ORIGINFORMSTUDIO.COM – DAF Form 965 – Overseas Tour Election Statement – An individual who is registered to vote in the United States and intends to become a citizen may file an overseas tour election statement with the Department of Homeland Security (DHS) if they are outside of the United States on an election campaign tour. The statement must be filed no later than 90 days before the date of the election.

Download DAF Form 965 – Overseas Tour Election Statement

| Form Number | DAF Form 965 |

| Form Title | Overseas Tour Election Statement |

| File Size | 36 KB |

| Form By | 16-11-2022 |

What is a DAF Form 965?

DAF Form 965 or the Overseas Tour Election Statement is a legal document used by members of the United States Air Force (USAF) who are stationed overseas. The form allows USAF personnel to elect for an extended tour of duty at their current overseas location, which can be up to 36 months, and receive certain incentives as well. The extended tour option is available in most overseas locations where there is a significant demand for USAF personnel.

The DAF Form 965 requires basic information such as the individual’s name, rank, serial number, and assignment details. It also includes important information about the terms and conditions of the extended tour option and any incentives that come with it. For example, individuals who choose to extend their tours may be eligible for additional leave days or family member travel expenses.

It is important to note that individuals must carefully consider whether an extended tour is right for them before filling out the DAF Form 965. Factors such as family needs, personal goals, and career aspirations should all be taken into account when making this decision. Additionally, individuals should consult with their supervisors or career counselors before submitting the form to ensure that they fully understand its implications.

What is the Purpose of DAF Form 965?

DAF Form 965 is an Overseas Tour Election Statement that serves the purpose of allowing military personnel to elect whether or not they want to be accompanied overseas by their dependents. The form is typically used by service members who are being assigned to a location outside of the continental United States (OCONUS) for an extended period of time, usually one year or longer.

By completing DAF Form 965, service members can indicate whether they want their dependents to accompany them on their overseas tour or if they prefer for them to remain in the United States. This helps ensure that military families have sufficient time to make arrangements and plan accordingly before a deployment. Additionally, it allows the military to properly allocate resources and provide support services for both service members and their dependents.

In summary, DAF Form 965 is a crucial document that enables military personnel to make informed decisions about how best to manage their family’s needs while serving overseas. It plays a significant role in ensuring that both service members and their families receive appropriate support from the government during deployments, helping them navigate what can be a challenging experience with greater ease.

Where Can I Find a DAF Form 965?

If you are a member of the U.S. military or a civilian employee stationed overseas, you may be eligible for certain tax benefits. To take advantage of these benefits, you will need to fill out DAF Form 965, also known as the Overseas Tour Election Statement. This form allows you to elect to exclude certain types of income from your taxable income.

So where can you find this important form? The easiest way is to visit the official website of the Internal Revenue Service (IRS). You can download DAF Form 965 directly from their website, along with instructions on how to fill it out properly. Keep in mind that there may be specific deadlines for submitting this form, so it’s important to get started early and stay organized throughout the process.

In addition to downloading DAF Form 965 online, you may also be able to obtain a copy through your local military or government office. Many installations have dedicated tax assistance offices that can help answer any questions you have about this form and other tax-related issues. By taking advantage of these resources and staying informed about your tax obligations while living overseas, you can ensure that you are getting all of the benefits and deductions available to you under U.S. law.

DAF Form 965 – Overseas Tour Election Statement

If you are a U.S. citizen working abroad, it is important to understand the tax implications of your overseas earnings. One key form to consider is the DAF Form 965 – Overseas Tour Election Statement. This form allows eligible taxpayers to exclude a portion of their foreign earned income from U.S. taxation.

To be eligible for this exclusion, a taxpayer must have been physically present in a foreign country for at least 540 days during any consecutive 548-day period, and must not have taken advantage of the exclusion in any previous tax year. The amount that can be excluded varies depending on various factors such as income level and location.

It’s important to note that while this exclusion can greatly reduce an expat’s tax liability, it does not exempt them from paying taxes in their country of residence or complying with local tax laws. It’s recommended that expats consult with a qualified tax professional to ensure compliance with both U.S. and local tax requirements when utilizing the DAF Form 965 – Overseas Tour Election Statement.

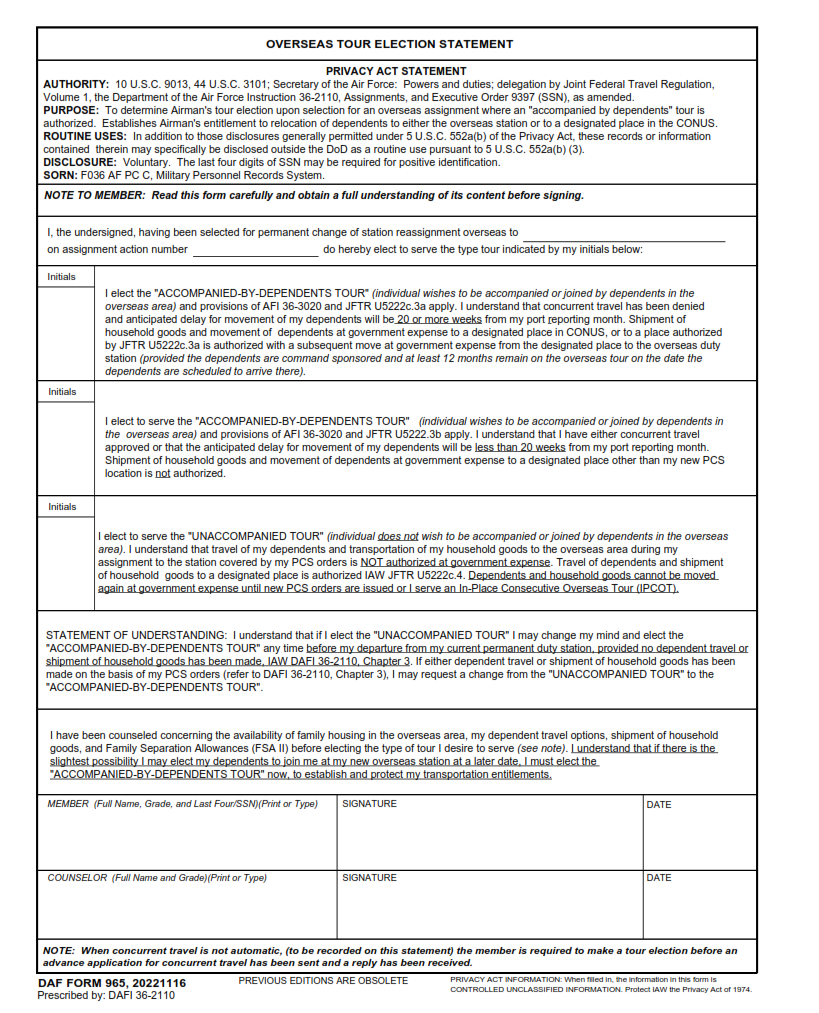

DAF Form 965 Example