ORIGINFORMSTUDIO.COM – SBA Form 1919 – Borrower Information Form – SBA Form 1919, also known as the Borrower Information Form, is an essential document that must be completed by individuals or businesses applying for financial assistance from the U.S. Small Business Administration (SBA). This form provides the SBA with important information about a loan applicant’s business and personal history and financial standing. Completing this form correctly is critical to determining whether or not you will be approved for a loan, so it’s important to understand what information is required and how to properly complete it.

Download SBA Form 1919 – Borrower Information Form

| Form Number | SBA Form 1919 |

| Form Title | Borrower Information Form |

| File Size | 466 KB |

| Form By | SBA Forms |

What is an SBA Form 1919 Form?

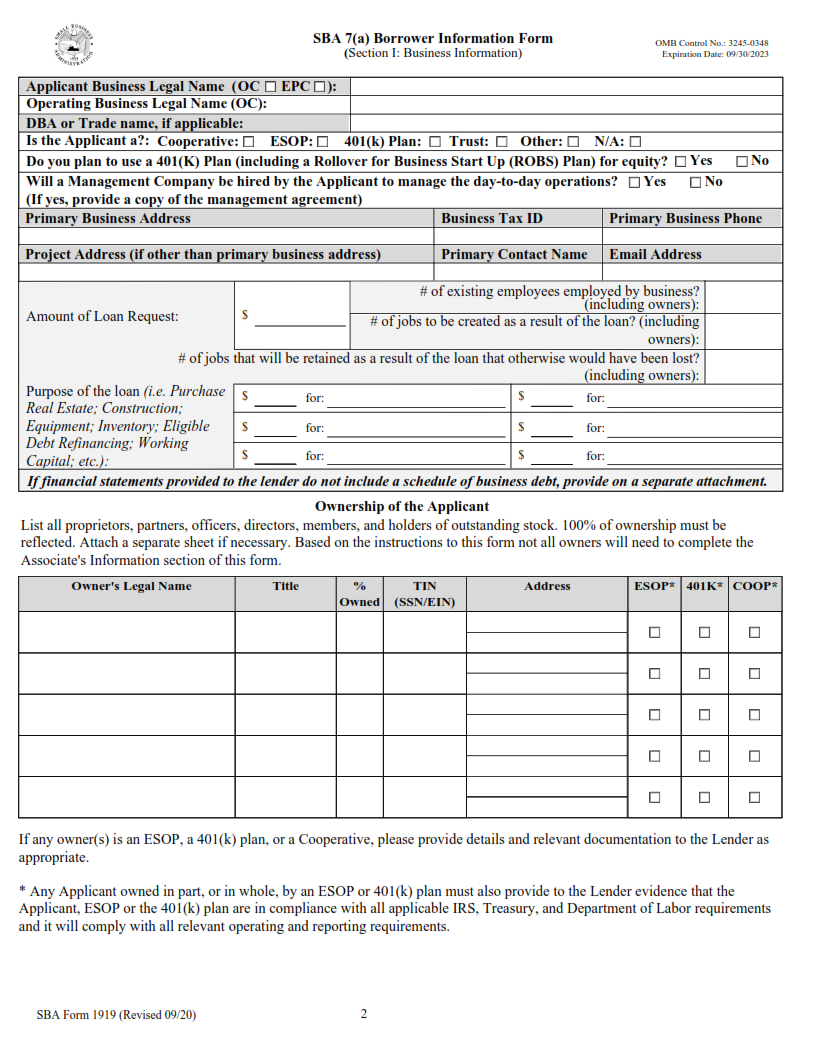

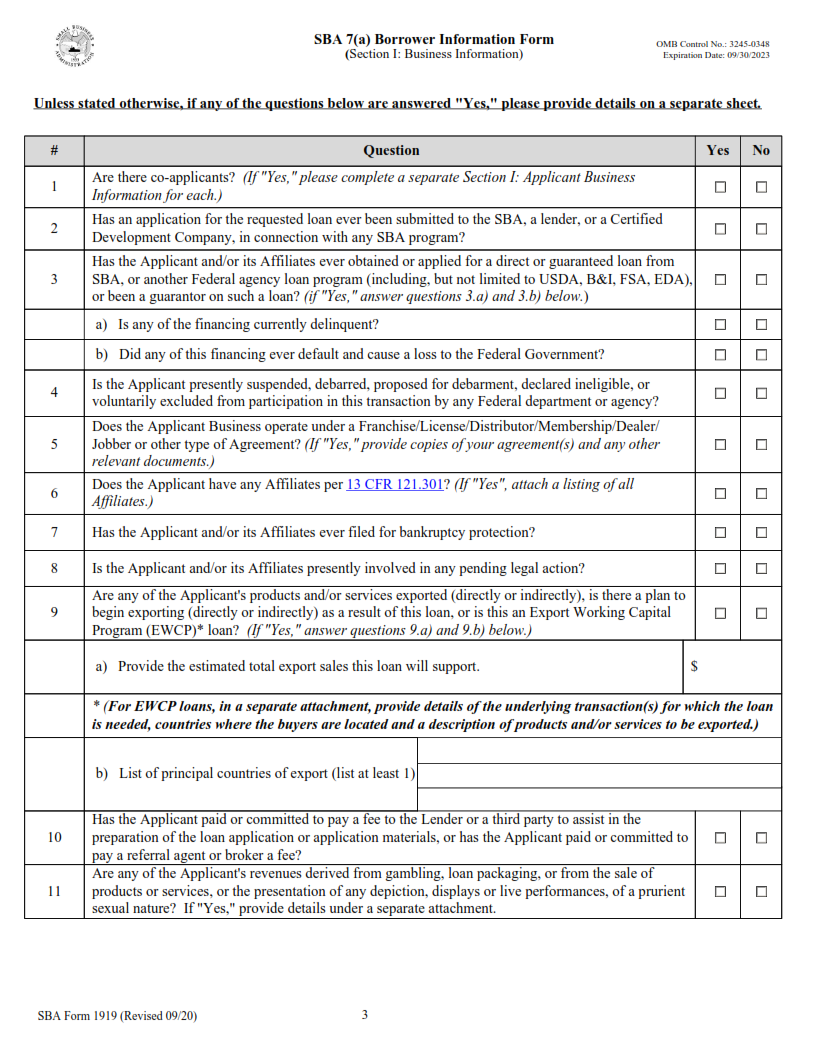

SBA Form 1919, also known as the Borrower Information Form, is an important document for any small business that has obtained a loan from the U.S. Small Business Administration (SBA). This form is used to collect information from borrowers about their business and financial status, including background information on ownership structure, company size, income levels, and current debt obligations. The SBA uses this form to evaluate the borrower’s ability to repay the loan and assess the risk of potential defaults.

The SBA Form 1919 must be filled out in full detail before any loan can be granted or modified by the agency. This includes providing personal identification documents such as driver’s license or passport numbers for all shareholders of 25% or more in addition to other required documents like tax returns and credit reports.

What is the Purpose of the SBA Form 1919?

The SBA Form 1919 is a crucial tool for small business owners who are looking to obtain financing from the U.S. Small Business Administration (SBA). The form, also known as the Borrower Information Form, is used by lenders to collect information about an applicant and their business before approving a loan. This form helps lenders determine whether or not a small business owner has the financial stability and creditworthiness required to qualify for a loan.

The SBA Form 1919 requires applicants to provide personal information such as name, address, Social Security Number, prior addresses and phone numbers, as well as details about their businesses such as legal name of the company, type of industry, physical address of place of business and number of employees. Applicants must also provide financial information such as revenue sources and expenses associated with running their businesses.

Where Can I Find an SBA Form 1919?

The Small Business Administration (SBA) Form 1919, also known as the Borrower Information Form, is an important form for anyone applying for a loan from the SBA. It is required when applying for 7(a), 504 and Microloan programs, and must be completed by all applicants. The form can be filled out online or printed in order to be submitted along with other required paperwork.

The SBA website provides instructions on how to fill out the form, including details such as what information needs to be included, what documents need to accompany the application and where they should be sent. Applicants can also access a printable version of the form directly from the website. Additionally, many banks and lending institutions that offer SBA loans may have their own versions of this form available for download or in-person completion.

SBA Form 1919 – Borrower Information Form

The Small Business Administration’s (SBA) Form 1919, known as the Borrower Information Form, is a crucial document required for all businesses seeking loan guarantees from the SBA. The form provides information about the business and its owners to allow the SBA to assess eligibility for loan guarantee programs.

The form requires details such as business name, address and tax identification number; type of ownership and years in operation; names and addresses of business owners; amount of requested funding; credit score of each owner; past bankruptcies or legal proceedings that may affect repayment ability; collateral offered for security on loans; projected cash flow from operations. Additionally, if current or former government contracts are involved in the loan guarantee request, then additional forms must be completed to provide further detail about those contracts.

SBA Form 1919 Example