ORIGINFORMSTUDIO.COM – SBA Form 33 – Authorization to Disburse Proceeds – The SBA Form 33 – Authorization to Disburse Proceeds is an important document that outlines the process of disbursing proceeds from a Small Business Administration (SBA) loan. This authorization form is completed by the borrower and approved by the lender, which allows for funds to be released. It must be filled out accurately and all information must be verified before any funds are released.

Download SBA Form 33 – Authorization to Disburse Proceeds

| Form Number | SBA Form 33 |

| Form Title | Authorization to Disburse Proceeds |

| File Size | 170 KB |

| Form By | SBA Forms |

What is an SBA Form 33?

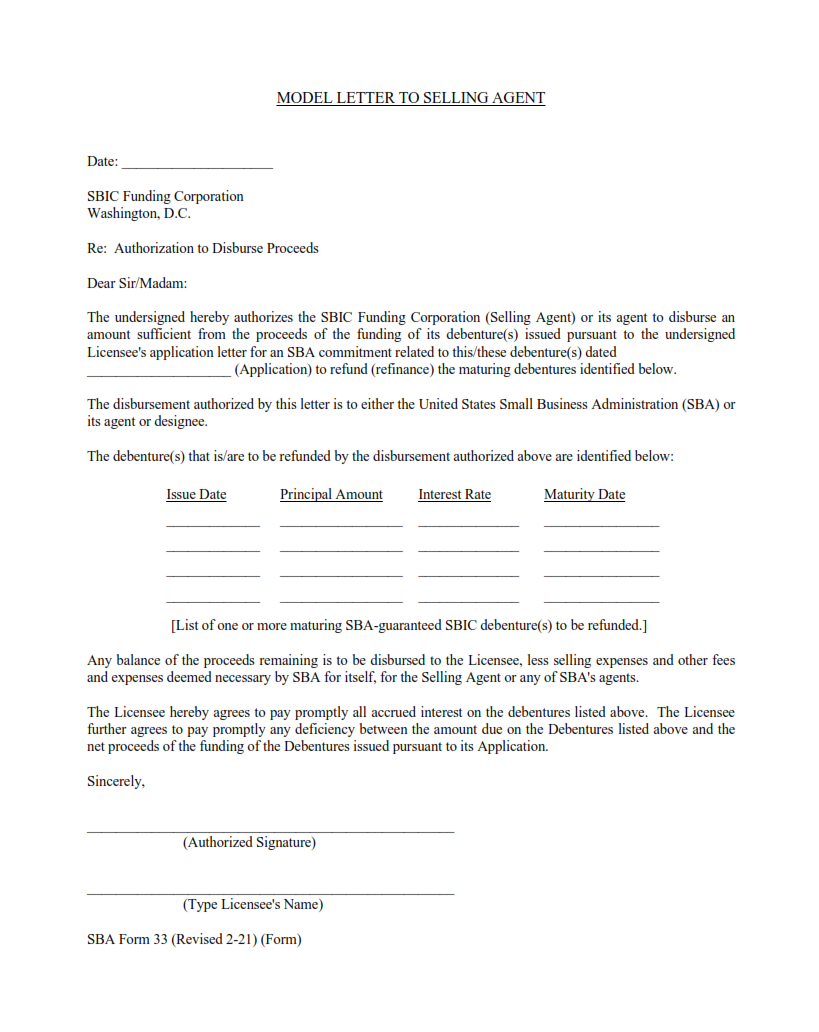

SBA Form 33, also known as the Authorization to Disburse Proceeds, is a form used by businesses that have received financing from the Small Business Administration (SBA). This form allows the business to authorize their lender to disburse proceeds from their SBA loan in order to cover expenses associated with starting or operating their business. The form must be signed by both the borrower and the lender before any funds can be released.

The form requires basic information about both parties involved, such as contact information and addresses. It also includes information about how much of the loan will be dispersed for various purposes such as equipment purchases, working capital, repairs and renovations, etc. Additionally, it outlines when payments are due along with penalties for late payments.

What is the Purpose of SBA Form 33?

Small Business Administration (SBA) Form 33 is an authorization form that allows the SBA to disburse proceeds from a loan or other financial assistance program. It is designed to ensure that funds are used for their intended purpose and are properly accounted for. The form must be filled out by the borrower before any funds can be disbursed.

The purpose of SBA Form 33 is to provide assurance that the proceeds from a loan or other financial assistance program will be used as intended. This form requires detailed information about the proposed use of funds, including a description of how they will be used, who will benefit from them, and what documents need to be presented in order to receive them. Additionally, it requires certification that all of the information provided is accurate and complete. By filling out this form, borrowers are agreeing to follow all applicable rules and regulations when using their loan proceeds.

Where Can I Find an SBA Form 33?

The Small Business Administration (SBA) Form 33, or Authorization to Disburse Proceeds, is a legal document used to transfer proceeds from the sale of a business to its seller. This form must be completed in order for the seller to receive the funds from the sale of their business. It also serves as proof that all parties involved in the transaction have agreed upon and properly documented the terms of the sale.

The SBA Form 33 can be obtained from any SBA office or online at sba-form33.gov. It is important that all parties involved in signing this document are aware of their rights and obligations under it, as failure to meet these requirements could lead to costly litigation down the line. When completing this form, sellers should make sure they provide accurate information regarding their identity, contact details, and other pertinent information related to the transaction.

SBA Form 33 – Authorization to Disburse Proceeds

The Small Business Administration (SBA) Form 33 is an authorization to disburse proceeds from a loan obtained through the SBA. This form allows the lender to release funds from the loan, typically in order to pay for the costs associated with starting or expanding a business. The borrower must provide detailed information about their business, including financial statements, credit history, and any other relevant documents. Once completed and approved by the lender, this form gives lenders permission to disperse payments from the loan amount as needed.

The SBA Form 33 must be filled out accurately and completely in order for it to be accepted by the lender. It should include accurate information regarding how much money is being requested, what it will be used for, and when repayment of these funds will take place. All signatures must also be included on this document in order for it to be valid.

SBA Form 33 Example