ORIGINFORMSTUDIO.COM – SBA Form 159D – Fee Disclosure Form and Compensation Agreement – The Small Business Administration (SBA) Form 159D, also known as the Fee Disclosure Form and Compensation Agreement, is an important legal document that outlines the fee structure associated with a loan. It is a key part of the SBA 7(a) loan process and helps both the borrower and lender understand the terms of any agreement they enter into. This article will discuss what information is included in this form, how to fill it out correctly, and why it’s important to pay attention to all of its details.

Download SBA Form 159D – Fee Disclosure Form and Compensation Agreement

| Form Number | SBA Form 159D |

| Form Title | Fee Disclosure Form and Compensation Agreement |

| File Size | 212 KB |

| Form By | SBA Forms |

What is an SBA Form 159D?

SBA Form 159D, also known as the Fee Disclosure Form and Compensation Agreement, is an important document that small business owners need to review carefully. This form must be filed with the Small Business Administration (SBA) in order for a lender to receive SBA loan guarantee funds. The purpose of this form is to provide transparency between borrowers and lenders about all fees associated with the loan agreement.

The Fee Disclosure Form provides detailed information about both initial and ongoing costs, such as origination fees, closing costs, interest rate adjustments, and other miscellaneous charges. It also outlines how much compensation lenders are receiving for providing services related to the loan. Additionally, it specifies which party will be responsible for paying each fee or commission during different stages of the loan process.

What is the Purpose of SBA Form 159D?

The purpose of SBA Form 159D, also known as the Fee Disclosure Form and Compensation Agreement, is to ensure that all parties in a Small Business Administration (SBA) loan transaction are aware of the total costs associated with the loan. It requires lenders to disclose all fees related to an SBA loan prior to closing on the loan. This form must be signed by both the lender and borrower in order for the transaction to move forward.

The form provides detailed information about each fee, including its amount and purpose. Information listed includes origination fees, application fees, processing fees, document preparation fees and other general closing costs such as title insurance or recording charges. It also outlines any compensation that may be granted by either party in connection with a particular fee. This ensures that borrowers are aware of any incentives or discounts offered by lenders for obtaining their services or products.

Where Can I Find a SBA Form 159D?

When applying for an SBA loan, it is important to make sure that you have the appropriate paperwork in order. The SBA Form 159D, also known as the Fee Disclosure Form and Compensation Agreement, is required for all SBA loans. This form provides information about any fees associated with obtaining an SBA loan and outlines contractual requirements between the lender and borrower.

The best place to find a copy of this form is on the Small Business Administration’s website. Here you can download a PDF version of the form that meets your needs. Additionally, many lenders may provide their own version of this form that should be used instead of the one from the Small Business Administration. It’s important to read through both versions carefully in order to ensure all necessary information has been included before submitting it for review.

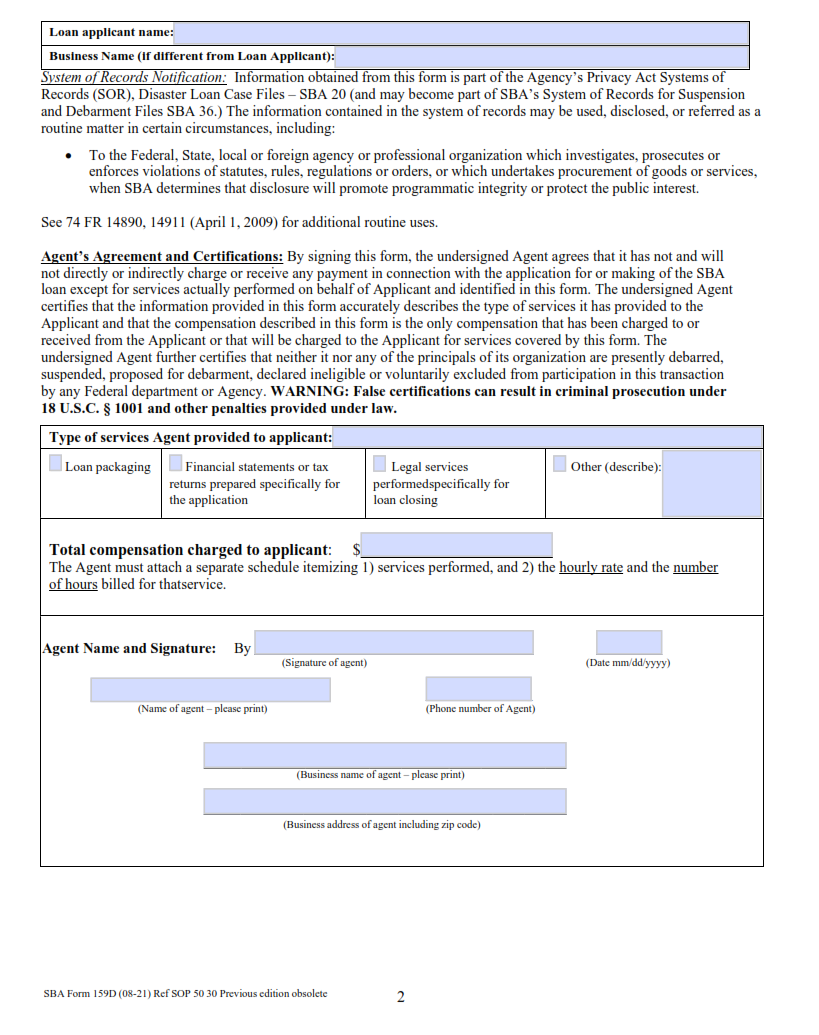

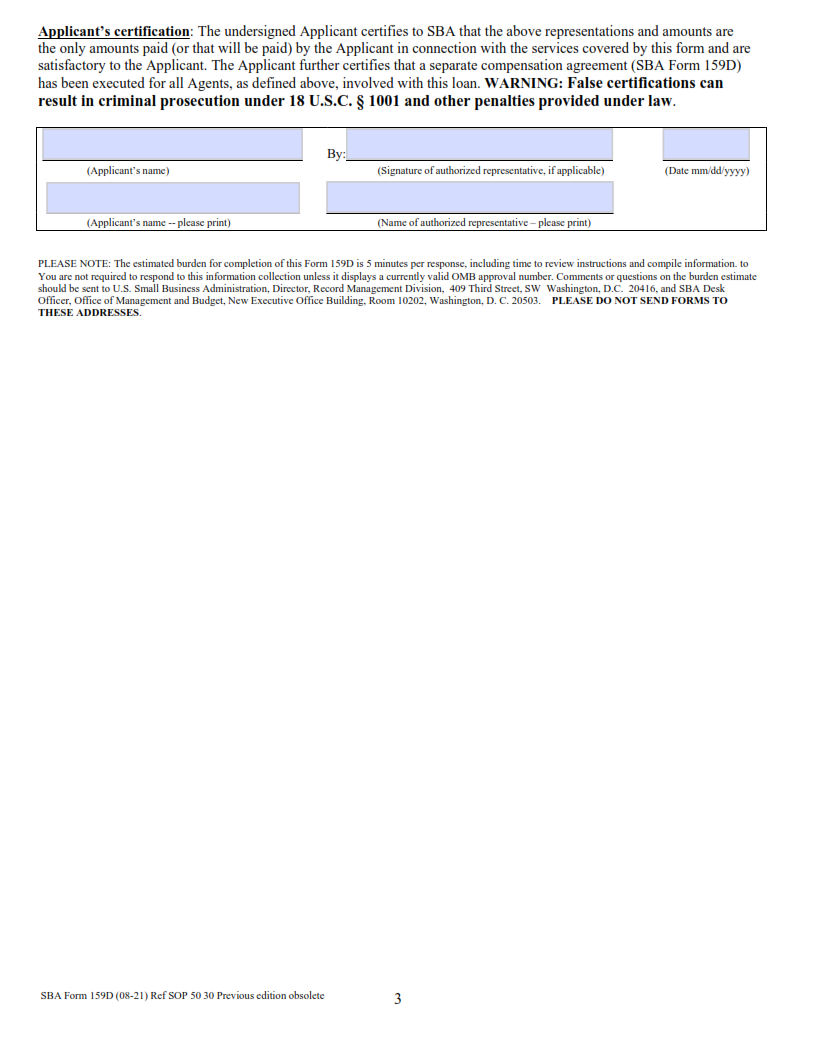

SBA Form 159D – Fee Disclosure Form and Compensation Agreement

SBA Form 159D is a fee disclosure form and compensation agreement designed for Small Business Administration (SBA) transactions. This form must be completed and signed by the borrower and lender when fees exceed the amount allowed by SBA regulations. It is important to understand each section of this form in order to ensure an accurate transaction.

The first section on SBA Form 159D requires that both parties specify the total amount of all fees associated with the loan, as well as how these fees will be collected – either through loan disbursement or direct payment to the lender. The second section outlines specifications for structuring the loan repayment schedule, such as how long any deferred payments will last. Lastly, it includes details about the interest rate charged on the loan and any other terms of repayment agreed upon between borrower and lender.

SBA Form 159D Example