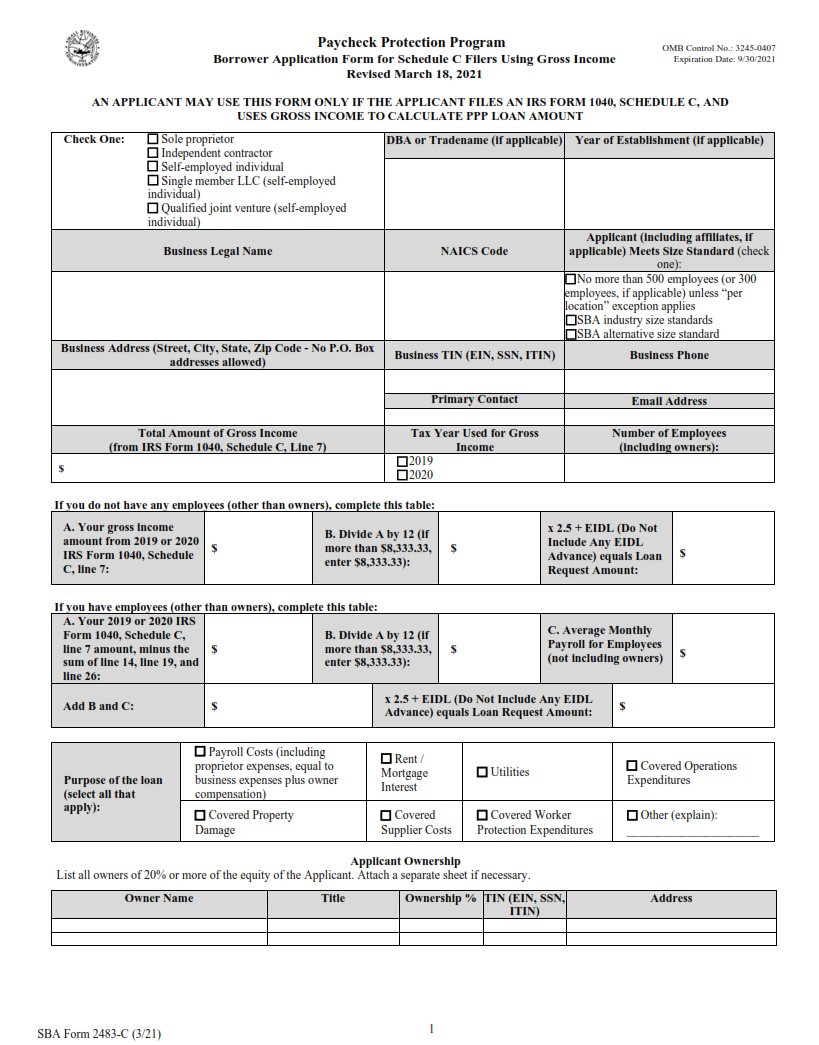

ORIGINFORMSTUDIO.COM – SBA FORM 2483-SD-C – Second Draw Borrower Application Form for Schedule C Filers Using Gross Income – The SBA Form 2483-SD-C is an important document for certain individuals who are seeking a Paycheck Protection Program (PPP) loan as part of the economic stimulus act caused by the Covid-19 pandemic. This borrower application form, specifically for Schedule C filers using gross income, is used to determine eligibility for the second draw PPP loan program. From gathering essential business information to establishing proof of eligibility, this form provides all necessary information required from both the lender and borrower in order to process a PPP loan.

Download SBA FORM 2483-SD-C – Second Draw Borrower Application Form for Schedule C Filers Using Gross Income

| Form Number | SBA 2483-SD-C |

| Form Title | Second Draw Borrower Application Form for Schedule C Filers Using Gross Income |

| File Size | 550 KB |

| Form By | SBA Forms |

What is a SBA Form 2483-SD-C?

The Small Business Administration (SBA) Form 2483-SD-C is a borrower application form designed specifically for businesses filing Schedule C with their taxes on gross income. This form, along with the other accompanying documents, is required to be completed and submitted in order to receive an Economic Injury Disaster Loan (EIDL) under the second draw program.

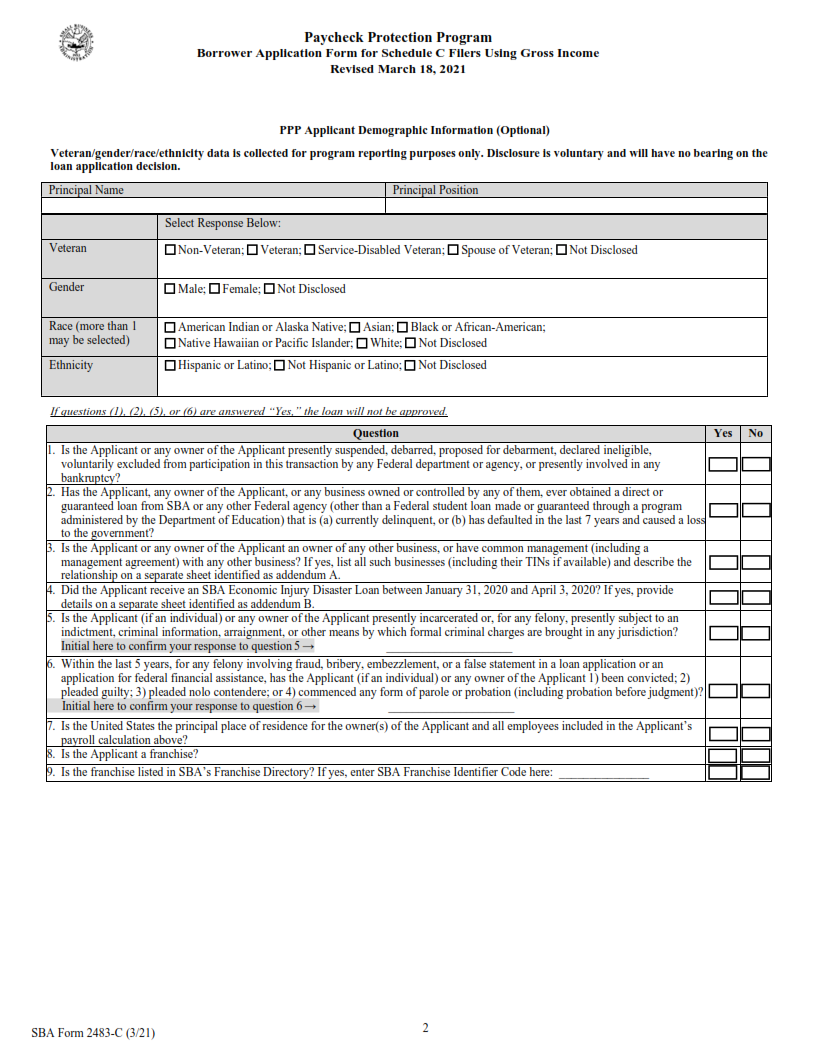

The purpose of this form is to provide the SBA and lenders with information about your business and its financial standing. It contains questions regarding your business type and size, details about any affiliates, economic impact from COVID-19, existing loans or lines of credit, loan amount requested, use of proceeds from the EIDL loan, as well as personal information such as name, address and Social Security number of all owners with more than 20% ownership interest in the company.

What is the Purpose of SBA Form 2483-SD-C?

The Small Business Administration (SBA) Form 2483-SD-C is a form that must be completed by all Schedule C filers who are applying for the second draw of the Paycheck Protection Program (PPP). This form is used to determine an applicant’s eligibility and their ability to receive loan forgiveness under the PPP. It requests information about the business’s gross income, expenses, employee costs, and other items necessary for assessing an applicant’s financial status. The information provided in this form will help lenders process applications quickly and accurately.

As part of completing Form 2483-SD-C, applicants are required to provide evidence of their gross income from Schedule C over a period of two years prior to submitting the application. Additionally, applicants must also provide documentation regarding any changes in payment structure or benefits since January 1st 2020.

Where Can I Find a SBA Form 2483-SD-C?

Small business owners who are filing as a Schedule C filer and applying for a second draw loan under the Paycheck Protection Program (PPP) need to complete SBA Form 2483-SD-C. The form can be found on the Small Business Administration’s website, which provides detailed instructions on how to fill it out correctly. This form is used to document an applicant’s payroll costs and financial documentation, such as bank statements, tax returns and other documents related to their business activities. It is important that all information provided on this form is accurate in order for an application to be approved by the SBA. Applicants should also keep copies of all forms submitted for future reference should there be any questions from the lender or the SBA about the accuracy of their application.

SBA FORM 2483-SD-C – Second Draw Borrower Application Form for Schedule C Filers Using Gross Income

The Small Business Administration (SBA) recently released SBA Form 2483-SD-C, the Second Draw Borrower Application Form for Schedule C Filers Using Gross Income. This form is for businesses that are using gross income to apply for a second draw of Paycheck Protection Program (PPP) funds.

The SBA Form 2483-SD-C contains all the necessary information needed to submit a second draw PPP loan application. It includes details on the borrower’s business structure, employment numbers, gross receipts or sales data and estimated expenses. Additionally, it requires applicants to provide evidence of their eligibility by supplying documents such as proof of identity and payment stubs from employees or independent contractors. After completing these requirements, borrowers must sign an attestation affirming that they meet all applicable program criteria before submitting their application.

SBA Form 2483-SD-C Example