ORIGINFORMSTUDIO.COM – SBA Form 424B – Assurances – Non-Construction Programs – The SBA Form 424B is a critical document for any business applying for non-construction related programs administered by the U.S. Small Business Administration (SBA). Completing this form is essential to ensuring that businesses meet the assurance requirements necessary to be eligible for federal and state funding. This article will provide an overview of what the SBA Form 424B is, how it relates to non-construction programs, and what business owners need to consider when completing it.

Download SBA Form 424B – Assurances – Non-Construction Programs

| Form Number | SBA Form 424B |

| Form Title | Assurances – Non-Construction Programs |

| File Size | 19 KB |

| Form By | SBA Forms |

What is an SBA Form 424B?

An SBA Form 424B is a document used by the Small Business Administration (SBA) to request assurances from entities applying for non-construction programs. It requires applicants to demonstrate that they have the financial capability to carry out their proposed project and will comply with related federal laws, regulations, and requirements.

The form provides a summary of key information about the applicant including their name, address, contact details, program for which they are applying for assistance, amount requested, and other related data. Additionally, applicants must certify that they are eligible under all applicable statutes and executive orders as well as agree to comply with all applicable laws when executing the proposed project.

What is the Purpose of SBA Form 424B?

SBA Form 424B is an important document for organizations seeking financial assistance from the Small Business Administration (SBA). The form provides assurance that funds will be utilized in line with SBA regulations and guidelines. It is used to demonstrate compliance with certain requirements, such as providing information on how the funding will be used.

In addition to providing assurances of compliance, SBA Form 424B also includes information on the organization’s size, scope of operations and other details that are necessary for meeting eligibility requirements for non-construction programs. By filling out this form, organizations can show that they meet all required criteria for receiving funds from the SBA. Additionally, it must be signed by an authorized representative of the organization which serves as proof that all information provided is accurate and up-to-date.

Where Can I Find an SBA Form 424B?

SBA Form 424B is an important document for businesses that are looking to secure funding from the Small Business Administration. The form provides assurances of compliance with all applicable laws and regulations related to the proposed project, including federal agency requirements, state and local laws, and equal opportunity provisions.

The form can be found on the official SBA website. It is available for download in both PDF and Word format. Additionally, it can also be filled out online with a free interactive tool provided by the SBA. To access this tool, simply navigate to the Small Business Forms page on the SBA website and locate the option labeled “Forms – Non-Construction Programs” under “Assurances”. Once there, you will find instructions on how to fill out Form 424B as well as links to download or open an online version of the form.

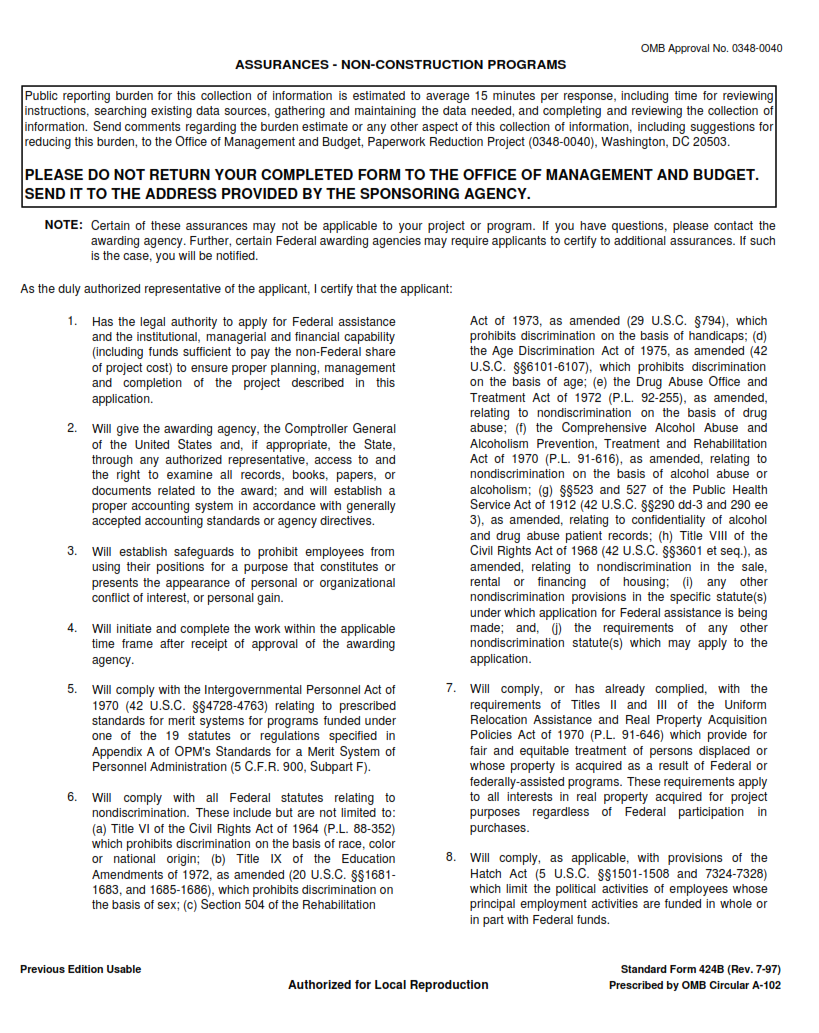

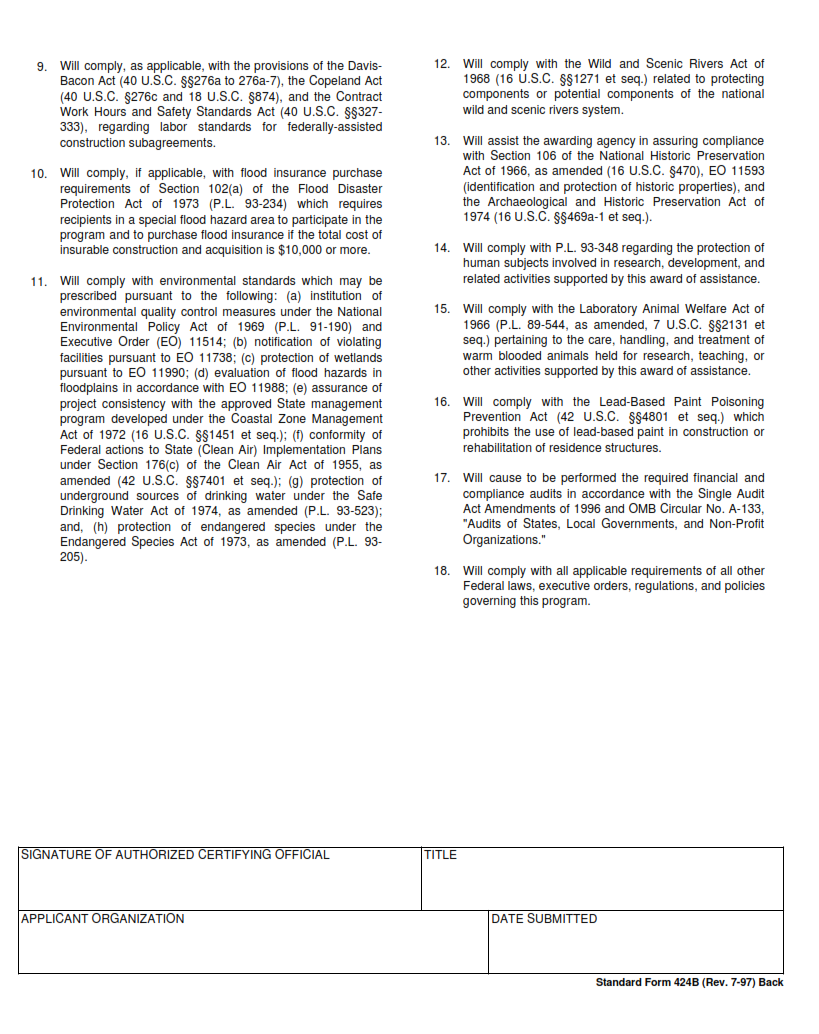

SBA Form 424B – Assurances – Non-Construction Programs

The Small Business Administration (SBA) Form 424B is an assurance form used in non-construction programs. It acts as a written agreement between the borrower and the SBA that all requirements and regulations of the loan program will be met. This document ensures that the borrower’s company meets any additional standards or regulations set forth by local, state, or federal governments.

The primary purpose of Form 424B is to protect both parties involved in the loan transaction by ensuring that all applicable guidelines and regulations are followed. The form also serves to inform applicants of their rights and obligations under the terms of their loan program. The information provided on this form must include evidence that demonstrates compliance with all relevant government policies, procedures, and laws related to SBA financing assistance. Additionally, this form must be signed by an authorized representative from both parties before it can be considered valid.

SBA Form 424B Example