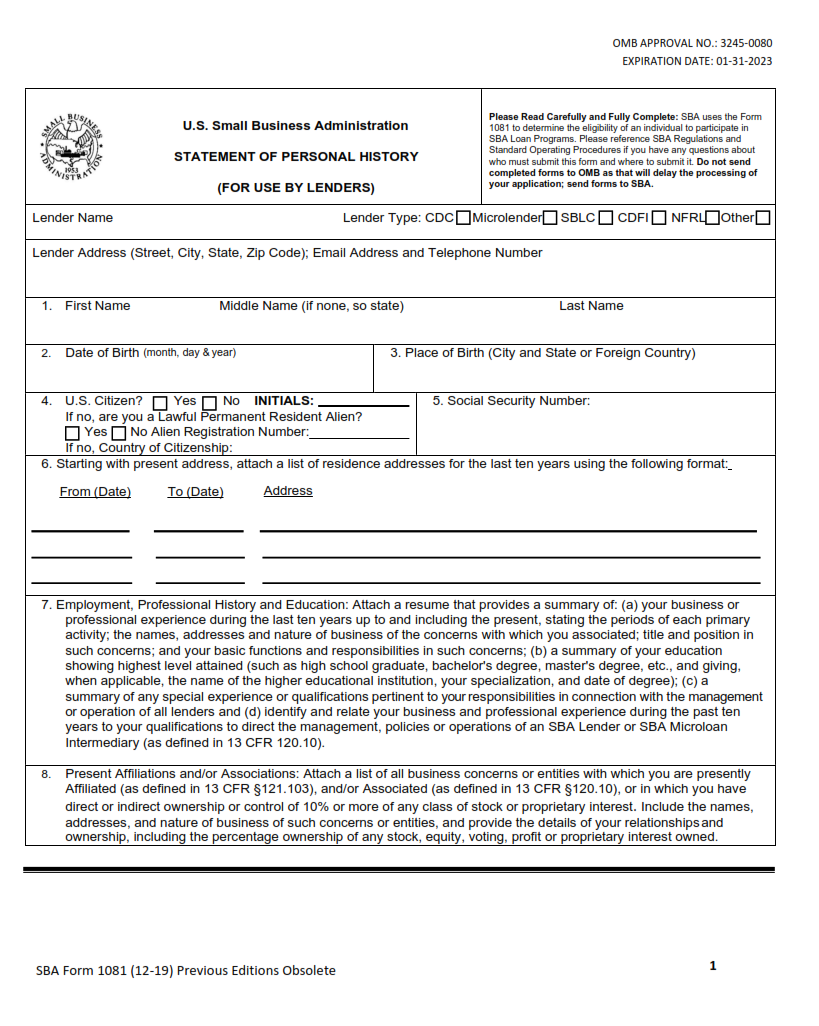

ORIGINFORMSTUDIO.COM – SBA Form 1081 – Statement of Personal History – The Small Business Administration’s (SBA) Form 1081, Statement of Personal History, is an important document that must be completed and submitted to the SBA by all individuals wanting to conduct business with them. This form provides the SBA with detailed information about the individual’s past employment history, legal record and other personal information. It is important that each section of the form is accurately filled out in order for it to be accepted by the SBA.

Download SBA Form 1081 – Statement of Personal History

| Form Number | SBA Form 1081 |

| Form Title | Statement of Personal History |

| File Size | 320 KB |

| Form By | SBA Forms |

What is an SBA Form 1081?

SBA Form 1081 is a standard form used by the Small Business Administration (SBA) for loan applicants to provide information about their personal and business history. The form is designed to help the SBA assess an applicant’s risk profile, creditworthiness, and overall financial stability. It includes questions related to employment history, financial records, residence history, past bankruptcies or defaults on loans, criminal convictions, and other personal information. To complete the form accurately and fully, applicants must provide documents such as tax returns and credit reports.

The required information collected in this form helps the SBA make an informed decision when considering loan applications. It also assists them in determining whether a borrower has had any difficulty with debt repayment in the past that could affect their ability to repay a new loan.

What is the Purpose of SBA Form 1081?

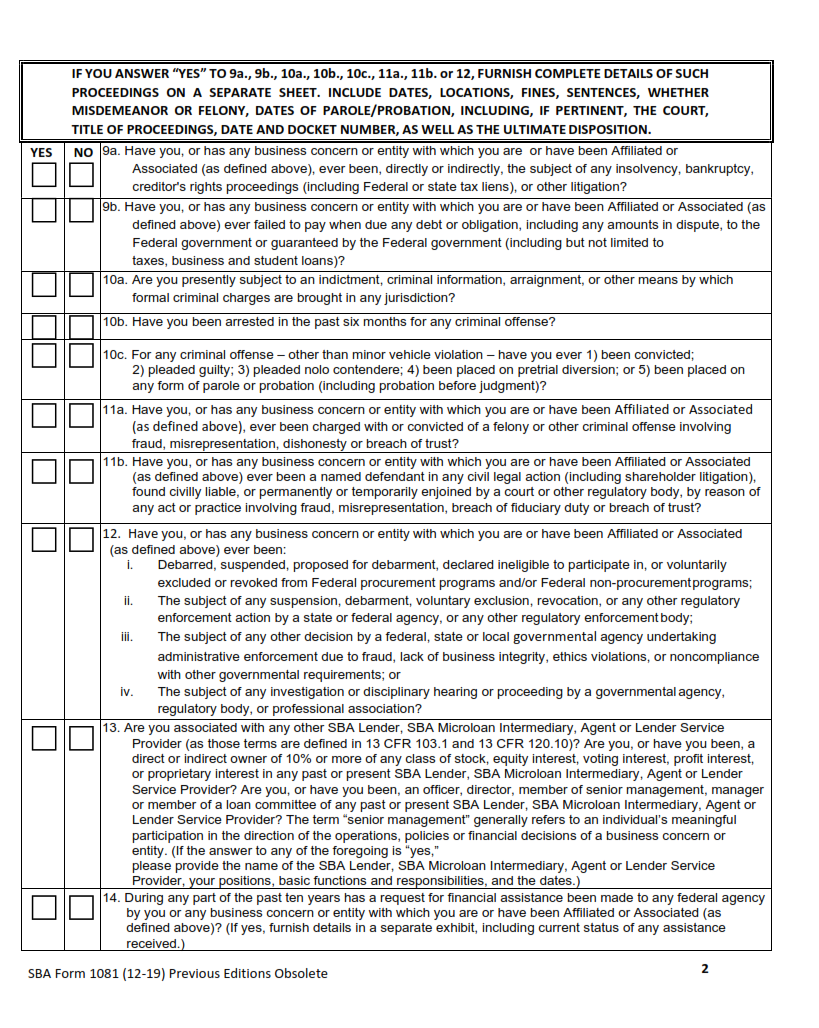

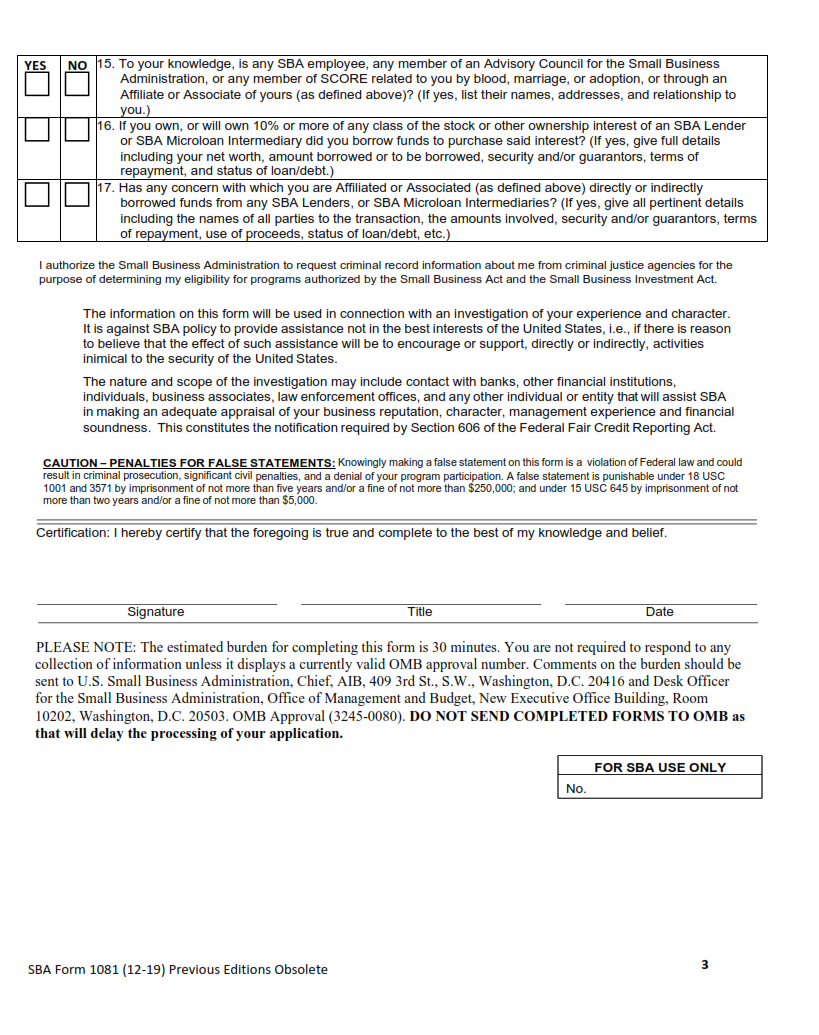

SBA Form 1081, also referred to as the “Statement of Personal History”, is a form required by the Small Business Administration (SBA) for all applicants for loan programs. The purpose of this form is to provide the SBA with information about an applicant’s personal history as it relates to their role in managing and operating a business. The SBA requires that individuals applying for loans undergo a background check to ensure they are qualified and suitable for the program.

The form itself contains several sections designed to collect information on various aspects of an applicant’s life, such as past employment history, financial stability, character references and creditworthiness. It also includes questions about any possible criminal or civil litigation in which an applicant has been involved. This helps the SBA assess whether or not an individual has experience managing and running a business successfully.

Where Can I Find an SBA Form 1081?

SBA Form 1081 is an essential document for any small business applying for financial assistance from the Small Business Administration (SBA). The form provides a detailed statement of personal history regarding the owner and/or key personnel within the company. This helps to ensure that all personnel within the organization meet SBA requirements, such as having a good credit score and moral character.

Where can I find an SBA Form 1081? You can download it directly from the SBA website at www.sba.gov/form1081. It’s important to read through all instructions carefully before completing and submitting your form, as incorrect or incomplete information may delay processing of your application. Additionally, you should keep in mind that this form must be filled out in its entirety by each individual associated with the business, not just one person on behalf of everyone else in the company.

SBA Form 1081 – Statement of Personal History

The SBA Form 1081, or Statement of Personal History, is an important form used by the Small Business Administration (SBA) when considering loan applications. It must be submitted as part of the application process for any type of SBA loan. The purpose of this form is to provide information about the applicant’s background, including their credit history and past business experience.

The form includes questions about the applicant’s work history, education background and financial information such as income and asset statements. Additionally, it requests detailed information about previous businesses owned or managed by the applicant, any bankruptcies filed in recent years and any judgments or liens against them. All this information helps determine whether an individual has both the financial resources and business acumen necessary to qualify for an SBA loan.

SBA Form 1081 Example