ORIGINFORMSTUDIO.COM – SBA Form 25 PCGP – Model Corporate General Partner Resolution for SBA Commitment – Small businesses are essential to the economic development of the United States, and they need access to capital in order to succeed. The Small Business Administration (SBA) offers a range of loan programs that can provide such funding. One option is the SBA Form 25 PCGP – Model Corporate General Partner Resolution for SBA Commitment, which enables small businesses to secure financing through an SBA-approved private lender. This article will explain what an SBA Form 25 PCGP is and how it works, including its eligibility requirements and potential benefits for qualified applicants.

Download SBA Form 25 PCGP – Model Corporate General Partner Resolution for SBA Commitment

| Form Number | SBA Form 25 PCGP |

| Form Title | Model Corporate General Partner Resolution for SBA Commitment |

| File Size | 83 KB |

| Form By | SBA Forms |

What is an SBA Form 25 PCGP?

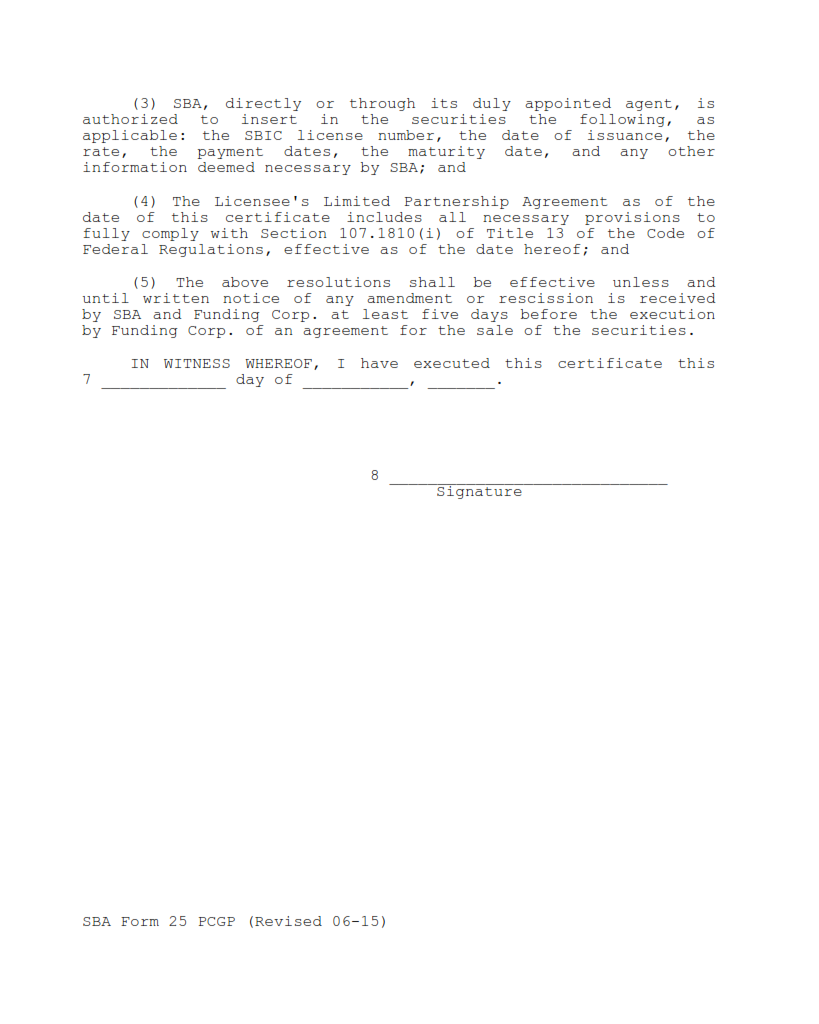

The SBA Form 25 PCGP is an important document that companies must submit when applying for a Small Business Administration (SBA) loan. This form serves as a resolution of the company’s corporate general partner and sets out the terms and conditions of the loan agreement. It’s also used to establish the legal authority for the company to enter into a commitment with an SBA lender.

The information provided in this form includes details about how much money is being requested, what type of loan is being requested, and other pertinent information about repayment terms, fees, interest rates, and other conditions associated with the loan. The SBA Form 25 PCGP must be signed by both parties – borrower and lender – before it can be submitted to the SBA for approval.

What is the Purpose of SBA Form 25 PCGP?

The purpose of SBA Form 25 PCGP is to provide the Small Business Administration (SBA) with information on the corporate general partner who will be responsible for overseeing the activities of a proposed business enterprise. The form is filled out by the individual or organization that will serve as the General Partner (GP) of an LLC or other legal entity which is seeking SBA financing. It outlines all of the important information about how and why a GP should be chosen, so that it can be used to inform both sides —the SBA and potential investors —about their respective roles in any given transaction.

The form contains several sections, including one which specifies what sort of qualifications and experience a prospective GP must have in order to qualify for consideration.

Where Can I Find an SBA Form 25 PCGP?

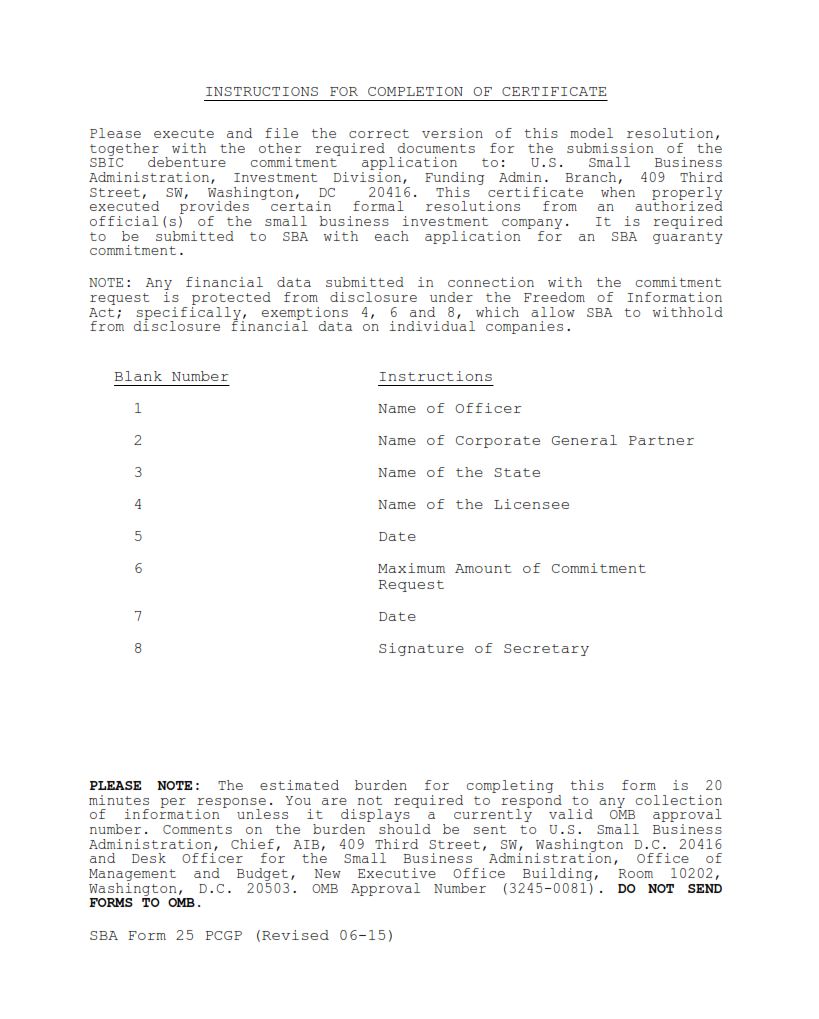

The Small Business Administration (SBA) Form 25 PCGP, or Model Corporate General Partner Resolution for SBA Commitment, is a document that is required for any company applying for a loan from the SBA. The form must be completed and signed by the company’s board of directors and all general partners in order to receive an SBA commitment.

The form can be found on the US Small Business Administration website at www.sba.gov/form25pcgp. Clicking on this link will direct you to the download page, where you can find a PDF copy of the form that you can print out and complete by hand. Alternatively, you can also fill out an online version of the form which is available through certain online lenders who offer SBA loans.

SBA Form 25 PCGP – Model Corporate General Partner Resolution for SBA Commitment

The Small Business Administration (SBA) Form 25 PCGP is a model corporate general partner resolution for an SBA commitment. This form is used when the SBA requires a limited liability company to have a corporate general partner in order to approve its loan application. The resolution outlines the roles and responsibilities of the corporate general partner, including providing legal advice on business matters, managing the limited liability company’s financial affairs, and ensuring compliance with all applicable laws and regulations. It also authorizes the corporate partner to enter into contracts on behalf of the LLC.

The form must be signed by all members of the LLC in order for it to be valid. In addition, a copy must be submitted to the SBA along with evidence that each member has been informed about their respective obligations as part of this agreement.

SBA Form 25 PCGP Example