ORIGINFORMSTUDIO.COM – SBA Form 2202 – Schedule of Liabilities – The Small Business Administration (SBA) Form 2202, Schedule of Liabilities, is an important form used to report and manage liabilities for businesses who are applying for loans or other financial assistance from the SBA. The form helps lenders understand the borrowing needs of businesses as well as their current financial situation. It also serves as a guide for borrowers to ensure accurate and timely payment of liabilities to creditors. Completing this form correctly is vital in order to be approved for a loan or other forms of SBA aid.

Download SBA Form 2202 – Schedule of Liabilities

| Form Number | SBA Form 2202 |

| Form Title | Schedule of Liabilities |

| File Size | 1 MB |

| Form By | SBA Forms |

What is an SBA Form 2202?

SBA Form 2202 is a small business form used to list all of the liabilities that the business has. This includes any money owed such as short-term and long-term debt, loan payments, credit card balances, taxes, or any other debt or financial obligation. This form provides a comprehensive overview of the businesses’ finances and allows lenders to assess whether the business may be able to pay off its existing debts.

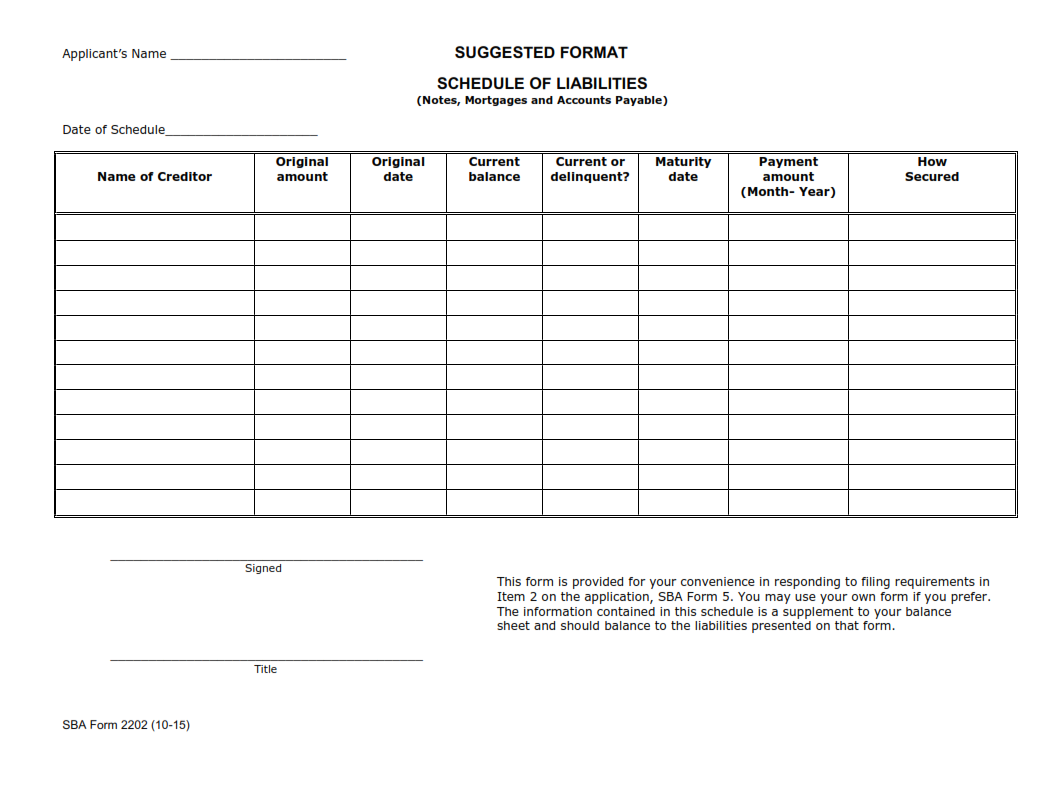

When filling out SBA Form 2202, it is important for small businesses to include accurate information about their liabilities including names of creditors, amounts owed, dates on which payments are due, interest rate associated with each liability account number and contact information for each creditor. It is also important for businesses to update this information regularly so that lenders have an accurate picture of the financial situation in order to make informed decisions about lending decisions.

What is the Purpose of SBA Form 2202?

The SBA Form 2202, also known as the Schedule of Liabilities, is a critical document that must be filled out when applying for an SBA loan. This document outlines the borrower’s existing liabilities at the time of loan application. It asks for information such as current creditor name, due date of payment and total balance owed on each liability. This helps lenders gain insight into the applicant’s financial situation and helps them decide if they are willing to extend credit to them. Additionally, it can help lenders assess any potential risks associated with issuing a loan to an applicant.

Completing this form accurately and thoroughly is essential in helping lenders determine a borrower’s eligibility for an SBA loan.

Where Can I Find an SBA Form 2202?

SBA Form 2202, also known as the Schedule of Liabilities, is an important document for businesses seeking a Small Business Administration loan. This form must be completed and submitted to the SBA in order to proceed with the loan process. Fortunately, finding this form is relatively easy; it can be located on the official SBA website.

The form can be found under “Forms & Resources” on the home page of sba.gov. From there, select “Borrowers” and you will see a list of documents related to loans that can open in PDF format. Scroll down until you find Form 2202 and click on it to download it and print if necessary. Additionally, some lenders may provide their own version of this form specific to their application process which should also be completed alongside any other documents requested by the lender.

SBA Form 2202 – Schedule of Liabilities

The SBA Form 2202 – Schedule of Liabilities is a form that must be completed by all applicants who are applying for loan assistance through the Small Business Administration (SBA). This form requires applicants to list out their current liabilities and obligations, including loans, leases, debtors’ accounts, vendor contracts, etc. It also requests information about any pending or future payment arrangements, whether they are in progress or not. The purpose of this form is to provide an accurate representation of the applicant’s financial situation in order to ensure eligibility for the requested funds.

The SBA Form 2202 must include detailed information about each liability item, such as the date it was acquired and its exact amount owed. Applicants should also include a brief explanation for each entry if necessary. Additionally, any collateral that is pledged against any of these liabilities must also be reported on this form.