ORIGINFORMSTUDIO.COM – SBA Form 4506-T – Shuttered Venue Operators Grant – The Shuttered Venue Operators Grant (SBA Form 4506-T) is a critical aid for businesses that have been impacted by the coronavirus pandemic. The grant offers financial assistance to those in the entertainment, arts and hospitality industries who have experienced revenue losses due to closures. It provides funding for six months of operating expenses and allows businesses to gain access to capital so they can remain viable through this difficult time. It is important for eligible business owners to understand the application process, eligibility requirements, and terms of the grant so they can maximize their chances of receiving funds.

Download SBA Form 4506-T – Shuttered Venue Operators Grant

| Form Number | SBA Form 4506-T |

| Form Title | Shuttered Venue Operators Grant |

| File Size | 1 MB |

| Form By | SBA Forms |

What is an SBA Form 4506-T?

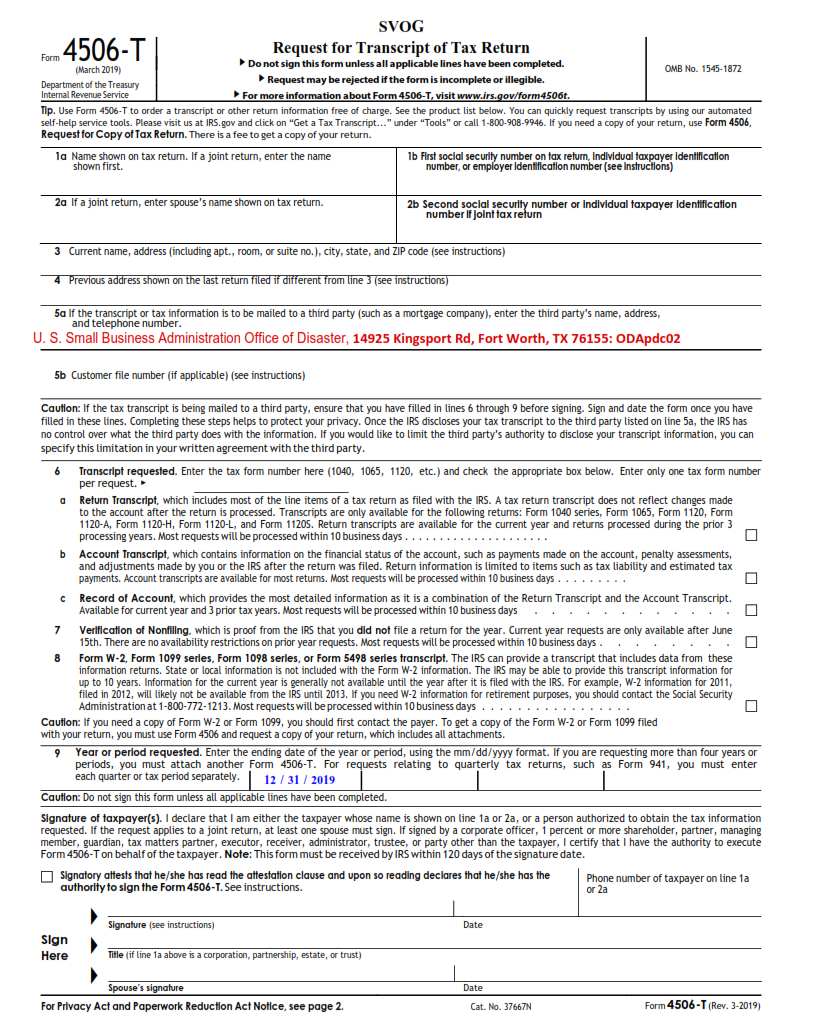

A SBA Form 4506-T is a form that the US Small Business Administration (SBA) requires Shuttered Venue Operators Grant (SVOG) applicants to complete. The purpose of this form is to authorize the Internal Revenue Service (IRS) to provide tax information related to the applicant’s past income and other business taxes. This includes information such as adjusted gross income, self-employment taxes, and personal exemption credits.

In addition, applicants are required to provide detailed information on their most recently filed tax return such as filing status and type of return. This information will help the SBA review the grant application quickly and accurately in order for it to be approved or rejected in a timely manner. By providing accurate information on this form, applicants can expedite their grant application process significantly and increase their chances of being approved for an SVOG grant.

What is the Purpose of SBA Form 4506-T?

The SBA Form 4506-T is a document used by the U.S. Small Business Administration to verify income and tax information for the Shuttered Venue Operators Grant program. This form allows those applying for this grant to provide the SBA with their federal income tax return transcripts from the last four years so that they can be reviewed and processed.

The purpose of this form is to ensure that all applicants are eligible for the Shuttered Venue Operators Grant program, which provides financial relief to businesses affected by COVID-19 closures or restrictions. By requiring applicants to submit their full federal income tax return transcripts, it ensures that only legitimate businesses are being considered for funding under this program. Additionally, it helps prevent fraud or abuse of the system by ensuring that all applicants meet eligibility requirements before being approved for funding.

Where Can I Find a SBA Form 4506-T?

The Small Business Administration (SBA) Form 4506-T is an important document needed to apply for the Shuttered Venue Operators Grant. This grant provides financial assistance to eligible live venue operators, theatrical producers, live performing arts organizations and museum operators who have been impacted by COVID-19 shutdowns. The form must be completed and submitted with other required documents in order to qualify for the grant.

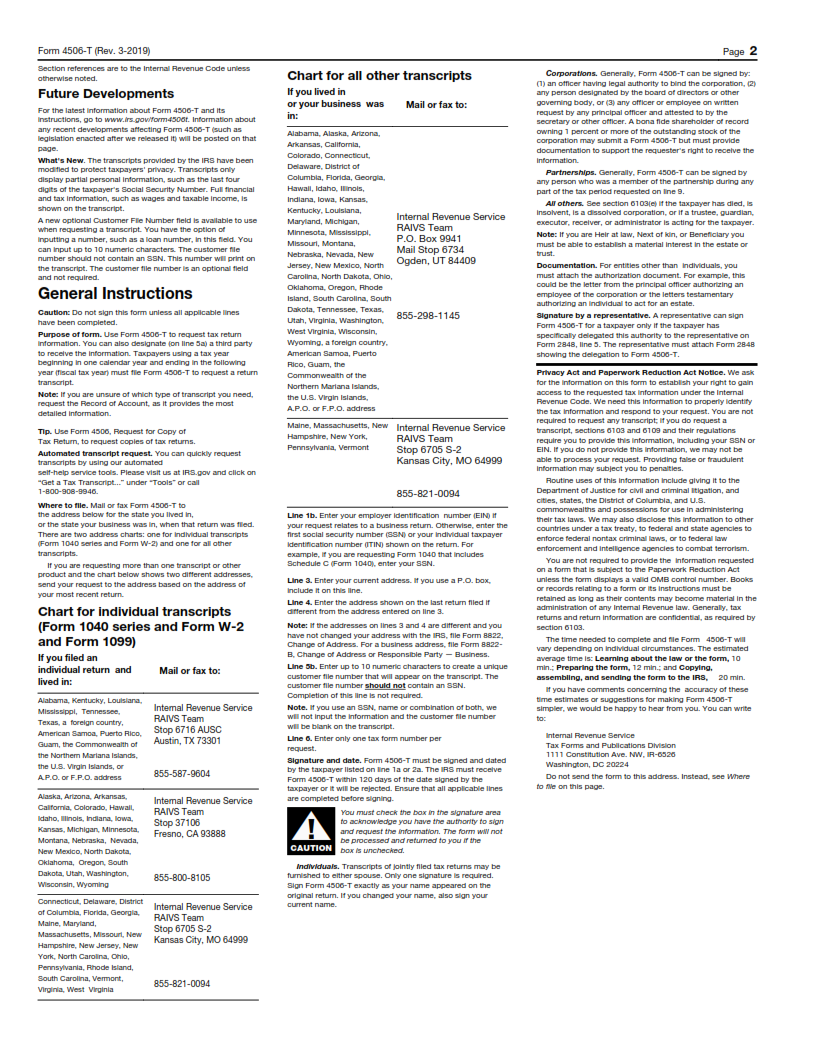

The SBA Form 4506-T can be found on the official website of the SBA as well as on many third party websites. It is important to ensure that you are using an official version of the form in order to ensure that your application is complete and accurate. On the SBA website, you will find instructions on how to fill out each field within the form as well as a sample copy for reference purposes.

SBA Form 4506-T – Shuttered Venue Operators Grant

The Small Business Administration (SBA) recently announced the Shuttered Venue Operators Grant (SVOG). This grant is designed to provide relief for eligible applicants who have been forced to close their business due to the Covid-19 pandemic. To apply for this grant, applicants must fill out and submit SBA Form 4506-T.

This form is intended to be used by businesses that have lost at least 25% of their revenue due to the pandemic. The application requires basic information including name, address, and tax identification number. It also requests a detailed explanation of how the applicant’s business has been affected and what types of expenses are expected in the near future. Once submitted, it will take approximately 3 weeks for an SBA representative to review the application and make a determination as to whether or not an award should be granted.

SBA Form 4506-T Example