ORIGINFORMSTUDIO.COM – SBA Form 2484-SD – PPP Second Draw Lender Application Form – The SBA recently released Form 2484-SD, the Paycheck Protection Program (PPP) Second Draw Lender Application Form. This form is used by lenders to apply for and receive PPP loans to provide on behalf of small businesses. It is a critical document that is necessary in order to access economic relief through the PPP program. This article provides an overview of the application process and key information regarding this form. We will discuss what you need to know about completing and submitting this form, as well as potential issues you may encounter along the way.

Download SBA Form 2484-SD – PPP Second Draw Lender Application Form

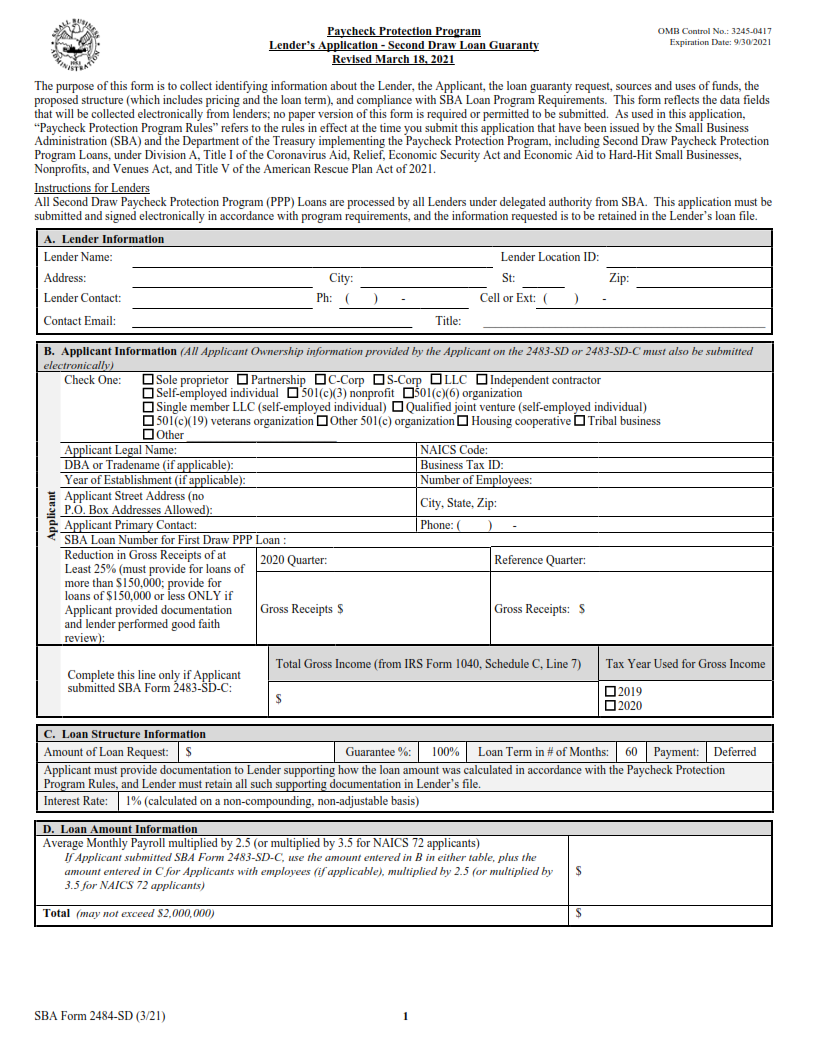

| Form Number | SBA 2484-SD |

| Form Title | PPP Second Draw Lender Application Form |

| File Size | 329 KB |

| Form By | SBA Forms |

What is an SBA Form 2484-SD?

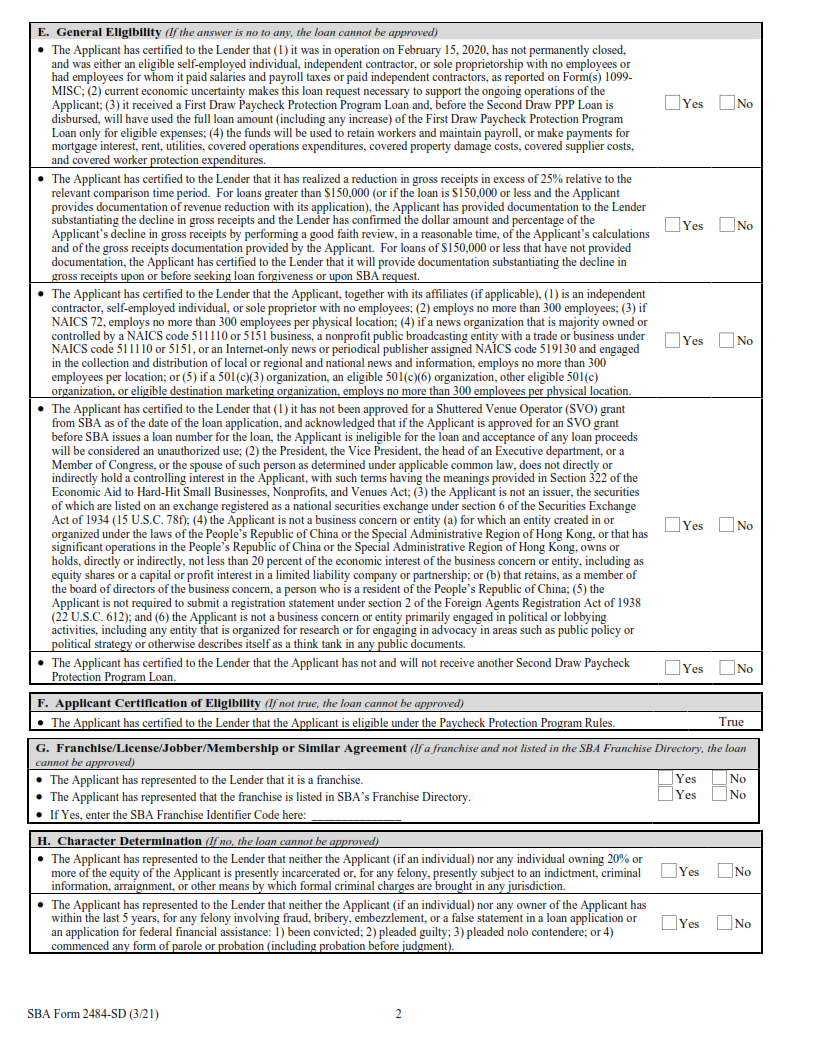

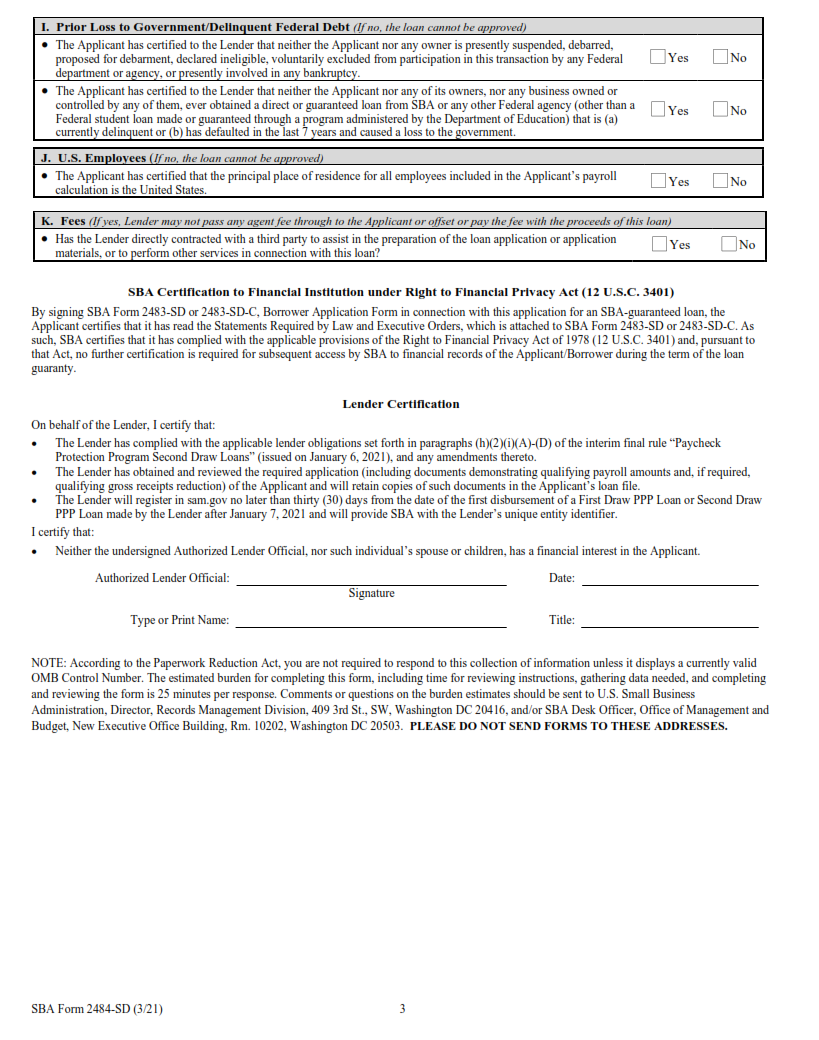

The SBA Form 2484-SD is an application form used by lenders offering Paycheck Protection Program (PPP) loans for the second draw. This form helps lenders gather information about small businesses that are eligible for the second draw of PPP funds. The form must be completed in full and signed by the borrower and lender to apply for a PPP loan.

The information required on SBA Form 2484-SD includes basic business information such as name, address, and tax identification number. It also requires statements of need, certifications regarding eligibility, documentation on economic injury suffered due to COVID-19, and other related documents necessary to complete the application process. Additionally, it contains questions concerning any prior PPP loan received and usage of those funds.

What is the Purpose of SBA Form 2484-SD?

SBA Form 2484-SD is the second draw application form for Paycheck Protection Program (PPP) loans. This form is used by banks and other lending institutions to apply for PPP loans from the Small Business Administration (SBA). It takes approximately 10 minutes to complete the form, which requires applicants to provide basic information about their business, such as its name, address, and tax identification number. Additionally, applicants must provide details regarding their loan history with the SBA and any affiliates or subsidiaries of the business.

The purpose of SBA Form 2484-SD is twofold: firstly, it helps lenders determine whether an applicant qualifies for a PPP loan; secondly, it helps the lender obtain additional information required by the SBA in order to process its loan request.

Where Can I Find an SBA Form 2484-SD?

The SBA Form 2484-SD, or the Paycheck Protection Program Second Draw Lender Application Form, is an essential document that lenders must use when applying for a second round of funding through the Small Business Administration’s PPP. The form can be found on the SBA’s website and is available for download in PDF format.

It is important to note that the form must be completed by hand and cannot be submitted electronically. Additionally, all signatures must also be original; copies are not accepted. Once complete, the form should be sent directly to the lender’s local SBA office or emailed to [email protected] with “Form 2484-SD” in the subject line. Detailed instructions on how to submit this form are outlined at www.SBA.gov/PaycheckProtectionProgram/SecondDraw/.

SBA Form 2484-SD – PPP Second Draw Lender Application Form

The SBA Form 2484-SD is a form used by lenders to apply for participation in the Paycheck Protection Program (PPP) Second Draw. This form must be completed and submitted by all lenders prior to disbursing second draw loan funds. The form requires the lender to provide basic information about their company, such as contact information and banking details. It also requests information related to borrower qualifications and loan terms, such as maximum loan amounts and repayment periods.

In addition, the lender must certify that they have met eligibility requirements set forth in Section 7(a)(36) of the Small Business Act as amended by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Furthermore, they are required to certify that their business complies with all applicable laws regarding fraud prevention measures and financial responsibility standards.

SBA Form 2484-SD Example

SBA Form 2484-SD – PPP Second Draw Lender Application Form