ORIGINFORMSTUDIO.COM – SBA Form 1086 – Secondary Participation Guarantee Agreement – The Small Business Administration (SBA) provides a variety of loan options to small business owners. One such option is the SBA Form 1086 – Secondary Participation Guarantee Agreement. This form is designed to help small businesses secure loans from larger lenders by providing a guarantee of repayment on their behalf. The SBA will provide a guarantee for up to 85% of the loan’s value, if it meets certain criteria. Understanding this form and how it works can be helpful for small business owners who need additional financing.

Download SBA Form 1086 – Secondary Participation Guarantee Agreement

| Form Number | SBA Form 1086 |

| Form Title | Secondary Participation Guarantee Agreement |

| File Size | 592 KB |

| Form By | SBA Forms |

What is an SBA Form 1086?

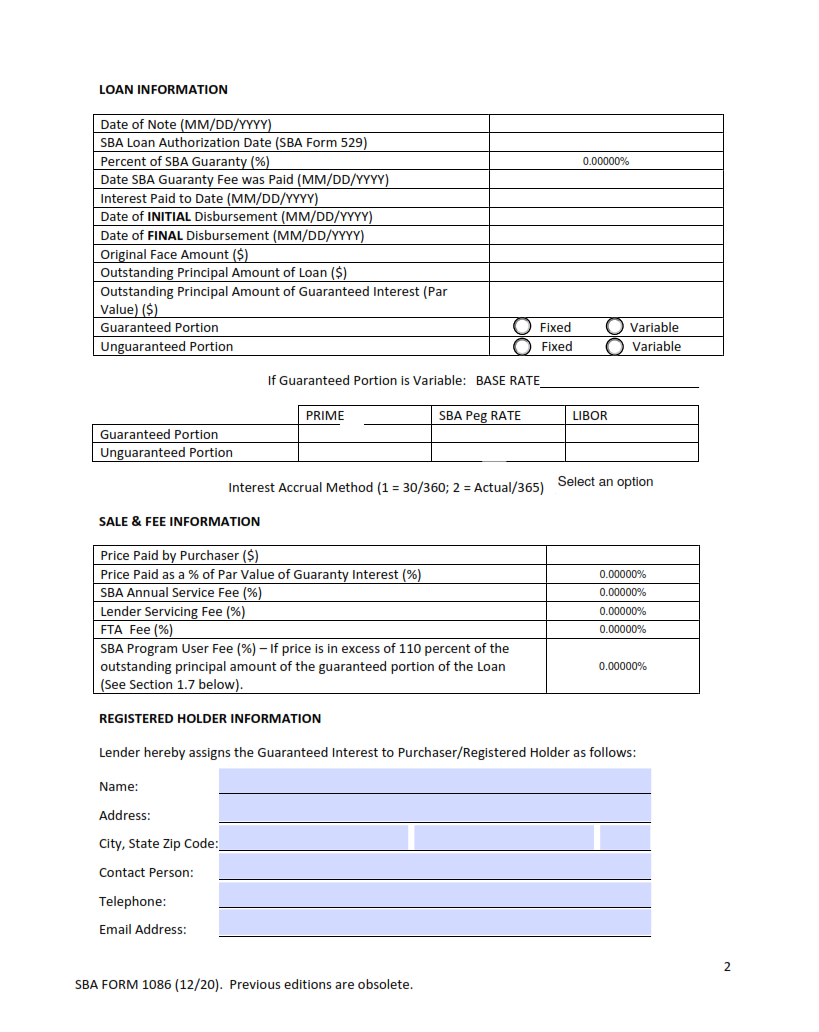

An SBA Form 1086 is a Secondary Participation Guarantee Agreement. This type of agreement allows the Small Business Administration (SBA) to guarantee the repayment of a loan provided by a lender, while also allowing another lender to participate in the loan. This form is commonly used when bank lenders are unwilling to provide the full amount of financing needed for businesses seeking an SBA loan. The guaranty reduces risk and encourages lenders who would not ordinarily make such loans due to perceived risks or lack of sufficient collateral.

The SBA Form 1086 requires lenders participating in secondary participation agreements to comply with certain requirements before their loan is approved. These include providing documents such as borrower financial statements, personal guarantees, and information about any additional collateral that might be pledged as security for the loan.

What is the Purpose of SBA Form 1086?

The purpose of SBA Form 1086 is to provide a guarantee agreement between the Small Business Administration (SBA) and another lender that is participating in the loan. This form helps to ensure that the secondary lender will receive their money in case of borrower default.

In addition, this form serves as a way for the SBA to approve additional financing for borrowers who do not qualify under normal criteria. By providing a guarantee agreement, the SBA can help small businesses get access to capital when they would otherwise be unable to obtain it.

Overall, SBA Form 1086 provides an important guarantee between lenders and the SBA while also helping small businesses secure additional funds when needed. It has become an integral part of obtaining loans from both primary and secondary lenders.

Where Can I Find an SBA Form 1086?

The SBA Form 1086 is an important document for those seeking financing from the Small Business Administration, and it’s important to understand where to locate it. The form is available on the official website of the Small Business Administration at sba.gov/document and can be downloaded as a PDF file. Additionally, many lenders have a copy of this form on their websites, so if you are working with a lender already they may provide you with the form directly or point you in the right direction.

For businesses that need assistance in filling out Form 1086, there is help available from an SBA district office near you or online through various third-party organizations that provide assistance with business loans and paperwork.

SBA Form 1086 – Secondary Participation Guarantee Agreement

The SBA Form 1086 – Secondary Participation Guarantee Agreement is a document that allows the Small Business Administration (SBA) to guarantee a loan to a small business owner. The agreement outlines the terms and conditions of the loan, which includes the interest rate and repayment schedule. It also covers any potential defaults by the borrower and how they would be handled should they occur.

The agreement also states that if there is an issue with repayment of the loan, then it could be sold to another lender for recovery purposes. This helps ensure that in case of default, lenders can still collect on their debt. The form also outlines any fees or costs associated with the transaction and stipulates who will pay them.

By signing this form, small business owners are agreeing to abide by all of these terms and conditions, including repaying their loans according to the agreed-upon schedule.

SBA Form 1086 Example