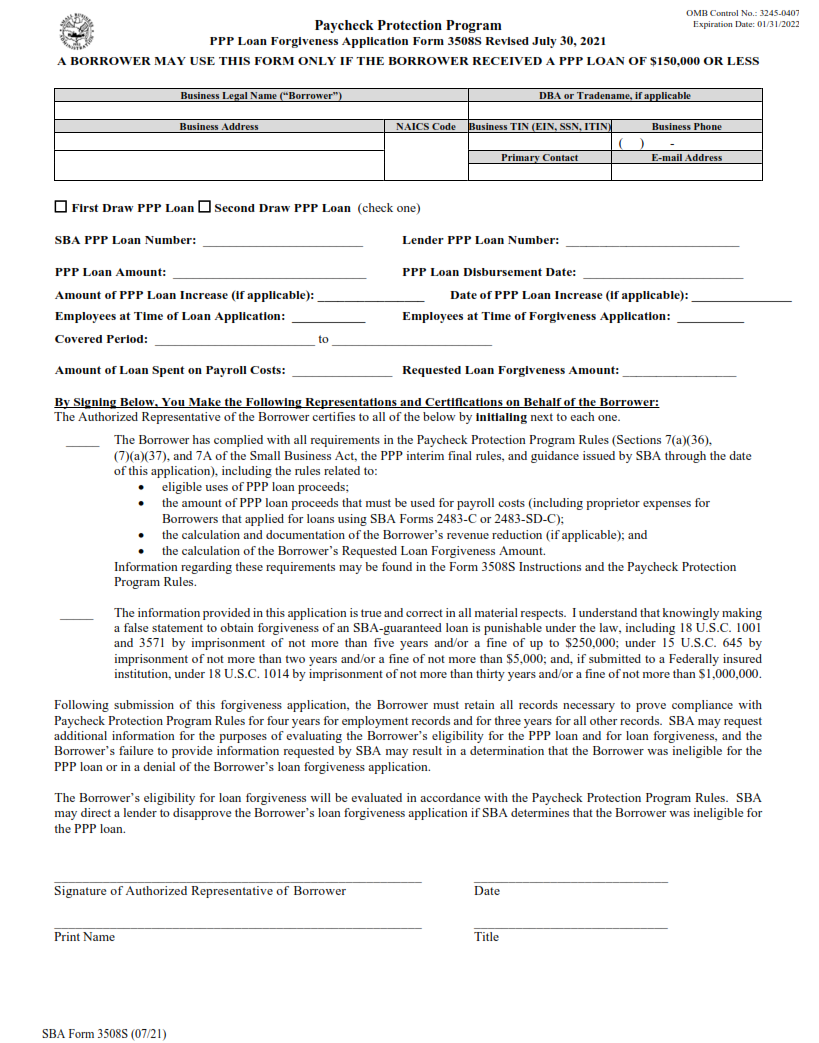

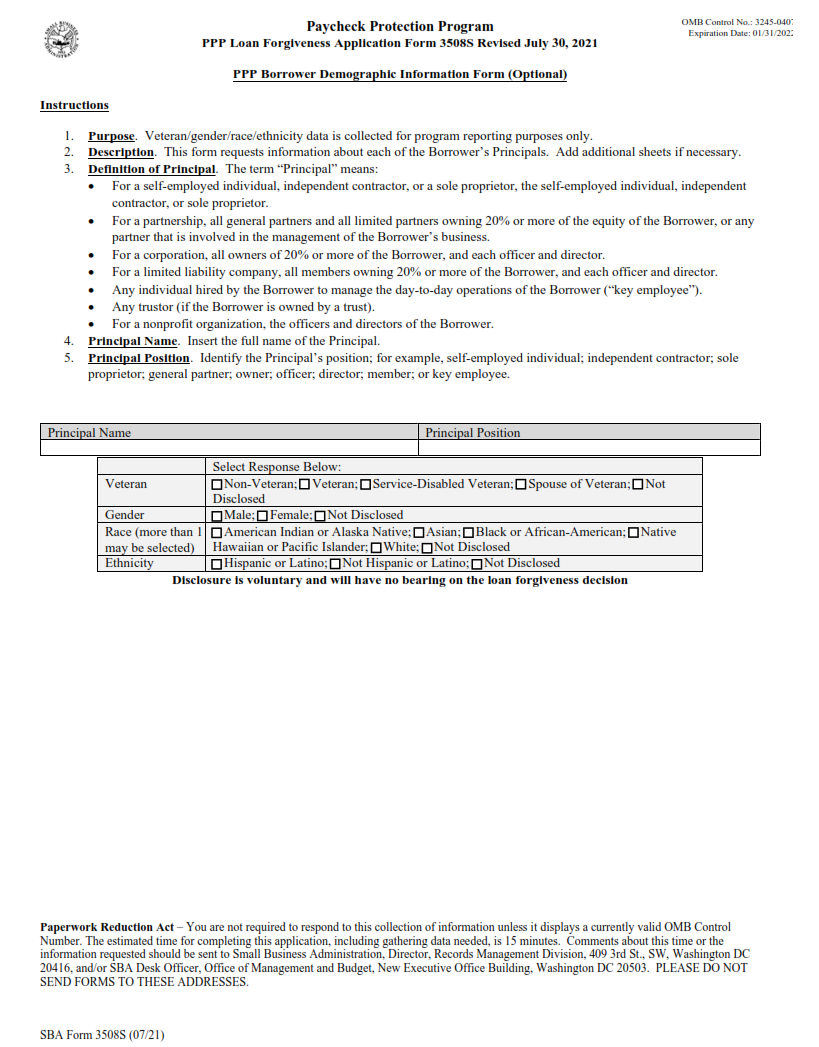

ORIGINFORMSTUDIO.COM – SBA Form 3508s – PPP 3508S Loan Forgiveness Application + Instructions – The new Paycheck Protection Program (PPP) has been designed to provide small businesses in the United States with financial assistance during the COVID-19 pandemic. As part of this initiative, business owners are required to fill out and submit an SBA Form 3508s – PPP 3508S Loan Forgiveness Application in order to be eligible for forgiveness of their loan. Understanding how to properly complete this loan forgiveness application is essential for small business owners who wish to take advantage of the benefits of PPP loans.

Download SBA Form 3508s – PPP 3508S Loan Forgiveness Application + Instructions

| Form Number | SBA Form 3508s |

| Form Title | PPP 3508S Loan Forgiveness Application + Instructions |

| File Size | 364 KB |

| Form By | SBA Forms |

What is an SBA Form 3508s?

The SBA Form 3508s is a loan forgiveness application form provided by the Small Business Administration (SBA) for businesses that have received Paycheck Protection Program (PPP) loans. The PPP was established to provide financial assistance to small businesses during the COVID-19 pandemic. It allowed qualifying businesses to receive forgivable loans of up to $10 million with terms of up to 10 years.

The SBA Form 3508s must be completed and submitted in order for business owners to apply for PPP loan forgiveness from the U.S. Department of Treasury. This form requires detailed information about the company’s business activities, expenses, and payroll costs during the covered period specified by the SBA. Businesses must also include documentation such as payroll tax forms and bank statements along with their application in order for it to be considered complete.

What is the Purpose of SBA Form 3508s?

The Small Business Administration (SBA) Form 3508s is the application form used by borrowers to apply for loan forgiveness under the Paycheck Protection Program (PPP). This form must be completed and submitted to the lender who provided their PPP loan in order to receive any potential loan forgiveness.

The SBA Form 3508s is designed to capture information from borrowers on costs that may be eligible for PPP loan forgiveness. It requests detailed information about payroll costs, as well as other eligible non-payroll costs such as mortgages, rent, and utilities during the covered period of 8 weeks or 24 weeks following the funding of a borrower’s PPP loan. The SBA uses this information to determine if a borrower meets all requirements for their PPP loans to be forgiven.

Where Can I Find an SBA Form 3508s?

The Small Business Administration (SBA) Form 3508s is the application for loan forgiveness through the Paycheck Protection Program (PPP). This form helps qualifying businesses apply for loan forgiveness after they have used their PPP loan funds. To find this form, business owners can visit SBA’s website or contact an SBA representative.

Businesses may choose to fill out the form online or print it out and complete it by hand. The online version of Form 3508s requires an active account on SBA’s website, which can be created by following the instructions provided on their website. Alternatively, business owners can download a copy of the form from the US Department of Treasury’s website. Once completed, businesses should submit their forms to the lender who issued them their PPP loan.

SBA Form 3508s – PPP 3508S Loan Forgiveness Application + Instructions

The Small Business Administration (SBA) Form 3508s is the loan forgiveness application for borrowers of the Paycheck Protection Program (PPP). The form outlines a step-by-step process for applicants to complete in order to have their loan forgiven. It is important that applicants fill out the form correctly and provide accurate and complete information, as any mistakes or omissions may lead to a decrease or denial of loan forgiveness.

When filling out the SBA Form 3508s, borrowers must first select which SBA PPP Lender they borrowed from. They then must indicate what type of business they are operating and whether or not they employed 500 employees or less before February 15th 2020. Applicants should also include a breakdown of their payroll costs as well as any other eligible non-payroll cost expenses during the covered period (February 15th – June 30th 2020).

SBA Form 3508s Example