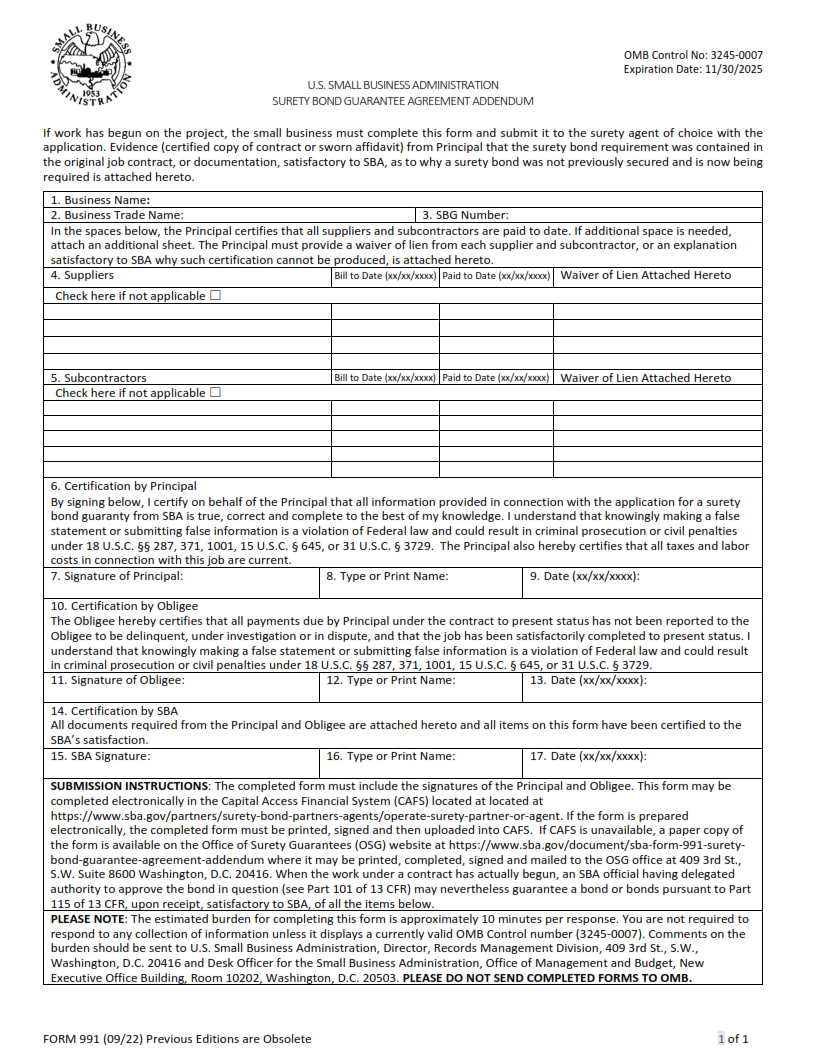

ORIGINFORMSTUDIO.COM – SBA Form 991 – Surety Bond Guarantee Agreement- Addendum – The Small Business Administration (SBA) Form 991, or Surety Bond Guarantee Agreement- Addendum, is an important document that businesses must understand and comply with. This document outlines the responsibilities of the business when it comes to obtaining surety bonds from a licensed surety company. It also provides information on how the SBA will guarantee the bond in case of default. The SBA Form 991 is a legally binding agreement between the business and their licensed surety provider. It will include details about payment terms, contract requirements, and other relevant information for both parties involved.

Download SBA Form 991 – Surety Bond Guarantee Agreement- Addendum

| Form Number | SBA Form 991 |

| Form Title | Surety Bond Guarantee Agreement- Addendum |

| File Size | 189 KB |

| Form By | SBA Forms |

What is an SBA Form 991?

SBA Form 991 is an official document from the Small Business Administration (SBA) that outlines the terms of a surety bond guarantee. This form is used when a small business obtains a loan through the SBA, and it guarantees repayment of up to 85 percent of any losses incurred by a lender in the event of default. It helps lenders feel secure about extending loans to businesses with little or no collateral, allowing for more financing options for small businesses.

The form details all the conditions under which a lender may be eligible for reimbursement from the SBA in case of insolvency by the borrower. This includes information on how long after default has occurred before payments can begin, as well as what type of proof must be provided to access funds from the guarantee.

What is the Purpose of SBA Form 991?

The Small Business Administration (SBA) Form 991 is an addendum to the Surety Bond Guarantee Agreement. Its purpose is to provide a guarantee of payment for contractors in case of default on their contract obligations. This form enables the SBA to give a financial guarantee on behalf of construction contractors and subcontractors, who are unable to obtain surety bonds from traditional sources, such as banks or insurance companies.

This form serves as an additional tool that the SBA can use to help small business owners secure financing and enter into contracts with larger organizations. The form also allows the contractor and subcontractor to enter into contracts without having collateral or credit history requirements.

Where Can I Find an SBA Form 991?

The Small Business Administration (SBA) Form 991 is a Surety Bond Guarantee Agreement- Addendum document that outlines additional terms and conditions of the surety bond. This form must be completed before a business can obtain an SBA-guaranteed surety bond. It is important to note that this form must be filled out completely in order to be valid, meaning all information provided on the form must be accurate and details should match up with other documents related to the surety bond agreement.

The SBA Form 991 can usually be found on the website of any financial institution or insurance company offering an SBA-guaranteed surety bond. It may also be available from state or local government websites, or at any agency or organization providing guidance for small businesses about how to obtain an SBA-guaranteed surety bond.

SBA Form 991 – Surety Bond Guarantee Agreement- Addendum

SBA Form 991 – Surety Bond Guarantee Agreement- Addendum is a document provided by the Small Business Administration (SBA) to ensure that a bond issuer guarantees its surety bonds. This addendum facilitates the execution of surety agreements with the SBA as part of their Guaranty Program.

The addendum outlines all pertinent provisions and requirements of a Surety Bond Guarantee Agreement between an SBA lender and the bonding company, including any necessary information regarding collateral or security for bond liabilities. It also clarifies that the SBA guarantee only applies to contracts secured by a Surety Bond issued through an approved bonding company and not on those negotiated directly with contractors. Furthermore, it notes that surety companies must provide adequate financial resources to support their commitments under this agreement in order to be considered eligible for participation in future bonds.

SBA Form 991 Example