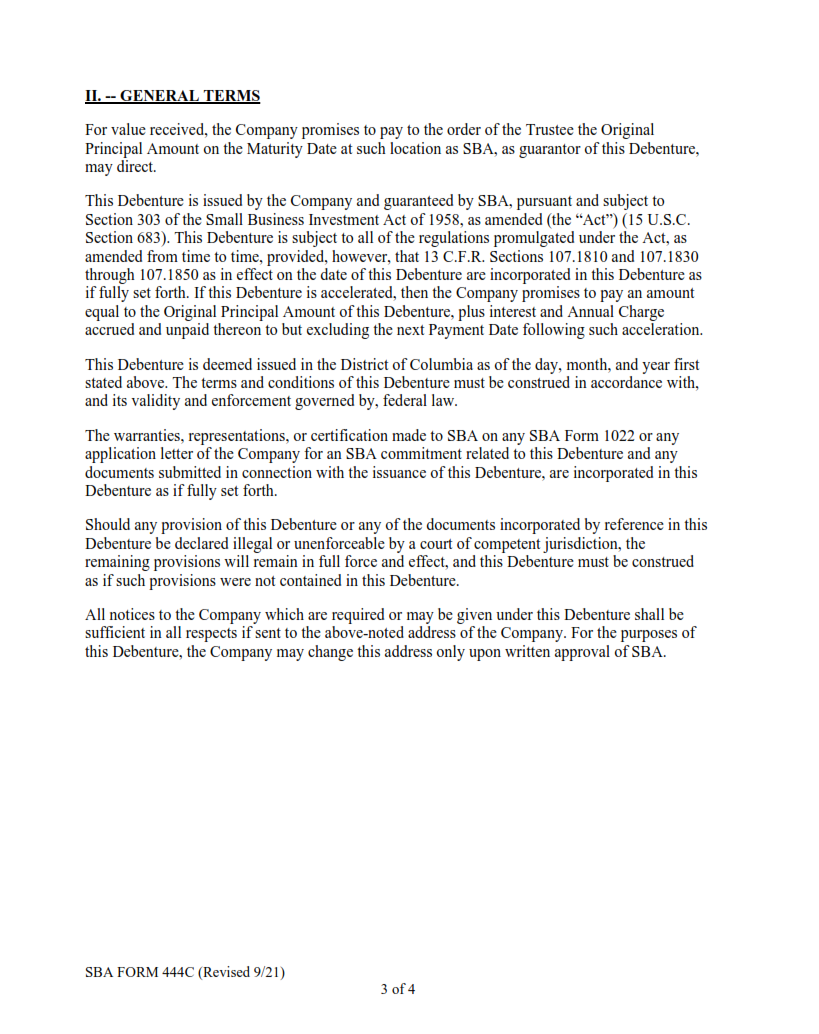

SBA Form 444C Example