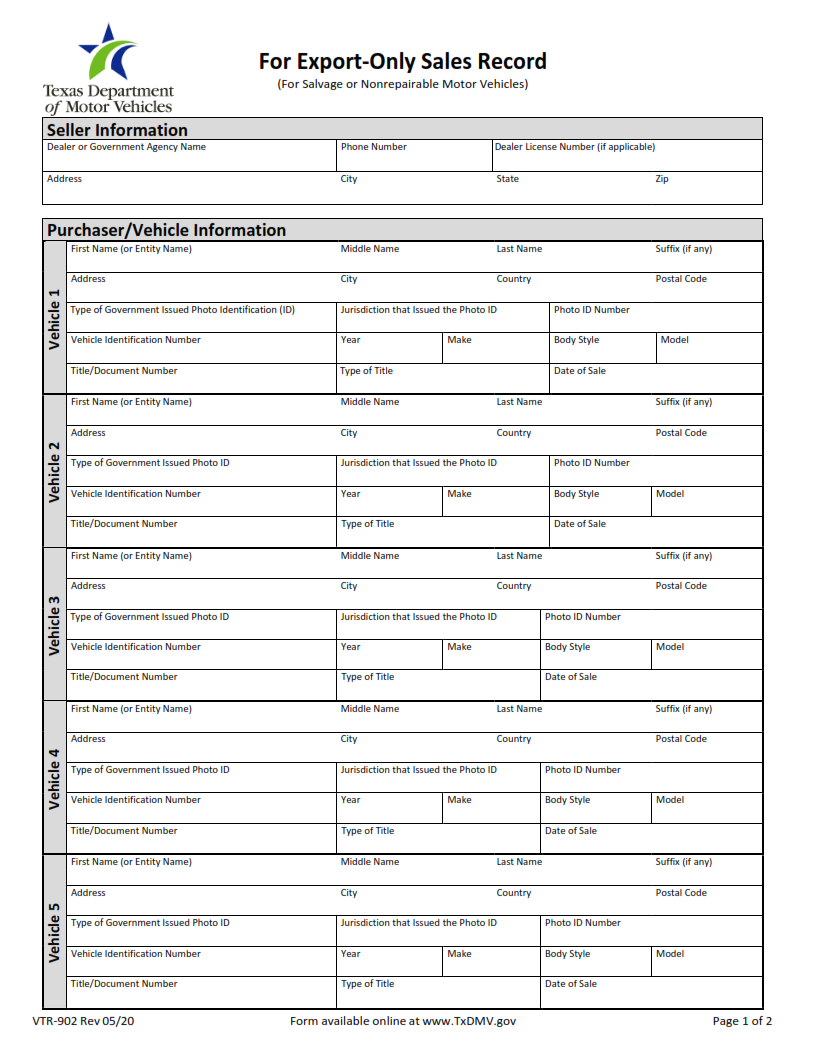

ORIGINFORMSTUDIO.COM – VTR-902 – For Export-only Sales Record – The VTR-902 is a vital document for export-only sales, providing an essential record of commercial transactions and its details. This article will provide an overview of the form and explain how to complete it correctly. With a proper understanding of the form, businesses can ensure their export-only sales records are kept up to date for smooth running operations. The VTR-902 is made up of several sections that require specific information from both the exporter and importer parties involved in the sale.

Download VTR-902 – For Export-only Sales Record

| Form Number | VTR-902 |

| Form Title | For Export-only Sales Record |

| File Size | 1 MB |

| Form By | Texas DMV Form |

What is a VTR-902 Form?

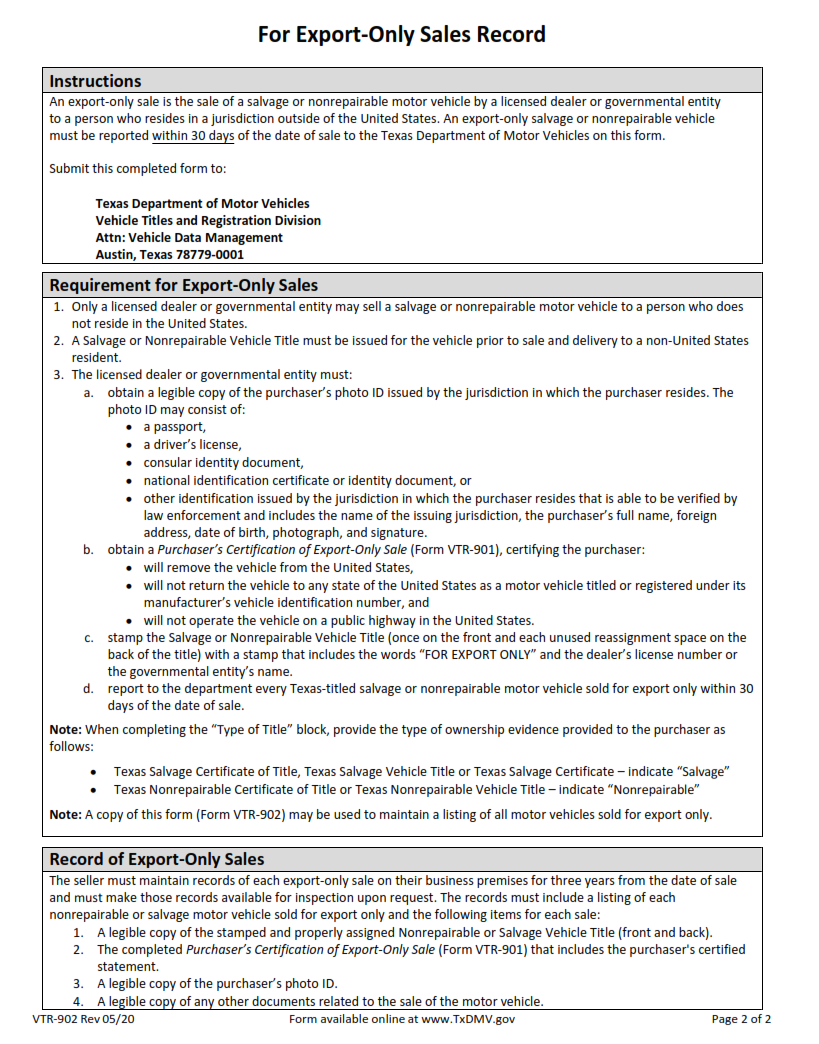

A VTR-902 is a form that must be completed and submitted to the Texas Department of Motor Vehicles (TxDMV) in order to register an exported vehicle in the United States. This form is used for export-only sales, where a vehicle will be shipped outside of the United States. The main purpose of this form is to ensure that all taxes, fees, and surcharges associated with the sale of a vehicle are properly collected and accounted for by both parties involved.

The VTR-902 Form requires information about both buyer and seller such as name, address, contact information; details about the transaction including date of sale, model year, make/model/series; documentation proving compliance with U.S.

What is the Purpose of the VTR-902 Form?

The VTR-902 form, also known as the Export-Only Sales Record, is a document issued by the Texas Department of Motor Vehicles (TxDMV) for export-only motor vehicle sales. It is used to document the sale of a vehicle that will be moved out of state permanently.

The purpose of this form is to provide a record of the sale and transfer process between two parties – buyer and seller – in order to ensure compliance with both federal and state laws. The information collected on this form includes details about the buyer, seller, and vehicle being sold. This data allows TxDMV to track vehicles exported out of state so they can be properly taxed or returned when necessary. It also ensures that buyers are not overcharged for taxes or fees during their purchase.

Where Can I Find a VTR-902 Form?

For those looking to obtain the VTR-902 form, it can be easily accessed online. The Texas Comptroller of Public Accounts’ website has the form available for download and includes instructions on how to properly complete the document. Additionally, any local tax office should have copies of the document and can provide further direction on how to fill out the form.

The VTR-902 is required by Texas law for all sales or leases of tangible personal property that are shipped outside of Texas or exported from a foreign trade zone in lieu of being delivered within Texas. This export-only sales record documents purchases by nonresident customers and must be submitted with a sales tax exemption certificate claiming an exemption from state sales tax due to export shipment out of state.

VTR-902 – For Export-only Sales Record

The VTR-902 is a revolutionary sales record and tracking system designed specifically for export sales. With this new system, companies can keep track of their shipments with real-time visibility over the entire transaction process. This state-of-the-art technology allows businesses to ensure that goods are shipped to the intended destination and arrive in good condition. Additionally, it provides powerful analytics and reporting capabilities which enable users to gain insights into their sales data and make better informed decisions about future orders.

The VTR-902 integrates seamlessly with existing systems so that companies can easily access its features without needing to install any additional hardware or software. It also offers secure data encryption for added protection against cyber threats. Moreover, it comes with an intuitive user interface which makes it easy for even novice users to quickly master the system’s functions.

VTR-902 Form Example