ORIGINFORMSTUDIO.COM – SBA Form 34 – Bank Identification form – The Small Business Administration (SBA) Form 34 – Bank Identification Form is an important document for entrepreneurs and small business owners alike. It is used by financial institutions to identify a small business, its ownership structure, and other key information that must be provided in order to open a business checking account. Knowing the importance of this form, it’s essential that you understand what is required, how to fill it out correctly, and any potential issues you may encounter along the way.

Download SBA Form 34 – Bank Identification form

| Form Number | SBA Form 34 |

| Form Title | Bank Identification form |

| File Size | 155 KB |

| Form By | SBA Forms |

What is an SBA Form 34?

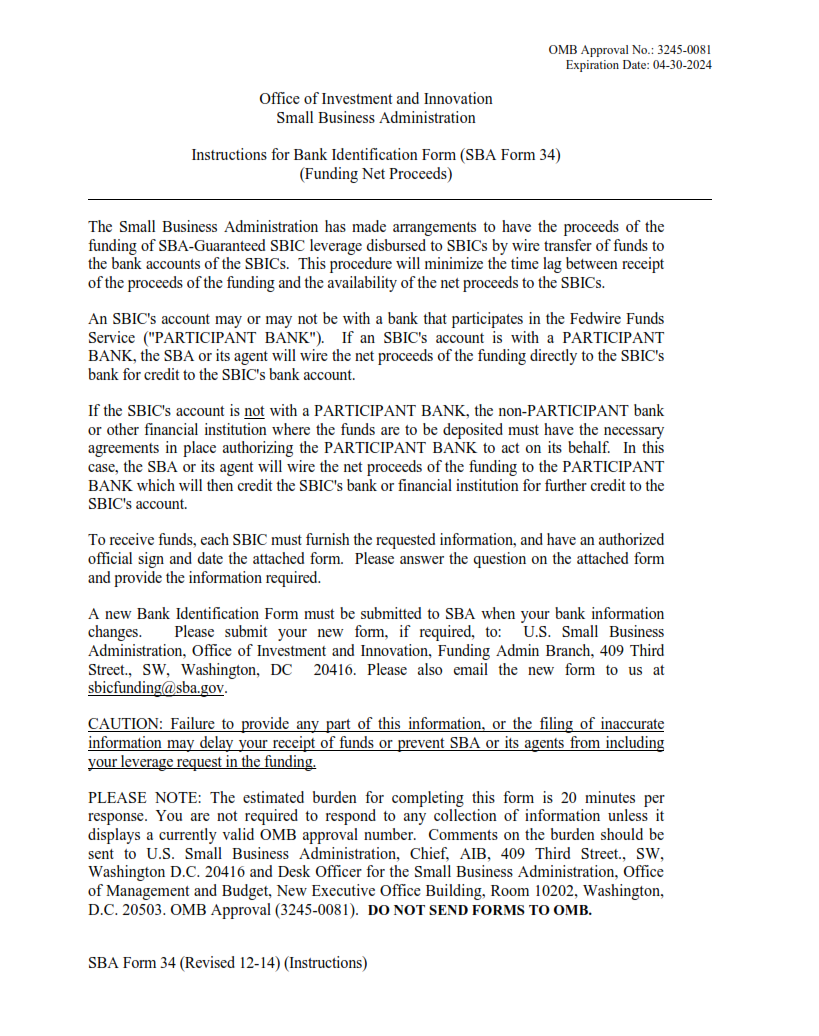

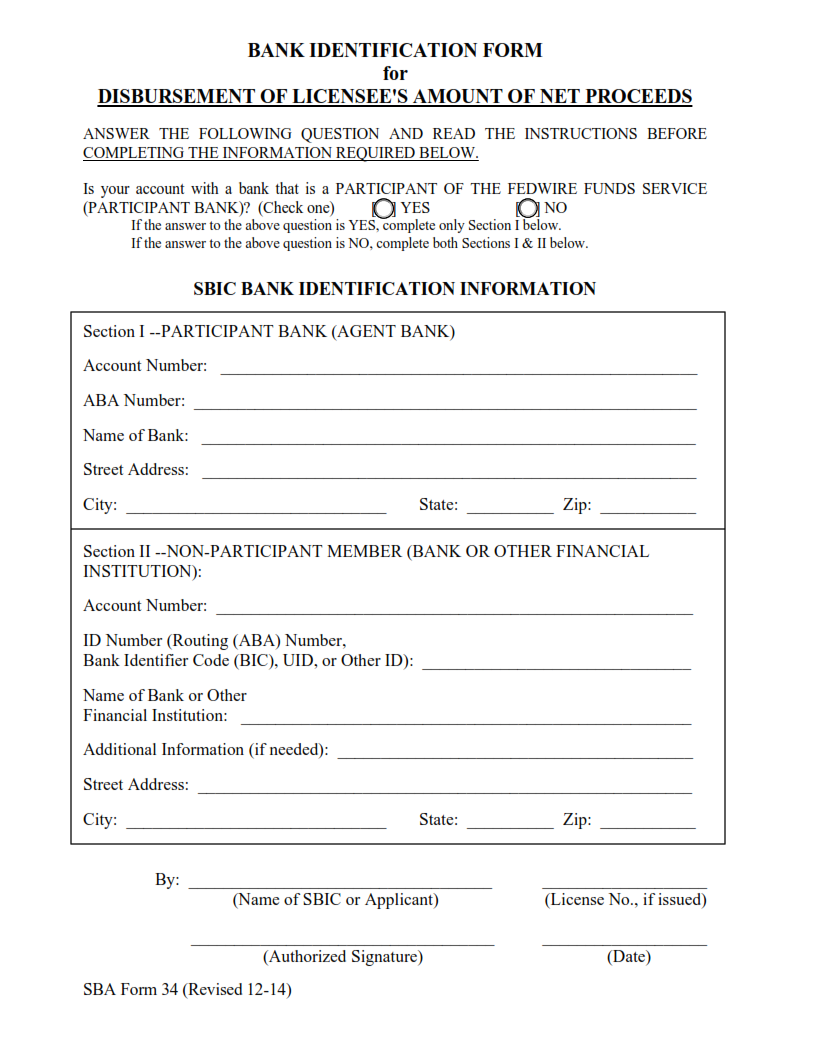

An SBA Form 34, also known as a Bank Identification Form, is an important form used by the Small Business Administration (SBA) when providing loans to small businesses. This form requires business owners to provide detailed information about their bank account and banking history in order to receive funding from the SBA.

The SBA Form 34 is required for all applicants looking to receive funds from the SBA’s loan programs. It requests information such as the name and address of your financial institution, account numbers and types of accounts you have at that institution, current balances in your accounts, and details on any other assets or debts associated with your finances. This helps the SBA determine if an applicant is eligible for a loan and how much they can borrow. The form must be completed accurately in order for applicants to be considered for an SBA loan.

What is the Purpose of SBA Form 34?

SBA Form 34, also known as the Bank Identification Form, is a form that is used by the Small Business Administration (SBA) to identify the banking institution that will handle loan payments. It serves as confirmation of eligibility for an SBA 7(a) or 504 loan and contains information such as the name and location of the lending bank, account numbers, contact information, and other relevant details. The purpose of this form is to ensure that all parties involved are aware of where funds are being deposited or withdrawn from in order to complete transactions.

Additionally, SBA Form 34 provides security measures for lenders and borrowers alike. By verifying all financial details before a loan is approved, it helps protect both parties from any potential fraudulent activity or misleading practices.

Where Can I Find an SBA Form 34?

The Small Business Administration (SBA) Form 34 or Bank Identification Form is designed to help small businesses quickly and securely identify their bank. This form allows the SBA to verify important information about your bank, such as its location, contact information, and other banking services offered.

You can find the SBA Form 34 on the official website of the Small Business Administration. The form is available in both a fillable PDF version and an HTML version for users who need assistance filling out the form. Additionally, it can be printed off from any computer with a printer or downloaded directly from SBA’s website. Once completed, you may submit your completed form either by mail or electronically via secure email transmission systems like SFTP or HTTPS protocol.

SBA Form 34 – Bank Identification form

The SBA Form 34 – Bank Identification form is an important document for small business owners that are seeking loans from the Small Business Administration (SBA). This form requires business owners to provide their banking information in order to receive a loan guarantee from the SBA. The borrower must list their bank’s routing number, account number, and financial institution name on the form. Additionally, borrowers are also required to provide contact information associated with their bank accounts, such as their address, phone number and email address.

Businesses applying for an SBA loan must complete this form accurately and submit it along with other required documents. Failing to do so may result in delays or rejection of a loan application by the lender or guarantor. It is strongly advised that businesses review all information on the Form 34 before submission to ensure accuracy and avoid any costly mistakes when applying for an SBA loan.

SBA Form 34 Example