ORIGINFORMSTUDIO.COM – SBA Form 1050 – Settlement Sheet (Use of Proceeds Certification) – The Small Business Administration (SBA) Form 1050 Settlement Sheet (Use of Proceeds Certification) is an essential document when it comes to filing for a loan with the SBA. This form provides lenders and borrowers with an accurate record of a loan’s proceeds and how these funds are allocated for use. It is important that both parties understand this form in order to accurately complete the application process and avoid discrepancies or misunderstandings.

Download SBA Form 1050 – Settlement Sheet (Use of Proceeds Certification)

| Form Number | SBA Form 1050 |

| Form Title | Settlement Sheet (Use of Proceeds Certification) |

| File Size | 234 KB |

| Form By | SBA Forms |

What is an SBA Form 1050?

SBA Form 1050 is the form used to certify that all proceeds from the sale of a business have been properly distributed. This document provides proof that all proceeds have been used in accordance with the Small Business Administration (SBA) guidelines and regulations. It also ensures that any funds not immediately needed for closing costs, legal fees, taxes, or other obligations related to the sale of a business are placed into an escrow account and held until they can be used for their designated purposes.

This form is typically completed by both the buyer and seller prior to completing an SBA-guaranteed loan transaction. The form must include details on how all proceeds were allocated between the parties involved in the transaction, including any lenders or investors who participated in financing portions of it. It should also include information about any terms and conditions imposed on either party as part of finalizing the sale agreement.

What is the Purpose of SBA Form 1050?

The Small Business Administration (SBA) Form 1050, Settlement Sheet (Use of Proceeds Certification), is an important document that outlines the details of a loan being issued by the SBA. This form is used to certify that proceeds from a loan have been properly accounted for and used for their intended purpose. It also serves as proof that all funds related to the transaction have been received and properly disbursed in accordance with SBA regulations.

The primary purpose of this form is to ensure that loan proceeds are not misused or diverted away from their intended purpose. The information provided on the form must be accurate and complete, as any discrepancies could potentially result in fines or other penalties from the SBA. Additionally, if there are any changes made to the use of proceeds outlined in this form, it must be promptly amended and updated with the SBA.

Where Can I Find an SBA Form 1050?

The Small Business Administration (SBA) Form 1050, also known as the Settlement Sheet or Use of Proceeds Certification, is an important document for businesses seeking SBA loan financing. This form allows borrowers to certify that they are using their loan proceeds properly and provides detailed information on how loan money will be allocated. As such, it’s necessary for borrowers to know where they can access this form in order to complete it correctly.

The SBA Form 1050 is available online through the SBA website. It can be found by searching “Settlement Sheet” or “Use of Proceeds Certification” under the Forms & Resources section of the site. Alternatively, borrowers can contact their local SBA office and request a copy from a customer service representative. Once downloaded and completed, borrowers must submit the form along with other required documentation when applying for an SBA loan.

SBA Form 1050 – Settlement Sheet (Use of Proceeds Certification)

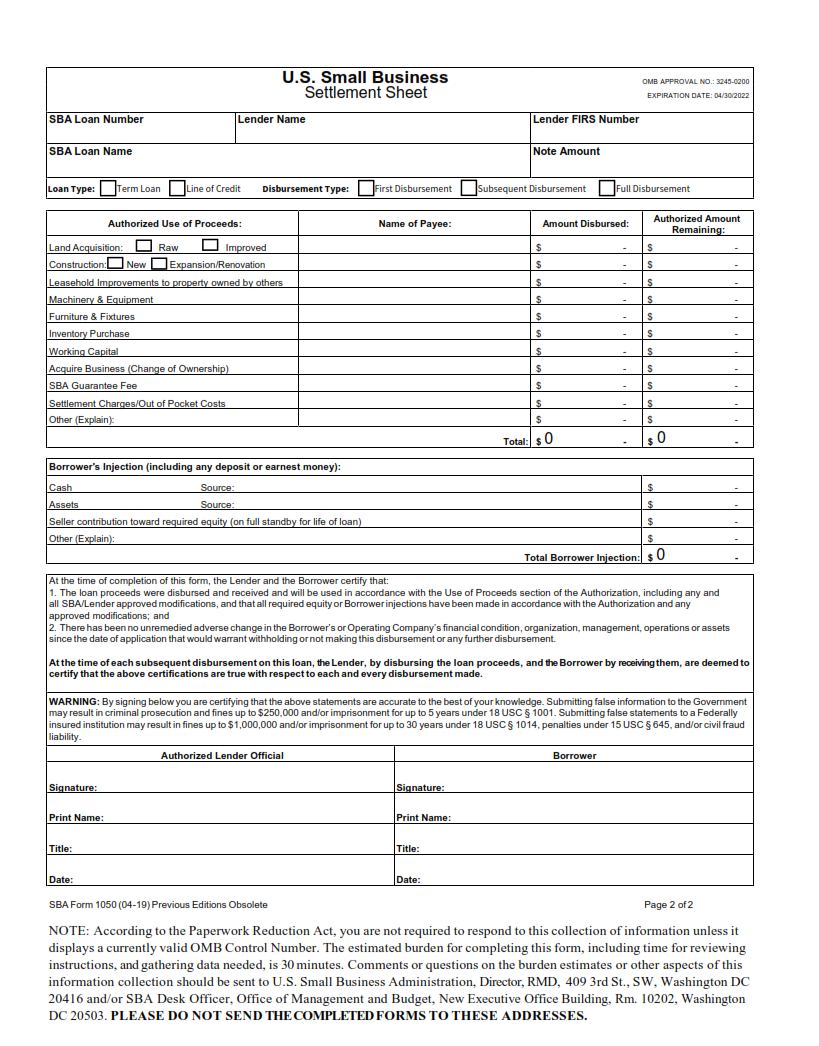

The SBA Form 1050, Settlement Sheet (Use of Proceeds Certification), is an important form for lenders and borrowers when closing a loan backed by the Small Business Administration (SBA). This form is used to certify how the funds from the loan will be used and it must be completed before the loan can close.

For lenders, this form ensures that the money received from SBA is being used in accordance with SBA regulations. It also allows them to track how their funds are being spent. Borrowers should use this form to provide proof that they have appropriate plans in place for using their loan proceeds, such as purchasing property or equipment, covering construction costs, meeting payroll expenses, or obtaining working capital.

SBA Form 1050 Example