ORIGINFORMSTUDIO.COM – SBA Form 413 – Personal Financial Statement – The SBA Form 413, also known as the Personal Financial Statement, is an important document used to assess a prospective borrower’s financial health. This form is required by many lenders when applying for a loan, and it must be filled out accurately in order to be considered for approval. It provides information about an individual’s assets and liabilities, income and expenses, necessary for lenders to evaluate creditworthiness. In addition to being used in loan applications, this form can also help individuals better understand their own personal finances and plan their financial future.

Download SBA Form 413 – Personal Financial Statement

| Form Number | SBA Form 413 |

| Form Title | Personal Financial Statement |

| File Size | 482 MB |

| Form By | SBA Forms |

What is a SBA Form 413 Form?

The SBA Form 413 Personal Financial Statement is used by the U.S. Small Business Administration (SBA) to determine the creditworthiness of loan applicants. This form provides the SBA with detailed information about the applicant’s financial situation, including their assets, liabilities, income and expenses related to their business. The form includes sections for personal and business information, sources of income and current debts and liabilities. It also includes two years of tax returns that must be signed by both the applicant and their accountant or tax preparer.

By requiring a detailed personal financial statement from loan applicants, it allows the SBA to evaluate an individual’s ability to repay any loans taken out from them. By providing an accurate picture of their finances, this helps ensure that loans are given out responsibly and will be repaid on time according to the agreed-upon terms between the applicant and lender.

What is the Purpose of SBA Form 413 Form?

SBA Form 413 is the Personal Financial Statement form used by the Small Business Administration (SBA) for loan applications. This form provides lenders with an in-depth look at an individual’s financial health, which helps them determine whether they are eligible for a loan. The form has two sections: one section is to be completed by the applicant themselves, while the other section is to be completed by their spouse or partner if applicable

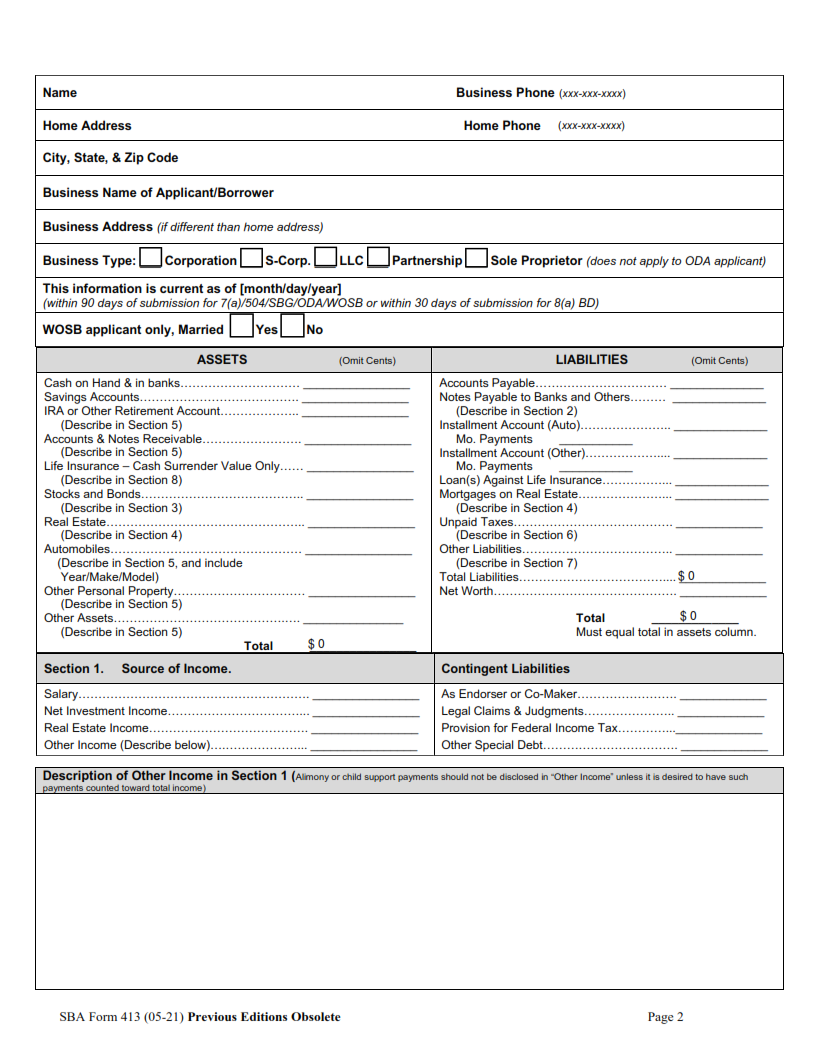

The purpose of SBA Form 413 is to collect detailed information about an individual’s current and long-term assets, liabilities, and income sources. This includes bank accounts, investments, retirement funds, real estate holdings, business interests and any other source of income or debt held by the borrower. The form also asks for information on any past bankruptcies or defaults that may have occurred within the past seven years.

Where Can I Find an SBA Form 413 Form?

The Small Business Administration (SBA) Form 413 is an important document used to determine the net worth of potential business owners. It is used by lenders and other institutions in order to evaluate the financial soundness of a potential loan applicant. The SBA Form 413 can be found on the official website of the Small Business Administration at sba.gov/sites/default/files/forms/413-0_0.pdf.

The form consists of three pages, and must be completed in order for applicants to provide their financial information for evaluation by lenders or other institutions. Applicants will need to provide personal information such as name, address, birthdate, Social Security Number, and contact information; employment information; business interests; assets; liabilities; and disclosure statements about any legal obligations or proceedings that may affect their ability to repay a loan or use credit properly.

SBA Form 413 – Personal Financial Statement

The Small Business Administration (SBA) Form 413 – Personal Financial Statement is one of the most important documents for entrepreneurs seeking financial assistance from the SBA. The form requires individuals to provide detailed information about their personal finances, including assets, liabilities, income and expenses. This information helps the SBA determine an individual’s ability to repay a loan or qualify for other forms of financing.

Completing this document accurately and honestly is essential; any misstatements can disqualify potential borrowers from receiving financing. It should also be noted that all co-applicants must complete the form as well. The following items are typically requested on this form: current bank account balances, current market value of properties owned, list of all creditors with account balances owed to each creditor and total amount of monthly payments made towards those accounts.

SBA Form 413 Form Example