ORIGINFORMSTUDIO.COM – SBA Form 3510 – PPP Loan Necessity Questionnaire (Non-profit borrowers) – The Coronavirus Aid, Relief and Economic Security Act (CARES) was passed by the United States government in response to the COVID-19 pandemic. The act allocated funds for small businesses through the Small Business Administration (SBA). As part of this program, non-profit organizations can apply for Paycheck Protection Program (PPP) loans. To be considered an eligible recipient for a PPP loan, non-profit organizations must complete the SBA Form 3510 – PPP Loan Necessity Questionnaire.

Download SBA Form 3510 – PPP Loan Necessity Questionnaire (Non-profit borrowers)

| Form Number | SBA Form 3510 |

| Form Title | PPP Loan Necessity Questionnaire (Non-profit borrowers) |

| File Size | 283 KB |

| Form By | SBA Forms |

What is an SBA Form 3510?

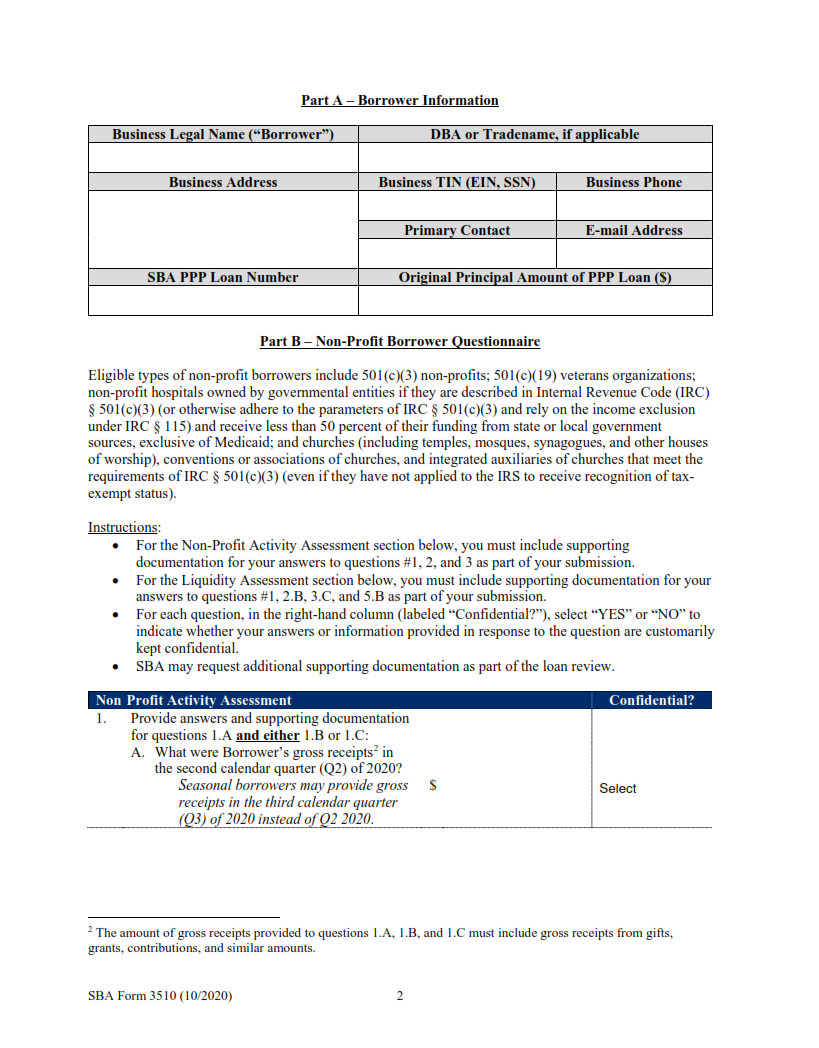

The Small Business Administration (SBA) Form 3510 is a necessity questionnaire for non-profit borrowers who are applying for a Paycheck Protection Program (PPP) loan. This form requires that the borrower explain why the loan is necessary and how it will be used to help their business remain operational during the pandemic. The SBA requires that this form be completed in order to demonstrate whether or not a PPP loan is necessary, as well as how the funds will be used.

When completing SBA Form 3510, non-profit borrowers must provide detailed information about their business and finances, including income sources, employee pay rates and payroll expenses. They must also explain what actions they’ve taken to reduce costs or increase revenue since the onset of the COVID-19 pandemic.

What is the Purpose of SBA Form 3510?

The Small Business Administration (SBA) Form 3510 is an important tool used to assess the necessity of Paycheck Protection Program (PPP) loan applicants. This form requires non-profit borrowers to provide detailed information regarding their financial situation, current and past employment, and economic circumstances in order to determine if they are eligible for the PPP loan program.

The purpose of SBA Form 3510 is twofold: firstly, it helps the SBA evaluate whether or not a non-profit borrower qualifies for a PPP loan. Secondly, it serves as an official record that documents all of the necessary steps taken by the borrower throughout their application process. By collecting this information, it ensures that all organizations applying for a PPP loan meet eligibility requirements and abide by SBA regulations.

Where Can I Find an SBA Form 3510?

The Small Business Administration (SBA) Form 3510 is an important document for non-profit borrowers seeking a Paycheck Protection Program (PPP) loan. It serves as a questionnaire to assess the necessity of the loan and its impact on the borrower’s operations. The SBA has made this form available online, making it easy to find and fill out.

The SBA Form 3510 can be found on the official government website, www.sba.gov. Upon entering the website, select “Forgiveness Portal” from the top menu bar and then select “Forms & Resources” from the left column.

SBA Form 3510 – PPP Loan Necessity Questionnaire (Non-profit borrowers)

Non-profit organizations are eligible to receive Paycheck Protection Program (PPP) loans from the Small Business Administration (SBA) and must complete SBA Form 3510 – PPP Loan Necessity Questionnaire in order to apply. The questionnaire consists of a brief form that requires an organization to affirm its qualifications for a loan, describe why the loan is necessary, and provide basic financial information.

The questionnaire begins by asking the applicant to certify their status as either an organization exempt from federal income tax under section 501(c)(3), 501(c)(19), or other similar statute; or an eligible nonprofit entity formed in the US. The form also asks if they are currently receiving COVID-19 relief funds and whether they applied for any other PPP loans prior to this one.

SBA Form 3510 Example