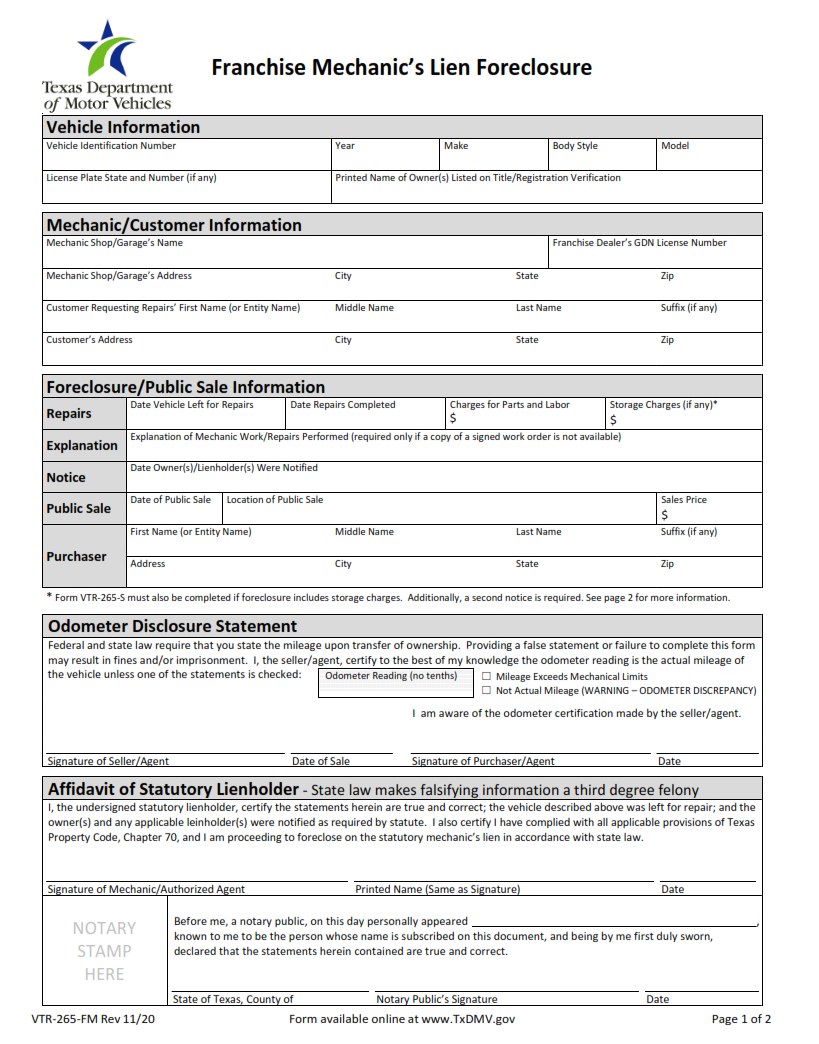

ORIGINFORMSTUDIO.COM – VTR-265-FM – Franchise Mechanic’s Lien Foreclosure – Today, franchise mechanics are being forced to take extra steps to protect their rights. The VTR-265-FM is a lien foreclosure system that helps them do just that. A lien foreclosure is a legal process in which a creditor can foreclose on an asset of the debtor if they fail to pay their debt obligations. This article will explain how the VTR-265-FM works and how it can help franchise mechanics protect themselves from debtors who owe them money for services rendered.

Download VTR-265-FM – Franchise Mechanic’s Lien Foreclosure

| Form Number | VTR-265-FM |

| Form Title | Franchise Mechanic’s Lien Foreclosure |

| File Size | 1 MB |

| Form By | Texas DMV Form |

What is a VTR-265-FM Form?

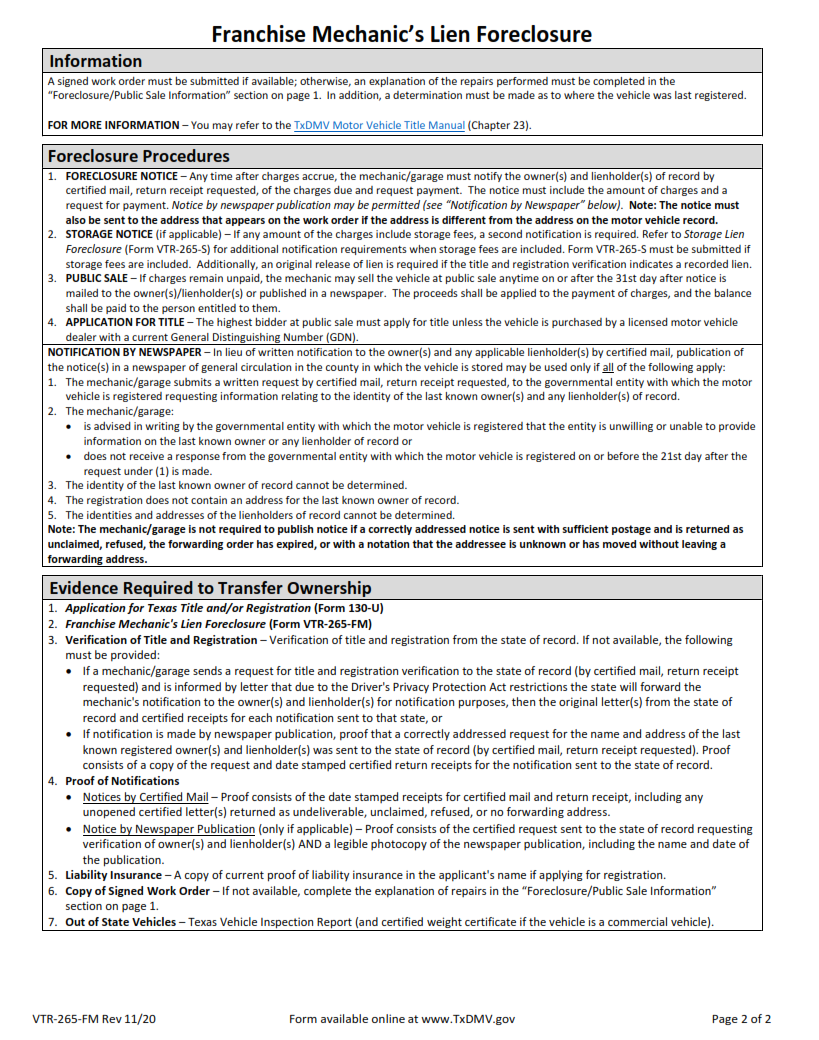

A VTR-265-FM is a form that must be filled out and filed with the Texas Department of motor vehicles for those seeking to foreclose on a franchise mechanic’s lien. It provides information about the property being foreclosed upon, as well as details about the legal action taken.

The VTR-265-FM must be filled out in accordance with Texas state laws regarding foreclosure proceedings. It must include detailed information such as the current owner of the property, any parties claiming interest in it, and any mortgages or liens that have been placed on it. In addition, all necessary signatures are required in order to complete the form correctly.

Filing this form is essential for an individual who wishes to legally foreclose on a franchise mechanic’s lien in Texas.

What is the Purpose of the VTR-265-FM Form?

The VTR-265-FM form is a crucial part of the franchise mechanic’s lien foreclosure process. This document, which is required by Texas law, serves as an official notice to inform all parties that a foreclosure action has been initiated and that the debt must be paid in full or else the property will be sold at public auction. It must be completed by both the franchisor and franchisee and submitted to the court for review.

The VTR-265-FM form serves two main purposes. First, it provides information about the nature of the debt and clarifies who holds title to which assets, including any machinery or equipment used by the franchisee. Second, it helps protect both parties from potential legal liability due to nonpayment of debts or other issues arising from their business relationship.

Where Can I Find a VTR-265-FM Form?

The Texas Department of Motor Vehicles (TxDMV) requires all dealers and mechanics to fill out a VTR-265-FM form when foreclosing on a franchise mechanic’s lien. This form is used to provide the TxDMV with evidence that the foreclosure was properly completed and that all parties involved were informed about the process.

The form can be found on the TxDMV website. It can also be obtained from any county clerk or tax assessor-collector office in Texas. It is important to note that while the form itself may be free, there are fees associated with processing it through these offices. Additionally, some offices may require an appointment before they will process the paperwork, so it is best to call ahead and confirm their requirements before visiting them in person.

VTR-265-FM – Franchise Mechanic’s Lien Foreclosure

The VTR-265-FM Franchise Mechanic’s Lien Foreclosure is a process designed to help franchise owners protect their businesses from unpaid debts. The lien foreclosure provides an alternative to traditional debt collection methods by allowing franchises to place liens on the property of delinquent customers. This type of lien foreclosure allows a franchisor to recover funds that are owed without having to resort to legal action.

The basic steps involved in a VTR-265-FM Franchise Mechanic’s Lien Foreclosure include filing the necessary paperwork with the court, obtaining approval from the court, and then sending out notices to all parties involved in the transaction including creditors and delinquent customers. After all of these steps have been completed, the franchise owner can proceed with repossessing or selling any items that were used as collateral for the loan or debt incurred by the customer.

VTR-265-FM Form Example