ORIGINFORMSTUDIO.COM – VTR-63 – Component Part(s) Bill of Sale – The VTR-63 Component Part(s) Bill of Sale is an important document for all businesses who purchase and sell parts. It outlines the details of the sale, including the components, prices, terms and conditions of the transaction. This document serves to protect both buyer and seller with a legally binding agreement that can be enforced in court if necessary. With this document, buyers can ensure that they are getting quality goods at a fair price while sellers can rest assured that they will be paid promptly upon completion of the sale.

Download VTR-63 – Component Part(s) Bill of Sale

| Form Number | VTR-63 |

| Form Title | Component Part(s) Bill of Sale |

| File Size | 1 MB |

| Form By | Texas DMV Form |

What is a VTR-63 Form?

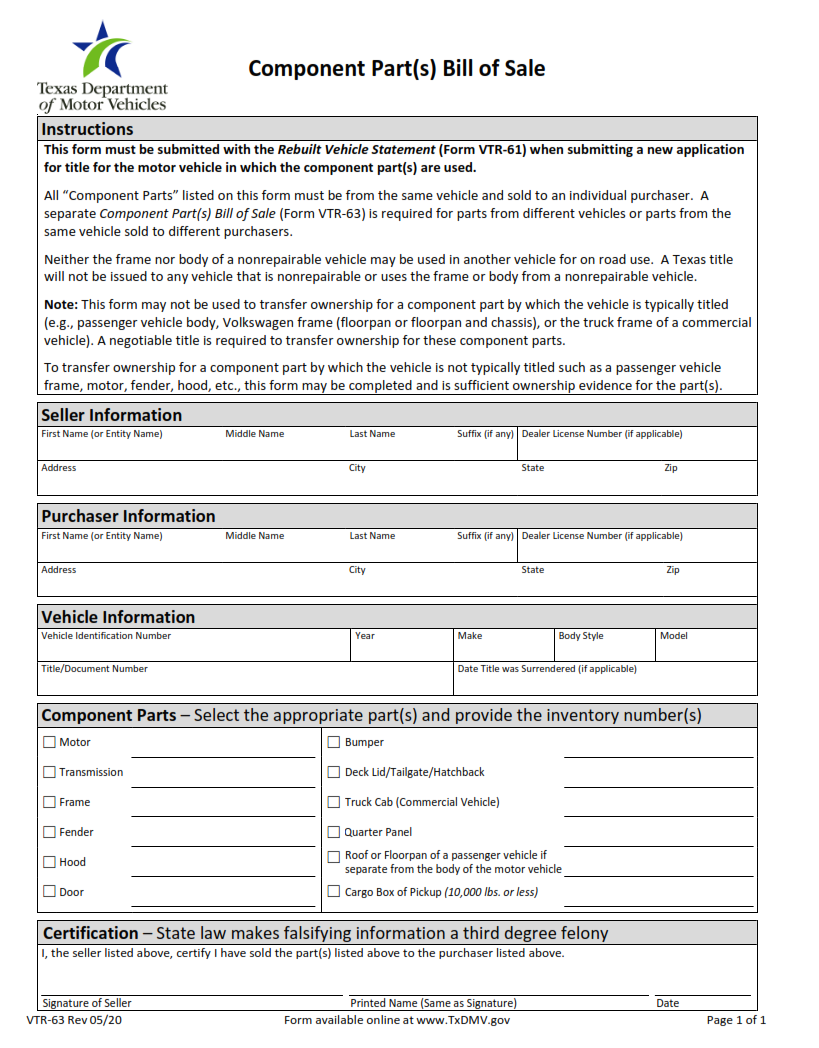

The VTR-63 is an important form for anyone looking to buy or sell a vehicle in the state of Texas. It is also known as the Component Part(s) Bill of Sale and is required by the Texas Department of Motor Vehicles whenever a vehicle is sold, bought, gifted, or transferred in any way. The form serves as proof that the sale has been conducted legally and that all parties involved have agreed to the transfer.

The VTR-63 must be filled out in its entirety and signed by both buyer and seller before being submitted to the DMV for processing. It must include information about both parties such as name, address, driver’s license number, date of birth, Social Security Number (if applicable), vehicle information including year make model and Vehicle Identification Number (VIN), list of components included with purchase (if applicable).

What is the Purpose of the VTR-63 Form?

The VTR-63 form, also known as the Component Part(s) Bill of Sale, is an important document used in Texas to register a vehicle. The purpose of this document is to provide proof of ownership and transfer of title when selling or buying a vehicle that contains multiple components. This form is necessary for any transfer that involves more than one part, such as a car with both an engine and body parts.

When purchasing or selling a vehicle in the state of Texas, it’s important to use the VTR-63 form in order to ensure proper documentation for the transaction. This form will provide evidence of ownership and serve as proof that all parties involved are legally bound by any agreements made during the sale. It will also be used by county tax offices when registering the vehicle or processing changes in title information.

Where Can I Find a VTR-63 Form?

The VTR-63 form is an important document that is used to transfer ownership of a vehicle in Texas. It is available for download from the Texas Department of Motor Vehicles (DMV) website. The form must be completed and signed by all parties involved in the transaction, including the seller and buyer, before it can be submitted to the DMV.

In addition to being able to download and print the VTR-63 form directly from the DMV website, it can also be found at many motor vehicle dealerships and other businesses throughout Texas. If you have any questions about how to complete or submit the form, you can contact your local DMV office or customer service hotline for assistance.

When purchasing or selling a vehicle in Texas, it is important that both parties keep copies of this form as proof of sale.

VTR-63 – Component Part(s) Bill of Sale

The VTR-63 Component Part(s) Bill of Sale is an important legal document that outlines the purchase and sale of component parts. It records the transaction between seller and buyer, including the description of each part being sold, the quantity, price, payment terms and other details. The bill of sale must be signed by both parties in order to be legally binding.

The VTR-63 Component Parts Bill of Sale should include a full description of all parts listed in it. This includes identifying information such as manufacturer’s name and model numbers for each item purchased or sold. It should also contain information on any warranties or guarantees associated with the parts being sold. In addition, it should list out any relevant taxes or fees associated with the sale transaction such as sales tax, shipping costs and so on.

VTR-63 Form Example