ORIGINFORMSTUDIO.COM – VTR-203 – Bill of Sale for a Junk Motor Vehicle – The process of buying and selling a motor vehicle doesn’t have to be complicated. Understanding the important legal document, known as the VTR-203 Bill of Sale for a Junk Motor Vehicle, is essential to ensure that you are protected as both a buyer and seller. This article will provide an overview of what this document entails, including who should use it and why it’s necessary. It will also explain the information required to complete the form correctly, such as identification details for both parties involved in the transaction.

Download VTR-203 – Bill of Sale for a Junk Motor Vehicle

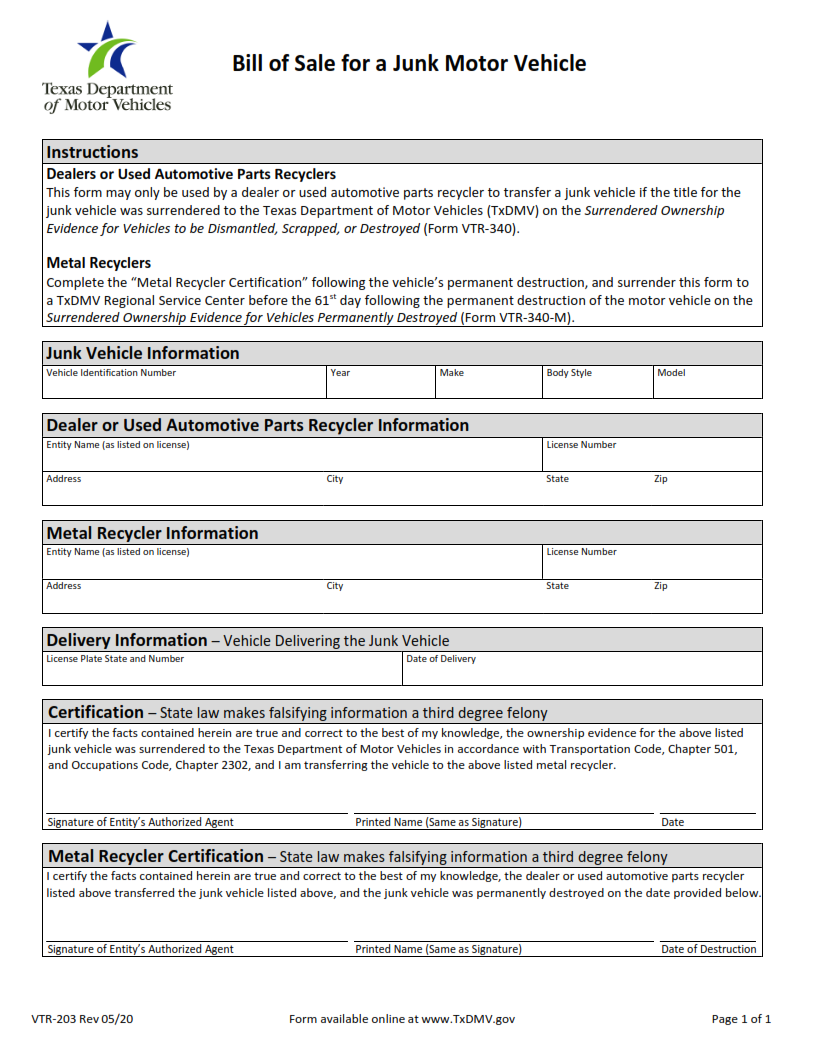

| Form Number | VTR-203 |

| Form Title | Bill of Sale for a Junk Motor Vehicle |

| File Size | 2 MB |

| Form By | Texas DMV Form |

What is a VTR-203 Form?

A VTR-203 form is a Texas Department of Motor Vehicles (TxDMV) document that serves as an official bill of sale for the transfer of ownership rights to a junk motor vehicle. It allows the seller and buyer to record the details of their transaction and provides protection from any liability issues that may arise in the future. The form must be signed and notarized by both parties, after which it must be submitted to TxDMV for approval and processing.

The VTR-203 form includes information such as: the make, model, year, license plate number, Vehicle Identification Number (VIN), price paid by buyer, date of purchase, purchaser’s name and address etc. Any additional agreements between buyer and seller can also be noted on this form.

What is the Purpose of the VTR-203 Form?

The VTR-203 Form is an important document for anyone looking to sell a junk motor vehicle in the state of Texas. The form serves as a bill of sale and must be completed by both parties involved in the transaction. It includes information such as the seller’s name, address, and license plate number; the buyer’s name and address; confirmation that payment has been received; vehicle description including make, model, year, title number; odometer disclosure statement; and signatures from both parties.

The key purpose of this form is to provide proof that ownership of the vehicle has legally been transferred from the seller to the buyer. This document is required when registering or transferring ownership with your local county tax office. Both parties should keep a copy of this form for their records in case it is needed in future transactions or legal proceedings.

Where Can I Find a VTR-203 Form?

If you are looking for a VTR-203 form, it is available online from the Texas Department of Motor Vehicles (TxDMV). The VTR-203 form is used to register and title junk or salvage vehicles in the state of Texas. You can download a copy of this form from the TxDMV website, or you can pick up a copy at any local tax office or county clerk’s office.

In addition to the VTR-203 form, there are also other documents that need to be completed when registering and titling a junk or salvage vehicle in Texas. These include an Application for Certificate of Title (Form 130-U), proof of ownership such as an original bill of sale, and proof of liability insurance if applicable. All these documents must be submitted with your application before your vehicle can be registered.

VTR-203 – Bill of Sale for a Junk Motor Vehicle

The VTR-203 Bill of Sale is an important document when it comes to selling a junk motor vehicle in the state of Texas. This form must be completed and signed by both parties involved in the transaction, including the buyer and seller. The bill of sale serves as proof that the buyer has acquired ownership of the vehicle and that all rights, title, and interest have been transferred from one party to another.

The VTR-203 is a four page document that includes information such as details about the vehicle (e.g., make, model year), registration number, odometer reading at time of transfer, names and addresses of both parties involved in the transaction, sales price paid for the vehicle, condition or description of damage or defects on the vehicle at time of transfer if any, statement indicating whether or not taxes have been paid on this sale (if applicable).

VTR-203 Form Example