ORIGINFORMSTUDIO.COM – VTR-207 – Inventory of Component Parts Purchased/Affidavit Bill of Sale – Today’s article will outline the importance of the VTR-207 – Inventory of Component Parts Purchased Affidavit Bill of Sale. This document is an important part of any purchase agreement, and it is important to understand its purpose. This document includes a detailed list of all components that have been purchased with regard to a particular transaction. It also states the terms and conditions associated with the sale, such as payment information or delivery dates.

Download VTR-207 – Inventory of Component Parts Purchased/Affidavit Bill of Sale

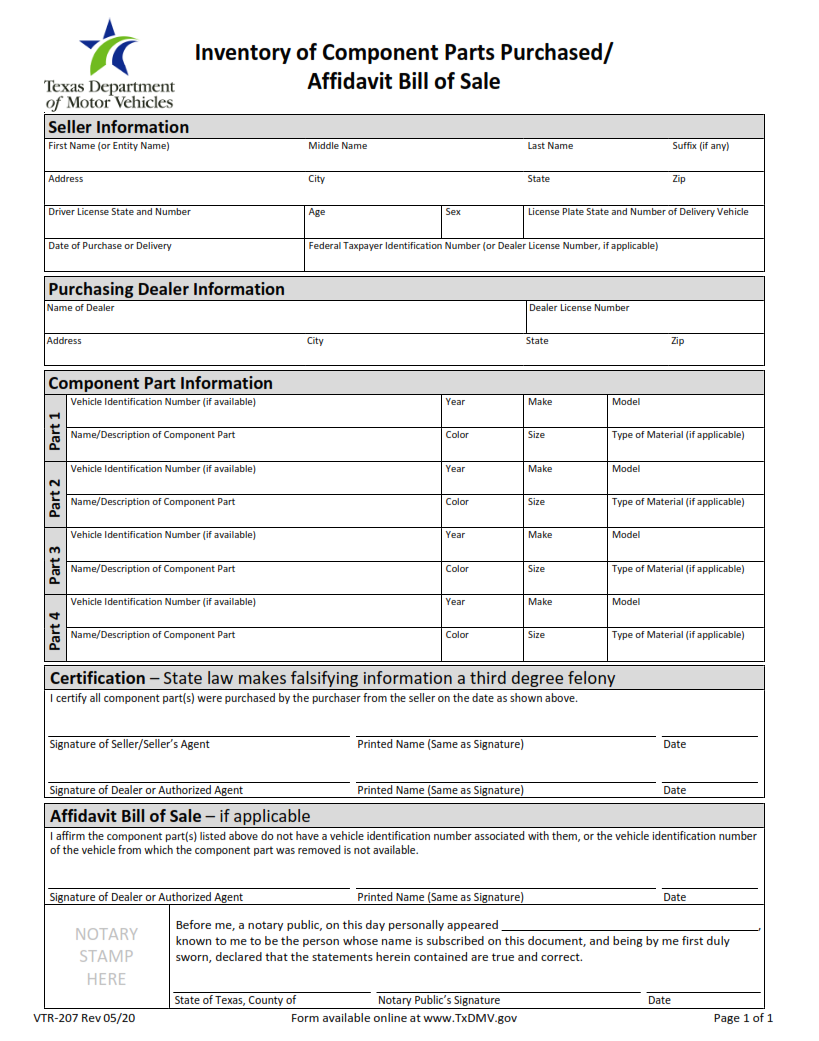

| Form Number | VTR-207 |

| Form Title | Inventory of Component Parts Purchased/Affidavit Bill of Sale |

| File Size | 1 MB |

| Form By | Texas DMV Form |

What is a VTR-207 Form?

The VTR-207 form is a required document that must be completed when purchasing a vehicle in the state of Texas. This form serves as an inventory for the component parts of the vehicle being purchased and also functions as an affidavit bill of sale.

When completing this form, the seller must provide basic information about the vehicle such as: make, model, year, body type, and VIN number. The seller must then list each item that is included in the sale and indicate whether or not it was an “original equipment manufacturer” (OEM) part or aftermarket part. This includes items such as tires and wheels, transmissions, engines, audio systems, etc. Once all items are listed on the VTR-207 form they must be signed by both buyer and seller to confirm that all components have been disclosed before purchase.

What is the Purpose of the VTR-207 Form?

The VTR-207 form is an Inventory of Component Parts Purchased Affidavit Bill of Sale that must be completed and submitted to the Texas Department of Motor Vehicles (TxDMV) whenever a motor vehicle, trailer, or boat is sold. This document serves as evidence that the vehicle being sold has been inspected for all parts it was originally sold with and that any missing parts have been noted on the form. It also serves as proof that all sales taxes are paid in full before the transfer of ownership can occur.

The purpose of this document is to protect both buyers and sellers when engaging in the sale of a motor vehicle, trailer, or boat. When completing this form, sellers must list each component part purchased with the vehicle which ensures buyers have a record of what they are purchasing and can verify they are getting what they bargained for.

Where Can I Find a VTR-207 Form?

In Texas, the VTR-207 form is used to certify an inventory of component parts that have been purchased and included in a bill of sale. This form must be signed by both the seller and purchaser before it can be completed. The VTR-207 is available from several sources, including online download sites and local county tax assessor-collectors offices.

Downloading a VTR-207 form online is convenient for many people. A simple search for “VTR-207” will bring up multiple results with downloadable PDFs or Word documents of the form. Alternatively, you can also find pre-filled forms that include all necessary information already filled out, making it easier to complete quickly.

VTR-207 – Inventory of Component Parts Purchased/Affidavit Bill of Sale

The VTR-207 – Inventory of Component Parts Purchased Affidavit Bill of Sale is an important document for individuals who are purchasing components for their vehicle. It allows them to inventory all of the parts purchased, and provides a record of what has been purchased in case any disputes arise between parties involved in the sale. The bill is a legally binding document and must be signed by both parties before the transaction can be completed.

In order to successfully complete this form, buyers should provide details such as their name, address, phone number, date of purchase, and vehicle information (including make, model year and body style). They should also list each part that was purchased along with its quantity, condition (new or used), cost per unit, total cost for all units bought and any applicable taxes.

VTR-207 Form Example