ORIGINFORMSTUDIO.COM – SBA Form 770 – Financial Statement of Debtor – Business owners and those that are self-employed understand the importance of having accurate financial records. One form they may be required to complete is SBA Form 770, also known as the Financial Statement of Debtor. This form is used by the Small Business Administration (SBA) to collect information about an individual’s financial history and current assets. It provides a comprehensive overview of a person’s finances, which can help lenders determine if they are suitable for loan assistance or other aid programs offered by the SBA.

Download SBA Form 770 – Financial Statement of Debtor

| Form Number | SBA Form 770 |

| Form Title | Financial Statement of Debtor |

| File Size | 361 KB |

| Form By | SBA Forms |

What is an SBA Form 770?

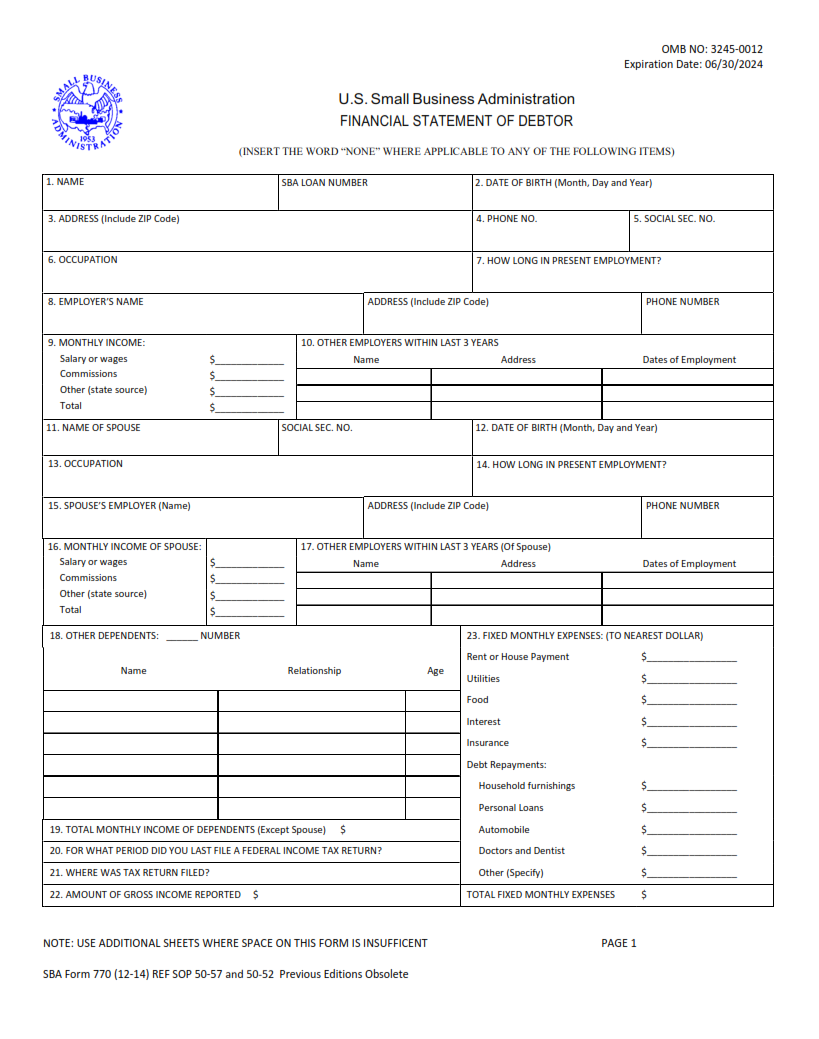

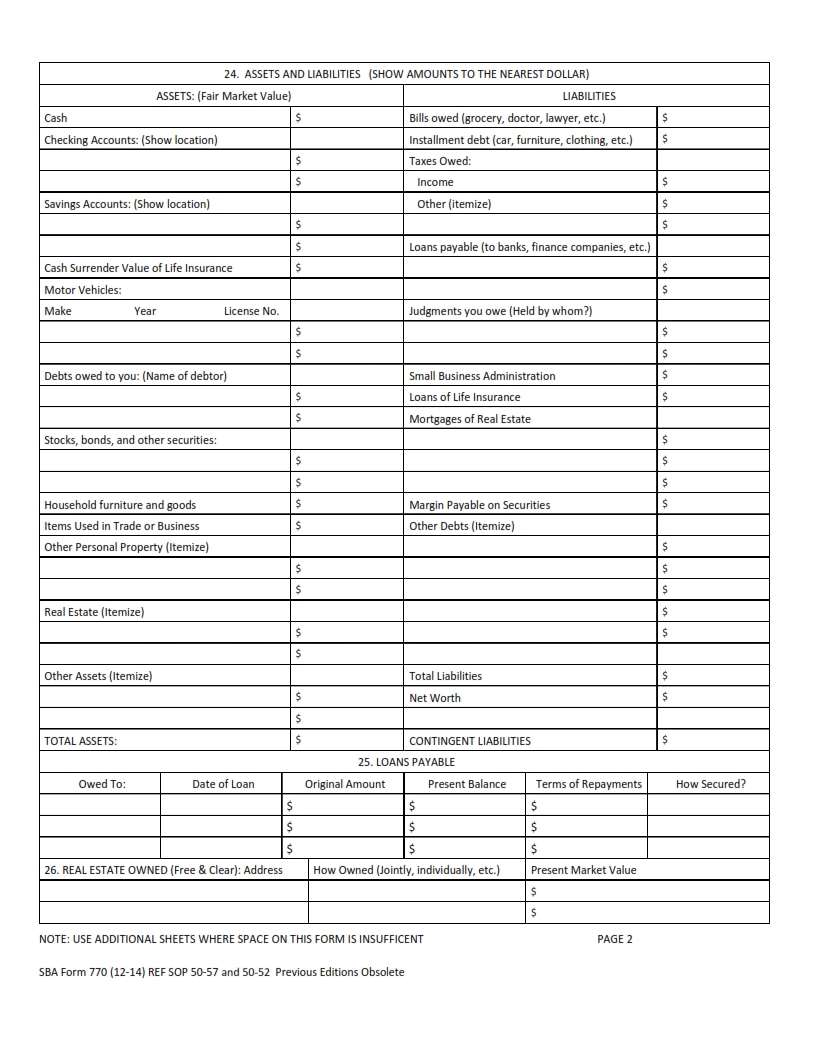

The Small Business Administration (SBA) Form 770, also known as the Financial Statement of Debtor, is a form used to report financial and business information associated with a debtor. This form provides the SBA with details of the debtor’s assets and liabilities, including income and expenses. It is an important document for those businesses seeking access to SBA-guaranteed financing or other forms of assistance from the agency.

The information provided on the SBA Form 770 must be accurate and up-to-date, reflecting any changes in the business since it was last reported. It should include all assets that can be used as collateral for loans or other types of capital raised from lenders or investors. Furthermore, it should disclose all sources of income so that lenders can determine whether the business can meet its obligations if loaned money is received.

What is the Purpose of SBA Form 770?

The SBA Form 770, also known as the Financial Statement of Debtor, is a form used by businesses when applying for an Small Business Administration (SBA) loan. It provides the lender with information about the business’ financial position and allows them to assess whether an SBA loan is appropriate for the borrower. The form requires detailed financial statements such as balance sheets and income statements so that creditors can determine if a business is eligible to receive an SBA loan.

The purpose of the form is to provide lenders with important financial information so they can make prudent decisions when considering lending money to businesses. By providing accurate and timely financial information on this form, lenders can accurately assess a company’s risk profile before approving or denying their loan application.

Where Can I Find an SBA Form 770?

The SBA Form 770 is the official financial statement of debtor used when submitting an application for a Small Business Administration (SBA) loan. The form helps lenders determine the borrower’s ability to repay the loan and serves as a tool for evaluating creditworthiness. Prospective borrowers must provide their lender with this form in order to be approved for an SBA loan.

The SBA Form 770 can be found on both the SBA’s website and through its Small Business Lending portal. On the SBA’s website, applicants should look under “Forms & Applications” and select “Financial Statement of Debtor (SBA Form 770)” from the drop-down menu. Through the Small Business Lending portal, applicants will find it listed under “Loan Forms” or by searching using keywords such as “financial statement.

SBA Form 770 – Financial Statement of Debtor

The Small Business Administration (SBA) Form 770 is a financial statement that is used to document the current financial state of a debtor. This form provides essential information to creditors and other relevant parties on the amount of debt held by the debtor as well as any assets they may have. It can be used in combination with other documents such as tax returns, income statements, or balance sheets. The SBA Form 770 is an important part of understanding and analyzing a debtor’s overall financial situation so that creditors can make informed decisions regarding whether or not to extend credit.

The SBA Form 770 consists of four sections: Assets, Liabilities, Equity/Net Worth, and Signature & Verification Section. Within each section there are several different fields which need to be completed in order for the form to be properly filled out.

SBA Form 770 Example