ORIGINFORMSTUDIO.COM – SBA Form 159 – Fee Disclosure and Compensation Agreement – The SBA Form 159 is an important document for small businesses looking to secure financing from the Small Business Administration. This form serves as a disclosure agreement that outlines the fees and compensation associated with the loan and must be completed by all parties involved in the loan application process. Completing this form correctly and accurately is key to avoiding costly mistakes or missed deadlines, so it is essential that small business owners understand what information needs to be disclosed on this form.

Download SBA Form 159 – Fee Disclosure and Compensation Agreement

| Form Number | SBA Form 159 |

| Form Title | Fee Disclosure and Compensation Agreement |

| File Size | 318 KB |

| Form By | SBA Forms |

What is an SBA Form 159?

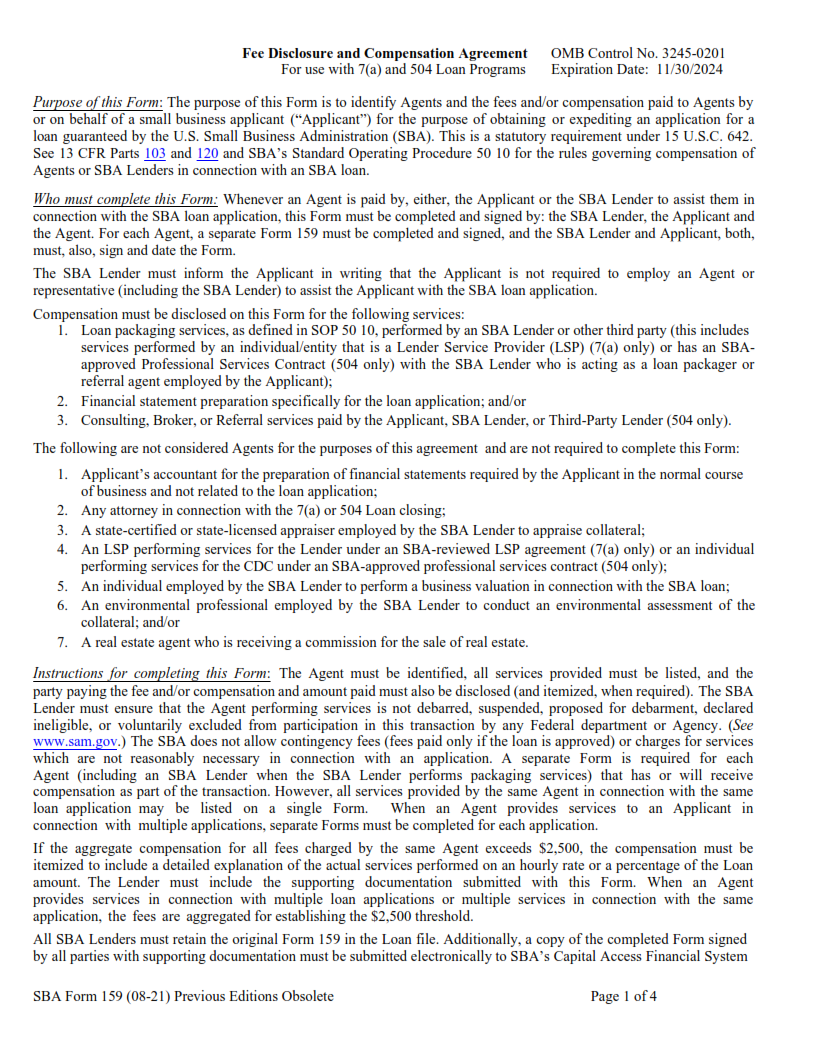

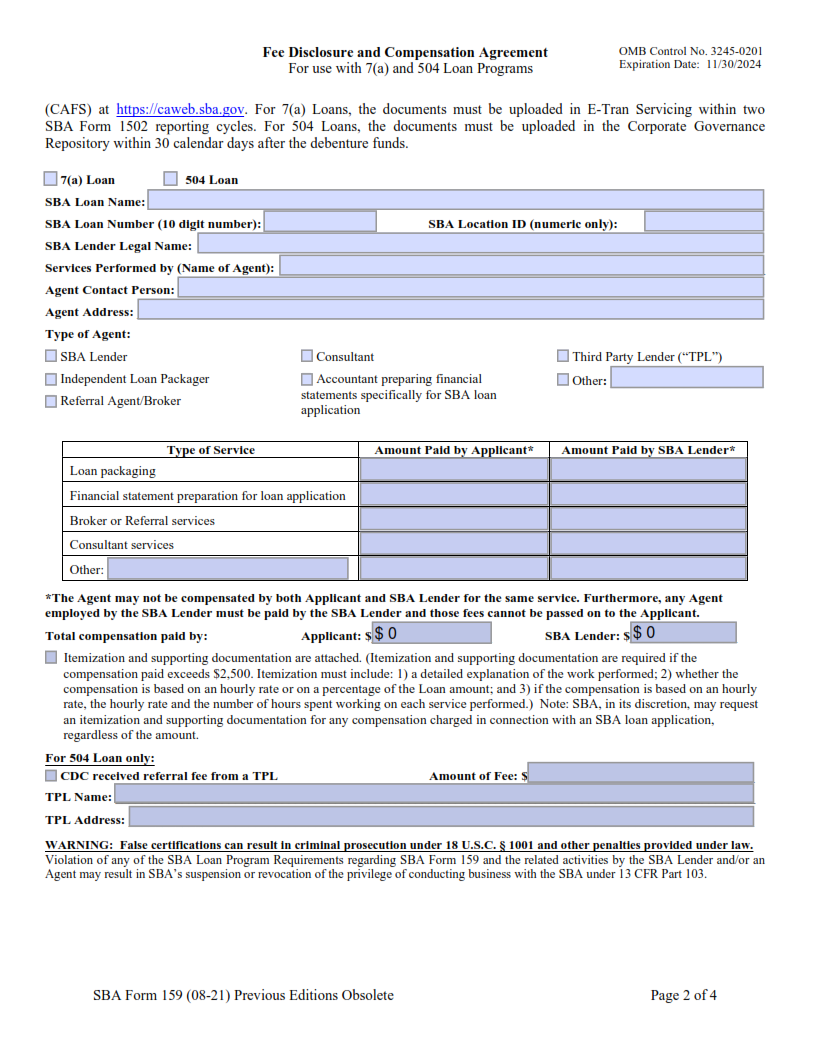

SBA Form 159, also known as the “Fee Disclosure and Compensation Agreement,” is a document prescribed by the United States Small Business Administration (SBA) used to document fees that third-party lenders charge in connection with SBA-guaranteed loans. This form must be completed and signed by both the lender and borrower before the loan can be approved. It outlines all of the fees associated with an SBA loan, as well as any other forms of compensation or remuneration involved in providing such loan. Additionally, lenders are required to disclose information regarding their experience with similar loans to ensure that borrowers are fully informed when making their decision.

The purpose of this form is to provide transparency between lenders and borrowers when it comes to fees charged in relation to an SBA-guaranteed loan.

What is the Purpose of SBA Form 159?

The purpose of SBA Form 159, Fee Disclosure and Compensation Agreement, is twofold. For business owners applying for an SBA loan, the form discloses the fees associated with their loan application as well as any potential compensation that could be associated with it. In addition to detailing all applicable fees and compensation, the form also serves as a legally binding agreement between the borrower and lender.

By signing this form, borrowers are agreeing to pay all applicable fees listed on the document and must disclose any additional compensation that may be accepted from lenders who process their loan applications. The form also requires disclosure of any third-party individuals or companies involved in brokering loans or other services related to Small Business Administration (SBA) loans. This transparency helps ensure that all parties involved in a loan transaction have a clear understanding of how funds will be disbursed throughout its duration.

Where Can I Find an SBA Form 159?

The Small Business Administration (SBA) Form 159, also known as the Fee Disclosure and Compensation Agreement, is an important document for all small business owners. It provides information about fees and compensation associated with SBA loan applications. The form must be completed before any loan application can be submitted to the SBA.

Fortunately, finding SBA Form 159 is not difficult. It can be found on the official website of the Small Business Administration or through its online partner, LendingTree. Additionally, most banks and lenders that offer government-backed loans will have a copy of this form available on their websites. Once you’ve filled out the form according to your particular situation, it should be signed by both parties involved in the transaction—the borrower and lender—or it won’t be considered valid by the SBA.

SBA Form 159 – Fee Disclosure and Compensation Agreement

The SBA Form 159, otherwise known as the Fee Disclosure and Compensation Agreement, is an important document for any business seeking a Small Business Administration loan. This form details the fees and costs associated with obtaining an SBA loan, so it’s essential that borrowers carefully read and understand it before completing and submitting it.

The form includes sections related to repayment terms, lender’s rights upon default or late payments, conditions of the loan agreement (including collateral requirements), drawdown policies, closing costs, and more. It also outlines in detail who will be liable for costs associated with servicing the loan – whether that be the borrower or the lender – as well as how those costs are shared between both parties. Furthermore, it requires lenders to disclose any other fees they may charge borrowers in order to obtain a loan via this program.

SBA Form 159 Example