ORIGINFORMSTUDIO.COM – SBA Form 3508 – PPP Loan Forgiveness Application + Instructions – The Small Business Administration (SBA) has created a specific form to assist small businesses in applying for loan forgiveness as part of the Paycheck Protection Program (PPP). Form 3508 is an essential tool for anyone looking to take advantage of this program. With its helpful instructions, it’s easier than ever to get the relief you need. In this article, we’ll discuss SBA Form 3508 and provide step-by-step instructions on how to complete it correctly. We’ll also answer any questions you may have about the process so you can maximize your chance for loan forgiveness.

Download SBA Form 3508 – PPP Loan Forgiveness Application + Instructions

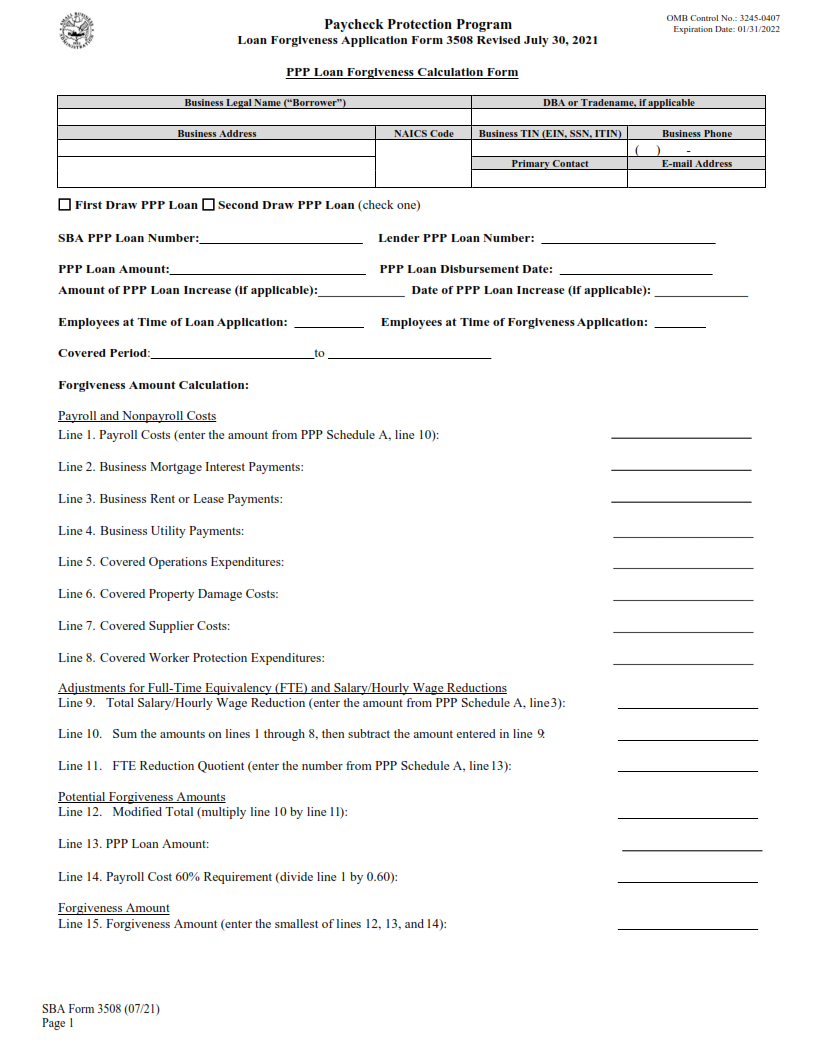

| Form Number | SBA Form 3508 |

| Form Title | PPP Loan Forgiveness Application + Instructions |

| File Size | 756 KB |

| Form By | SBA Forms |

What is an SBA Form 3508?

The SBA Form 3508 is the application for loan forgiveness from the Paycheck Protection Program (PPP). This form must be filled out by businesses that have received a PPP loan and wish to request forgiveness of all or part of their loan. The form requires applicants to provide detailed information about their business operations, including payroll expenses, total number of employees, and amount of loan used for eligible expenses.

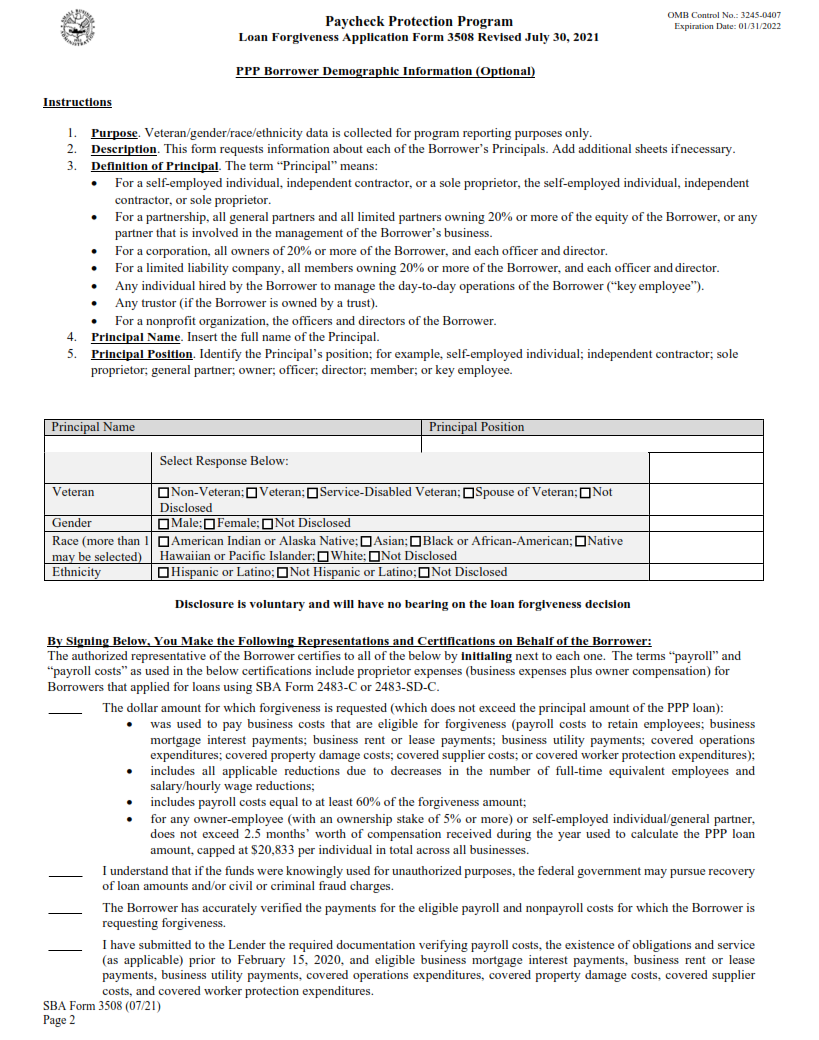

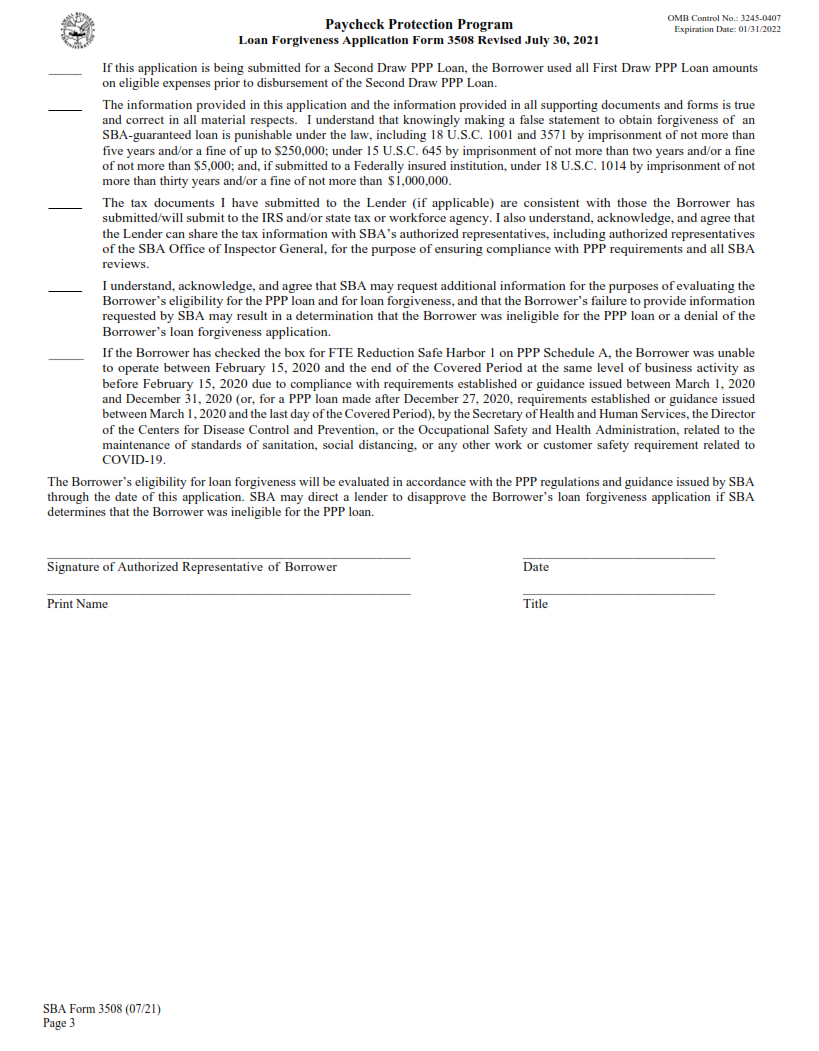

In addition to the SBA Form 3508, borrowers must also submit documentation verifying their eligibility for loan forgiveness. This includes records such as payroll tax filings and proof that funds were used on eligible expenses. The borrower’s PPP lender will review this information and make a decision regarding whether or not they approve the loan forgiveness request.

What is the Purpose of SBA Form 3508?

The Small Business Administration’s (SBA) Form 3508 is the official loan forgiveness application designed for businesses to apply for Paycheck Protection Program (PPP) loans. It outlines the necessary steps that must be taken in order to properly receive loan forgiveness from the SBA after a borrower has exhausted their PPP funds. The form contains a variety of sections and questions that borrowers must answer correctly in order to qualify.

The main purpose of Form 3508 is to provide transparency and accountability throughout the loan forgiveness process. In addition, it allows lenders and borrowers to ensure they have met all requirements necessary for receiving full or partial loan forgiveness from the SBA. By providing detailed information on payroll costs, non-payroll costs, full-time equivalent employees and other related expenses, borrowers can accurately demonstrate how they used PPP funds in accordance with program guidelines set by the government.

Where Can I Find an SBA Form 3508?

The Small Business Administration (SBA) Form 3508 is an important document for businesses that have taken out a loan under the Paycheck Protection Program (PPP). The form is used to apply for PPP loan forgiveness. In order to receive loan forgiveness, borrowers must submit the SBA Form 3508 to their lenders.

The SBA Form 3508 can be found on the official website of the U.S. Small Business Administration. This form can also be accessed through many third-party websites and applications that offer additional guidance and assistance in completing the application process. Additionally, some lenders may provide their own specific forms or instructions which should also be complied with when submitting your application for PPP loan forgiveness.

SBA Form 3508 – PPP Loan Forgiveness Application + Instructions

The Small Business Administration (SBA) Form 3508 is an application used for businesses to apply for loan forgiveness under the Paycheck Protection Program (PPP). The PPP is a federally funded loan program designed to help small businesses cover operational costs during the COVID-19 pandemic.

In order to be eligible for loan forgiveness, borrowers must submit their SBA Form 3508 along with supporting documentation within 10 months of the end of their covered period. The form requires information about payroll expenses and other eligible costs that have been paid over the 8-24 week covered period. Additionally, borrowers must provide proof that they have used at least 60% of their loan proceeds on payroll expenses in order to qualify for full loan forgiveness.

SBA Form 3508 Example