ORIGINFORMSTUDIO.COM – SBA Form 3509 – PPP Loan Necessity Questionnaire (For-profit borrowers) – The CARES Act has been a lifeline for many small businesses throughout the United States. The Paycheck Protection Program (PPP) was created in response to the Covid-19 pandemic and it allows eligible borrowers to receive forgivable loans from the federal government. In order to access these funds, for-profit borrowers must fill out SBA Form 3509 – PPP Loan Necessity Questionnaire. This article will explain how this challenging form works, who is eligible to apply, and why it’s necessary for those looking to get PPP loan funds.

Download SBA Form 3509 – PPP Loan Necessity Questionnaire (For-profit borrowers)

| Form Number | SBA Form 3509 |

| Form Title | PPP Loan Necessity Questionnaire (For-profit borrowers) |

| File Size | 363 KB |

| Form By | SBA Forms |

What is an SBA Form 3509?

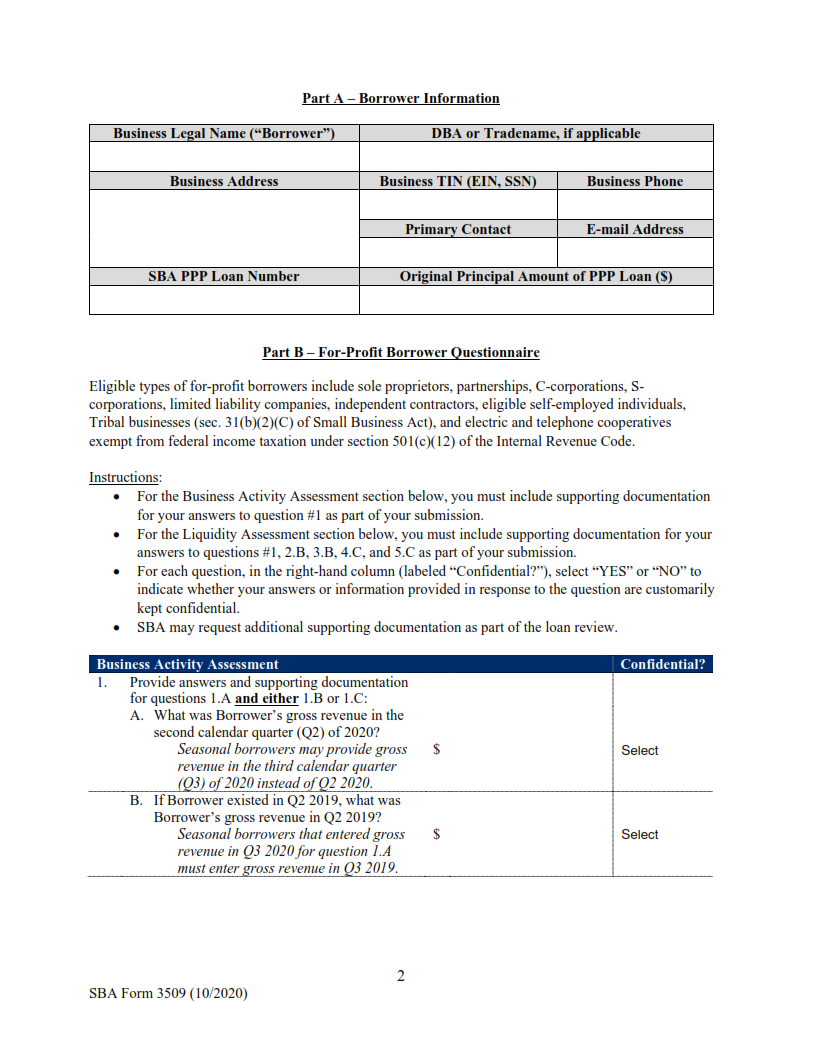

SBA Form 3509 is a questionnaire used by the Small Business Administration (SBA) to determine if a for-profit business’s Paycheck Protection Program (PPP) loan was necessary. This form must be completed and submitted by all businesses that received PPP loans of $2 million or more. It requires information about why the organization applied for the loan, the economic impacts of COVID-19 on their business, and how they used or plan to use their PPP funds.

The SBA uses this form to assess whether a business could have obtained credit elsewhere at the time it applied for its PPP loan, and whether it had other available sources of liquidity sufficient to support its ongoing operations in a manner that is not significantly detrimental to ordinary business operations.

What is the Purpose of SBA Form 3509?

The SBA Form 3509 is an essential questionnaire for for-profit borrowers looking to obtain a Paycheck Protection Program (PPP) Loan. This form helps the Small Business Administration (SBA) assess the borrower’s loan necessity and determine eligibility for the PPP program.

The purpose of this form is twofold. Firstly, it requires potential borrowers to provide specific details about their business operations and its financial health, including information on its employees, revenues, expenses, and other relevant factors. By doing so, the SBA can gauge whether granting a loan would be beneficial to both parties involved in the transaction. Secondly, this form also allows small businesses to demonstrate that they are genuinely struggling financially due to economic hardship caused by COVID-19.

Where Can I Find an SBA Form 3509?

The Small Business Administration (SBA) Form 3509 is an important document for any business seeking a Paycheck Protection Program (PPP) loan. This form asks borrowers to provide information about their business and explain why they are eligible for the loan.

Lenders are required by the SBA to collect this form before approving a PPP loan, so it’s essential that businesses have the most up-to-date version available. Businesses can find the latest version of SBA Form 3509 online through the U.S. Department of Treasury website or through their lender’s website. It is also available for download directly from the SBA website in both PDF and Word formats, making it easy for businesses to fill out and submit quickly and accurately.

SBA Form 3509 – PPP Loan Necessity Questionnaire (For-profit borrowers)

The SBA Form 3509 is an essential tool for small businesses looking to apply for the Paycheck Protection Program (PPP) loan. Designed specifically for-profit borrowers, this form requires you to attest that the funds will be used appropriately and in good faith to support your business during this time of economic hardship.

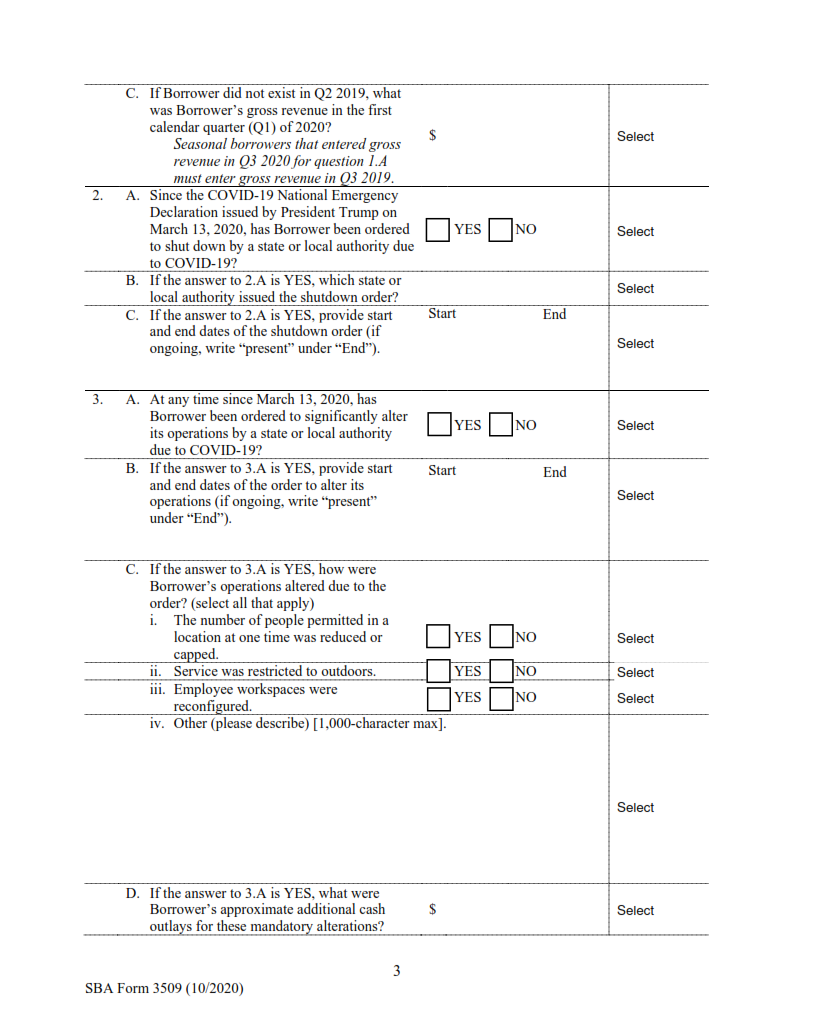

The questionnaire is made up of seven questions that are required by law. Each question must be answered accurately and honestly as all information will be verified before approval. Additionally, applicants must provide other documentation such as financial records and payroll reports to demonstrate their need for PPP funds. This extra paperwork helps lenders better determine whether the borrower has been impacted by COVID-19 and if they qualify for assistance under the terms of the program.

SBA Form 3509 Example