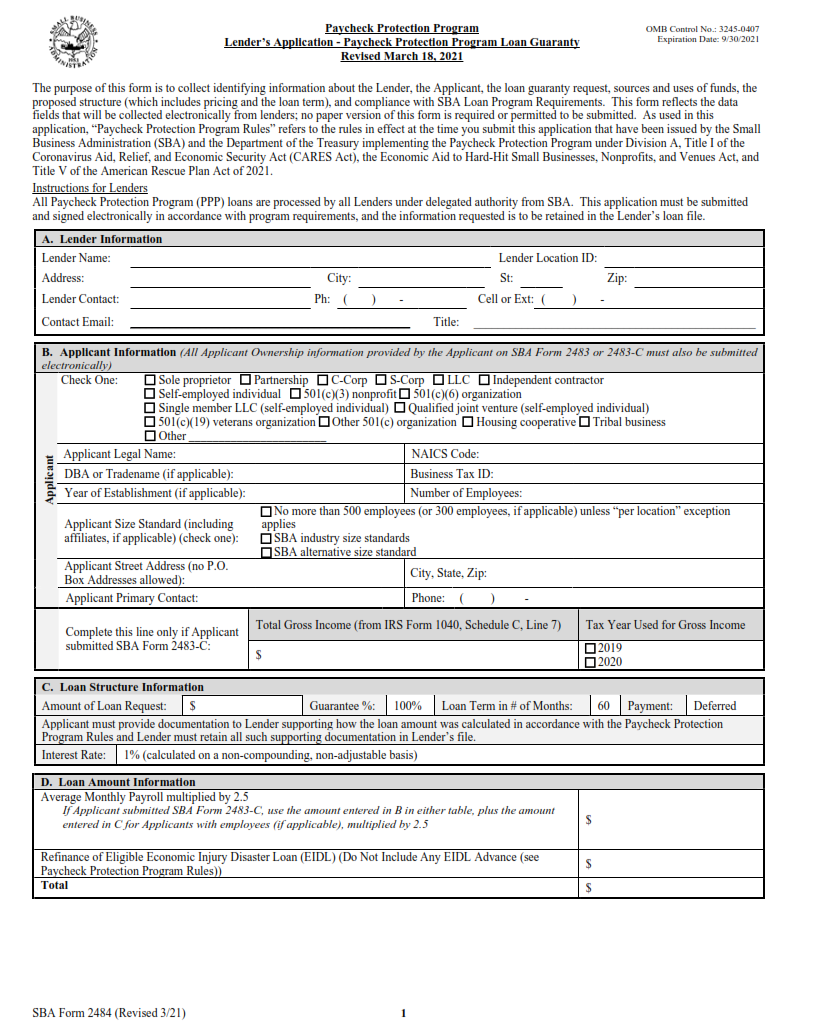

ORIGINFORMSTUDIO.COM – SBA Form 2484 – Lender Application Form – Paycheck Protection Program Loan Guaranty – The Small Business Administration (SBA) offers an array of financial assistance to small businesses, including the Paycheck Protection Program Loan Guaranty. For the program, SBA’s Form 2484 is the Lender Application Form that lenders must complete in order to process and guarantee a loan under the PPP. This article will explain how borrowers can use SBA Form 2484 to apply for a PPP loan and what information they should include when filling out this form. It will also explain how lenders can use the form to start processing and guaranteeing PPP loans.

Download SBA Form 2484 – Lender Application Form – Paycheck Protection Program Loan Guaranty

| Form Number | SBA Form 2484 |

| Form Title | Additional Liens Statement |

| File Size | 334 KB |

| Form By | SBA Forms |

What is an SBA Form 2484?

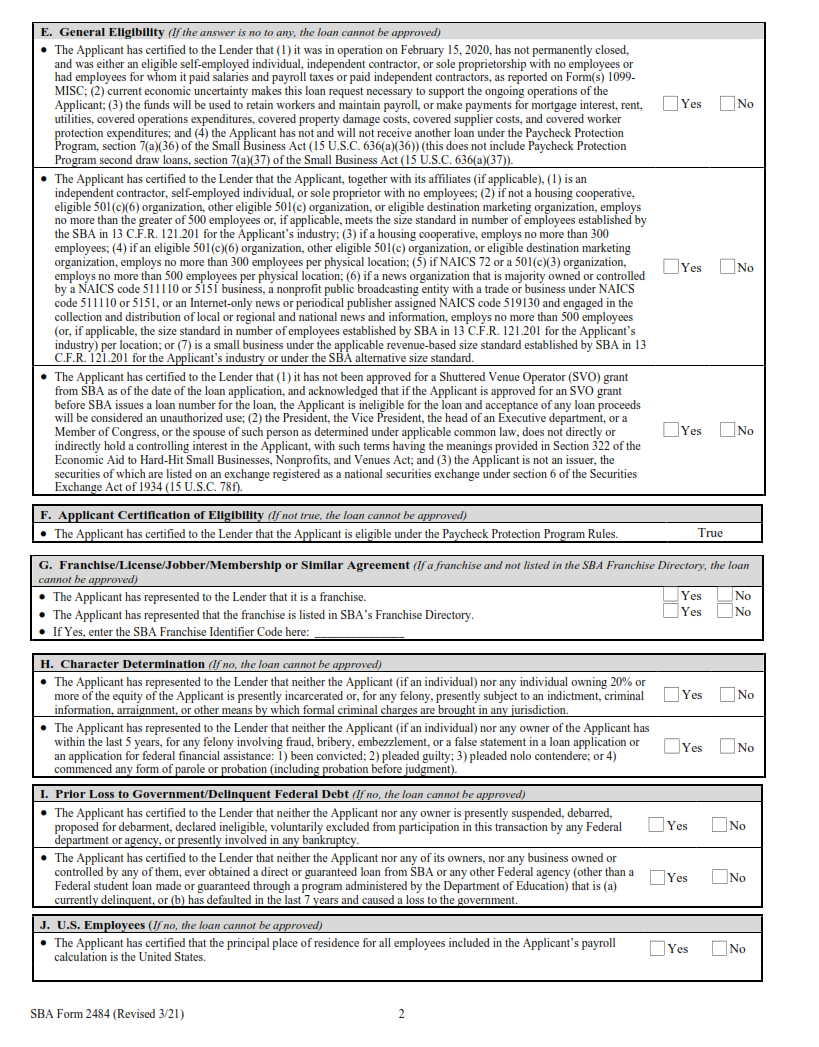

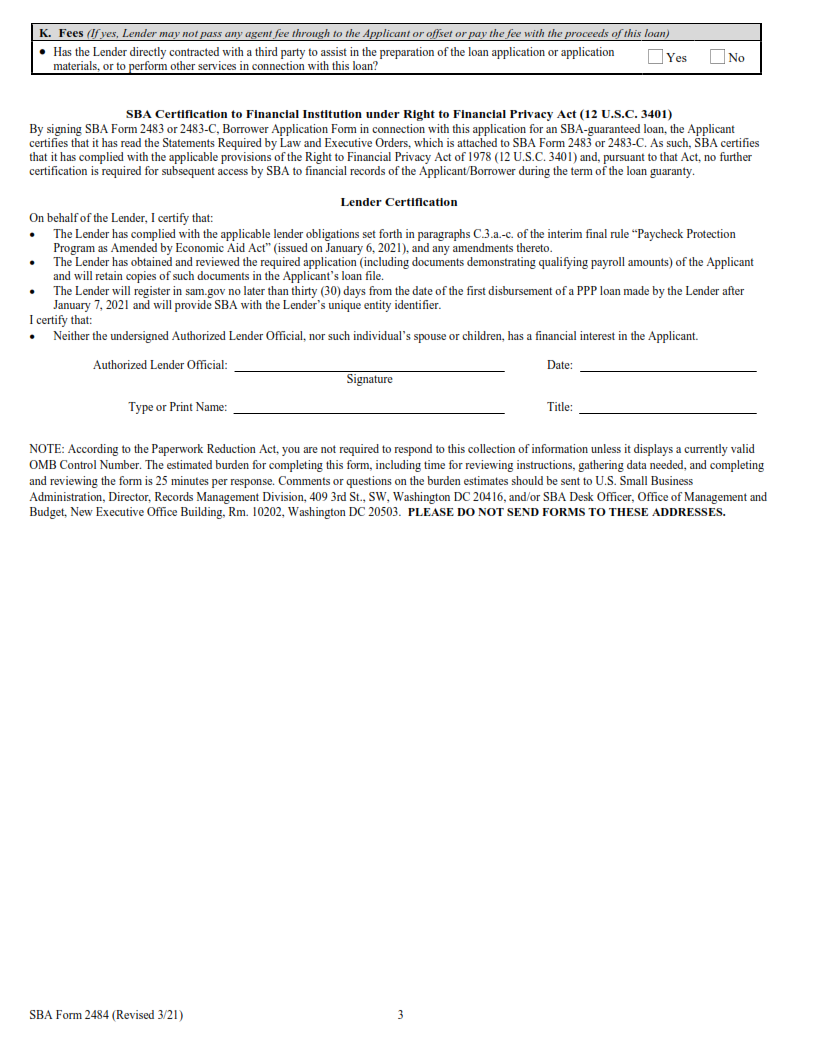

The Small Business Administration (SBA) Form 2484 is a lender application form used to apply for Paycheck Protection Program (PPP) loan guaranty. This form must be completed by lenders when they are applying to the SBA for the program. It is important that all information provided in this form is accurate and complete, as it will be used to determine whether or not a PPP loan can be approved.

The purpose of the SBA Form 2484 is to provide financial data about a borrower and their business in order to assess their eligibility for a PPP loan. The form requests details about the borrower’s business structure, size, industry, income sources, and other relevant financial information needed by lenders to accurately assess the credit risk associated with approving such a loan.

What is the Purpose of SBA Form 2484?

The SBA Form 2484 is the Lender Application Form for the Paycheck Protection Program (PPP) Loan Guaranty. This form serves as an application for lenders to become PPP loan guarantors, which will allow them to provide loans to small businesses affected by COVID-19. The form outlines the requirements and responsibilities of participating lenders, as well as other important information about the program such as eligibility and maximum loan amounts.

Completion of this form is required for any lender wishing to participate in the PPP loan program. It provides key details about a lender’s qualifications and experience that the Small Business Administration (SBA) needs to assess in order for them to be approved as a guarantor. By becoming a PPP loan guarantor, lenders can help ensure that small businesses are able to access needed funds during these difficult times.

Where Can I Find an SBA Form 2484?

The Small Business Administration (SBA) Form 2484 is an important form for those looking to apply for a loan under the Paycheck Protection Program. This form is required by lenders in order to process and approve applications for PPP loans. The SBA provides the form on their website, as well as other resources that potential borrowers can use to prepare their application properly.

The SBA Form 2484 can be found on the official website of the Small Business Administration at https://www.sba.gov/document/sba-form-2484-lender-application-form. The form is available in both PDF and Word format, so you can choose whichever version works best for you. Additionally, there are instructions included on how to fill out the form correctly and accurately so that it can be processed quickly by your lender.

SBA Form 2484 – Lender Application Form – Paycheck Protection Program Loan Guaranty

The Paycheck Protection Program Loan Guaranty is an important step for businesses looking to secure financial assistance through the Small Business Administration (SBA). The SBA Form 2484 is used by lenders to apply for loan guarantees from the SBA. It provides information about the applicant, the requested amount of the loan guarantee and other relevant information so that lenders can make a decision about providing assistance.

In order to apply for a loan guarantee, a business must first fill out an SBA Form 2484. This form requires basic information such as name and address of applicant, type of business activity, requested amount of loan guarantee, purpose of funds and other pertinent details. Additionally, it also requires information regarding collateral requirements and personal financial statements in order to assess creditworthiness.

SBA Form 2484 Example