ORIGINFORMSTUDIO.COM – VTR-125 – Motor Vehicle Appraisal for Tax Collector Hearing / Bonded Title – When a motor vehicle appraisal is requested for tax collector hearing and bonded title, the VTR-125 form must be submitted. This appraisal is one of many procedures that must be taken in order to complete the process for transferring ownership of the vehicle. The purpose of this article will be to provide a comprehensive overview of the VTR-125 motor vehicle appraisal form, its requirements and instructions, as well as additional information related to tax collector hearings and bonded titles.

Download VTR-125 – Motor Vehicle Appraisal for Tax Collector Hearing / Bonded Title

| Form Number | VTR-125 |

| Form Title | Motor Vehicle Appraisal for Tax Collector Hearing / Bonded Title |

| File Size | 1 MB |

| Form By | Texas DMV Form |

What is a VTR-125 Form?

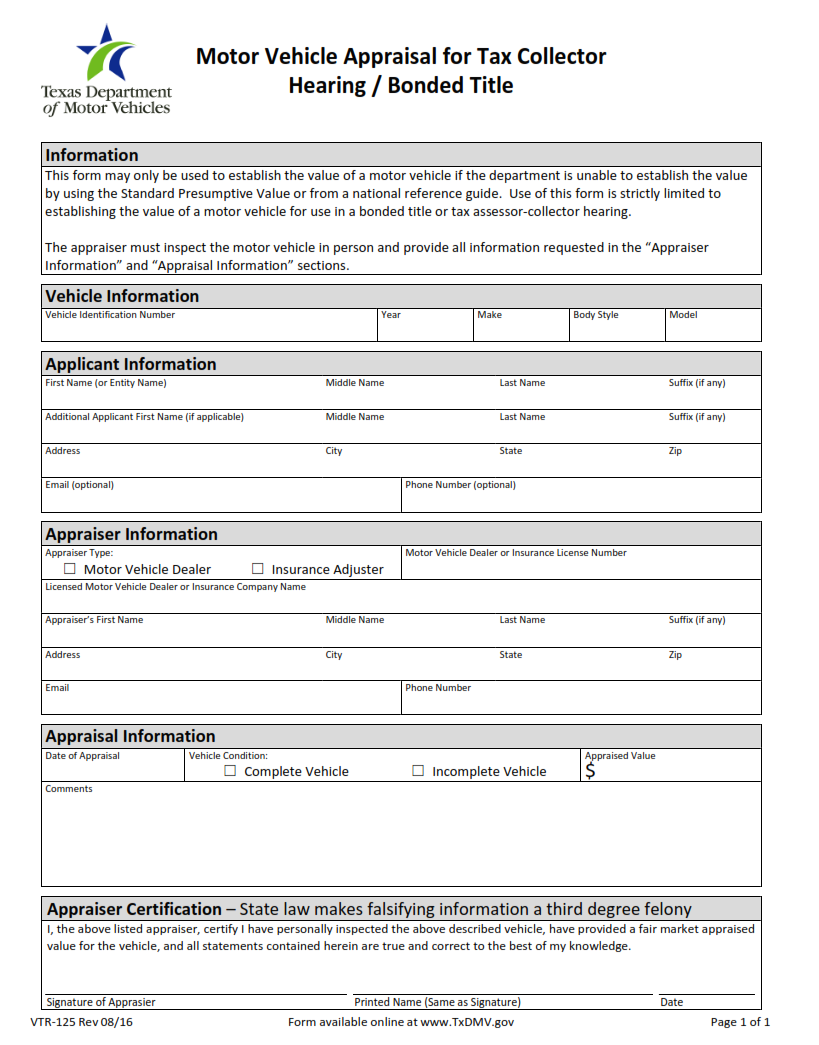

The VTR-125 form is used by the Texas Department of Motor Vehicles when a vehicle must be appraised for tax collector hearing. It is also used for bonded titles, which are typically required when there are questions about the true ownership or validity of a vehicle title. The form includes information such as the type of hearing requested, an estimated value of the vehicle, and any additional documentation required from the taxpayer.

The VTR-125 form must be completed and signed by both parties involved in the appraisal process. This includes all interested parties such as lien holders, insurance companies, law enforcement agencies, and other state agencies who may have an interest in determining the ownership or value of a vehicle. The form should also include detailed information on any repairs that were made to the vehicle to increase its value before it was appraised.

What is the Purpose of the VTR-125 Form?

The VTR-125 form is a necessary part of the motor vehicle appraisal process for tax collector hearing bonded title cases. This form is used to report the condition and value of a vehicle for taxation purposes, and must be completed in order for an applicant to obtain a bonded title.

The purpose of the VTR-125 form is to accurately assess a vehicle’s physical and mechanical integrity. The form requires information regarding the make, model, year, engine type, body style and odometer readings in order to calculate the fair market value of the car. Additionally, it will ask questions about any possible damage or defects that may affect its overall worth. Once all relevant data has been entered on this form by an independent appraiser or auto technician, it can be submitted as part of an application for a bonded title.

Where Can I Find a VTR-125 Form?

The VTR-125 form is an important document for anyone going through the process of getting a bonded title for their vehicle in Texas. If you’re looking to get a VTR-125 form, there are several places you can go to find it.

One option is to visit your local county tax office. The tax office will have the form readily available and can provide guidance on how to properly fill it out. Additionally, many offices offer online services that allow you to print out the form from home or complete it electronically if desired.

Another option is to search online for the VTR-125 form. This method will usually bring up links directly from the Texas Department of Motor Vehicles website, where you can download and print a copy of the form yourself at no cost.

VTR-125 – Motor Vehicle Appraisal for Tax Collector Hearing / Bonded Title

When a vehicle is involved in a Tax Collector hearing, the VTR-125 Motor Vehicle Appraisal must be completed. This form can only be filled out by an authorized appraiser and must accompany any request for a Bonded Title. The form assesses the vehicle’s condition at time of appraisal and assigns a value based on its current market worth.

The VTR-125 form contains several categories including: make and model of the vehicle, its year of manufacture, odometer reading, description of parts or damage present, cost for repairs to get it roadworthy again and an overall assessment. Additionally, it requires photos that show interior and exterior damage as well as close ups of all damaged areas. All this information is necessary so that the appraiser can provide the most accurate assessment possible when assigning the value to the car.

VTR-125 Form Example