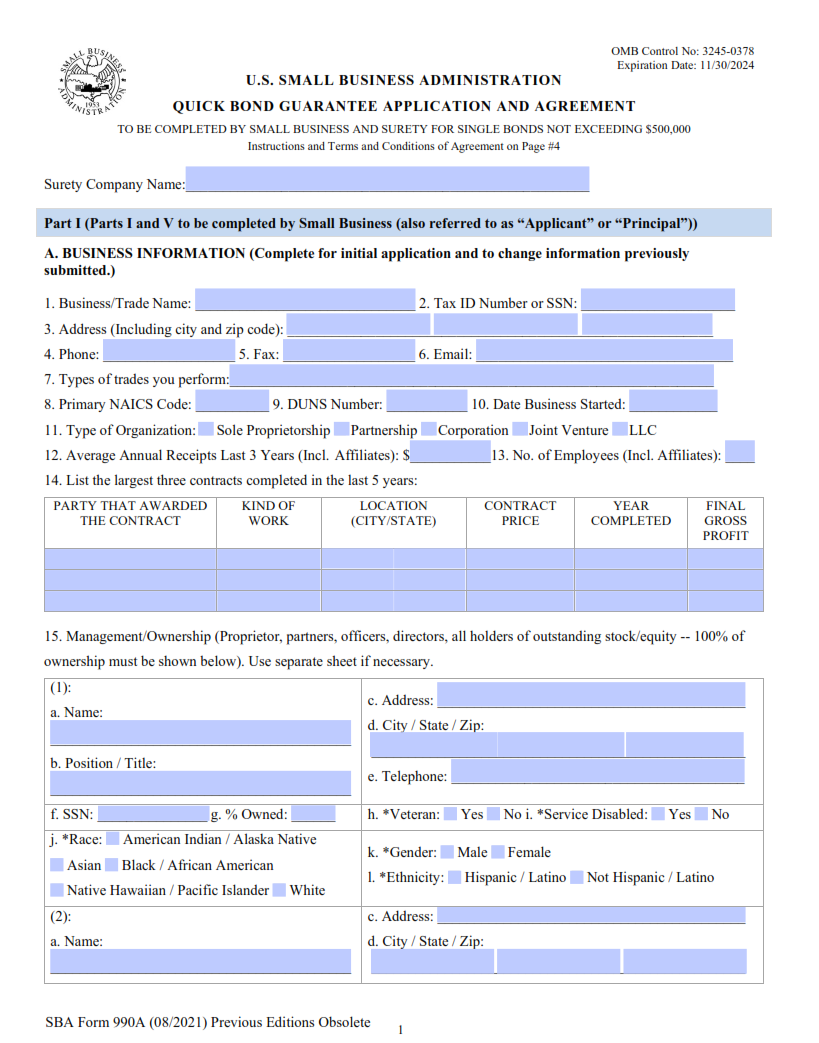

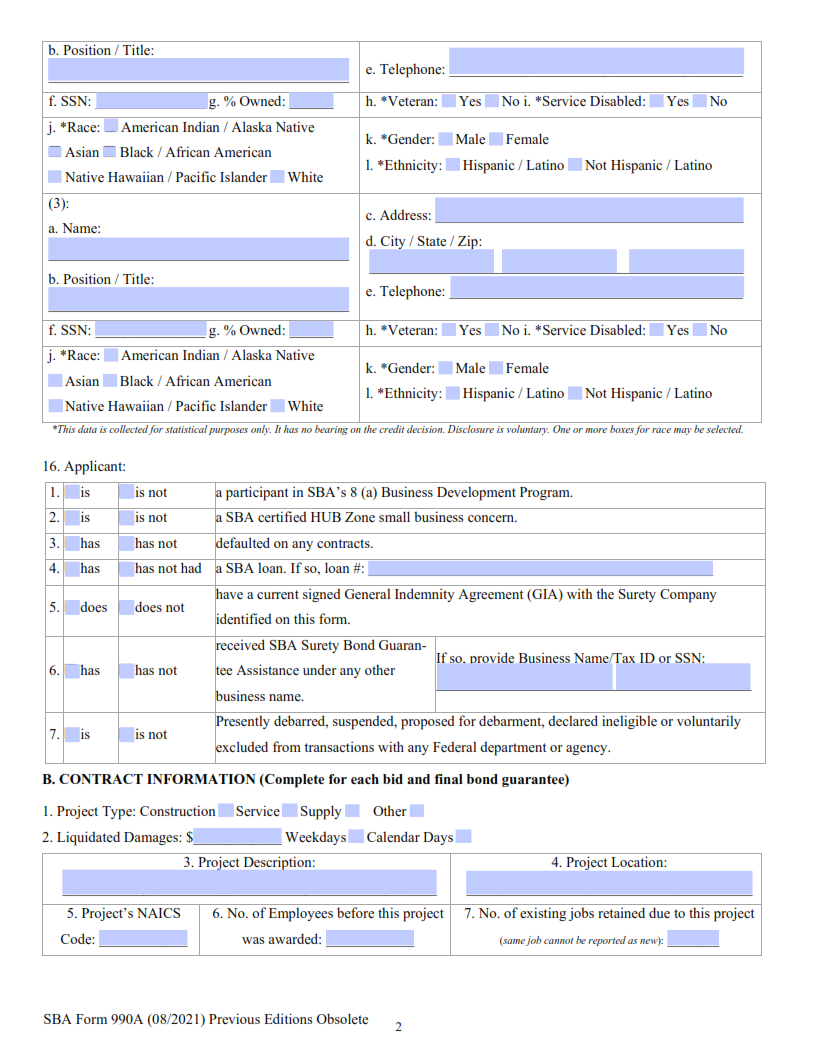

ORIGINFORMSTUDIO.COM – SBA Form 990A – Quick Bond Guarantee Application and Agreement – The U.S. Small Business Administration (SBA) offers a range of loan guarantees to small businesses and startups, and the SBA Form 990A is an essential part of the process for applying for such loans. This form provides an easy way for business owners to apply for a loan guarantee from the SBA without having to go through lengthy paperwork or complex requirements. The Quick Bond Guarantee Application and Agreement portion of the form is designed to enable borrowers to apply quickly and easily, thereby expediting their access to capital in order to fund their projects or business endeavors.

Download SBA Form 990A – Quick Bond Guarantee Application and Agreement

| Form Number | SBA 990A |

| Form Title | Quick Bond Guarantee Application and Agreement |

| File Size | 519 KB |

| Form By | SBA Forms |

What is an SBA Form 990A?

An SBA Form 990A is an application developed by the Small Business Administration (SBA) that helps small businesses secure a loan guarantee. The form provides all of the necessary information for a lender to assess whether or not to approve a business owner’s request for financing. Upon completion, it serves as an agreement between the borrower and lender that outlines the repayment terms and conditions associated with the loan. It also provides information about how much money is being requested from the lending institution, what type of collateral is needed to secure the loan, and any other details pertinent to obtaining a loan guarantee from the SBA.

The form comes with instructions on how to fill out each section correctly, which makes it easier for business owners who are unfamiliar with SBA financing requirements.

What is the Purpose of SBA Form 990A?

The Small Business Administration (SBA) Form 990A is a quick bond guarantee application and agreement designed to help small businesses access capital more quickly and easily. This form, developed by the SBA in partnership with the US Department of Treasury and the US Department of Defense, offers a streamlined way for businesses to obtain loan guarantees for their projects.

The purpose of SBA Form 990A is to provide a faster alternative to traditional loan applications and approval processes. The form allows eligible applicants to submit their loan applications online in an easy-to-use format that minimizes paperwork and delays. By providing this expedited process, it helps small business owners tap into capital more quickly so they can start or expand their operations.

Where Can I Find an SBA Form 990A?

The Small Business Administration (SBA) Form 990A is a critical document for any business that seeks to obtain a quick bond guarantee from the SBA. The form is available on the SBA’s website and can be accessed by businesses seeking to take advantage of this program.

The form, which can be completed online or downloaded in PDF format, provides important information such as the applicant’s name, address, business structure, number of employees and other related information. Once filled out and submitted with all required documents attached, the SBA will review and approve or deny the application based on its merits. The form also requires applicants to provide proof of financial capability in order to receive an approval for their quick bond guarantee request. By filling out this form accurately and completely, businesses can increase their chances of obtaining a quick bond guarantee from the SBA with ease.

SBA Form 990A – Quick Bond Guarantee Application and Agreement

The Small Business Administration (SBA) Form 990A is a critical document for businesses that need access to capital. The Quick Bond Guarantee Application and Agreement provide businesses with the ability to obtain surety bonds without having to go through a lengthy process. This form allows small business owners the opportunity to quickly and easily secure funds needed for their business operations.

The application process requires applicants to submit financials, an SBA-approved bond issue, a guarantee agreement, and other documents as requested by the SBA. The Guarantee Agreement must be signed by both parties – the applicant and the issuing company – in order for it to be valid. Once all requirements have been met, the applicant will receive their surety bond in a timely manner so they can begin using it immediately.

SBA Form 990A Example