ORIGINFORMSTUDIO.COM – VTR-901-A – Annual Purchaser’s Certification Of Export-Only Sale – The VTR-901-A is an important document for companies trading in the export market. This form, also known as the Annual Purchaser’s Certification of Export-Only Sale, is used to certify that goods are being sold only for exportation from the United States. The document provides assurance to U.S. Customs and Border Protection (CBP) that items purchased by a foreign buyer are intended for export only and not for domestic sale or use in the U.S., as well as other destinations such as Canada or Mexico.

Download VTR-901-A – Annual Purchaser’s Certification Of Export-Only Sale

| Form Number | VTR-901-A |

| Form Title | Annual Purchaser’s Certification Of Export-Only Sale |

| File Size | 1 MB |

| Form By | Texas DMV Form |

What is a VTR-901-A Form?

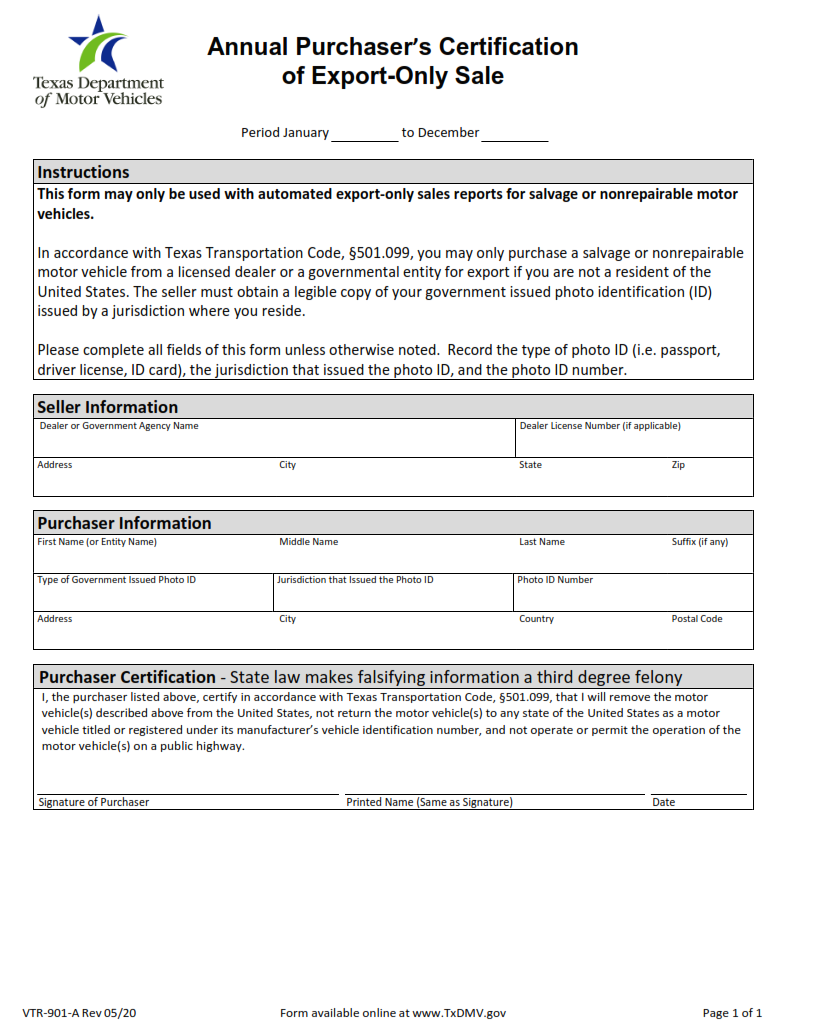

A VTR-901-A Form is a document used by the State of Texas to certify that a vehicle was sold for export only. The form must be completed and signed by both the purchaser and seller, as well as any agents or representatives involved in the sale. The form must also include all required information about the vehicle, including its make, model, year, body type and license plate number. All information provided on the VTR-901-A Form will be verified before being accepted by the state.

The purpose of this certification is to ensure that vehicles are legally exported out of Texas state borders. It is important to remember that all sales involving vehicles must comply with applicable laws, regulations and standards set forth by local governments and agencies such as Customs & Border Protection (CBP).

What is the Purpose of the VTR-901-A Form?

The VTR-901-A form is an important document for any automotive dealership located in the state of Texas. This form is required to be filled out annually by all dealerships as a way to certify they are only selling vehicles that are meant for export purposes. The purpose of this form is to help ensure that no vehicle purchased from a Texas dealer is used domestically within the United States, as this could lead to numerous legal complications.

By signing the VTR-901-A form, Texas auto dealers agree that all vehicles sold by them will be exported and not used inside the United States. Additionally, any vehicle purchased from the dealer must have a statement affixed to it saying that it is intended solely for export purposes.

Where Can I Find a VTR-901-A Form?

If you are a vehicle dealer in Texas, you may have heard of the VTR-901-A form. This form is an annual certification of export-only sale for motor vehicles and trailers registered in the state. It must be submitted to the Texas Department of Motor Vehicles (TxDMV) when registering certain motor vehicles or trailers.

The VTR-901-A form can be located on the TxDMV website at http://www.txdmv.gov/forms/vtrs/vtr901a/. The instructions for completing and submitting the form are also available on this page. Once completed, it must be signed by both the purchaser and seller before being delivered to any Regional Service Center or County Tax Assessor Collector’s office as part of your vehicle registration process.

VTR-901-A – Annual Purchaser’s Certification Of Export-Only Sale

The VTR-901-A is an annual certification form that must be completed and submitted by a purchaser of export-only goods. The purpose of the form is to ensure that the purchased goods are only being exported outside of the United States. All exporters must certify on this form that all items being purchased will not be used or resold within the United States, its territories, or possessions.

To complete the VTR-901-A, purchasers must provide detailed information about both themselves and their purchase. This includes name, address, contact information and type of business, as well as item description, quantity ordered, destination country for export and date of purchase. Once completed with all required information entered correctly and accurately, purchasers may sign off on their certification to attest to the accuracy of the data provided.

VTR-901-A Form Example