ORIGINFORMSTUDIO.COM – SBA Form 2483 – PPP First Draw Borrower Application Form – The Small Business Administration (SBA) Form 2483 is an essential part of the Paycheck Protection Program (PPP). This form is used by businesses to apply for the First Draw of PPP funds. The application process can be daunting, but with the right information and guidance, it doesn’t have to be. In this article, we will provide a comprehensive guide to understanding and completing SBA Form 2483 – PPP First Draw Borrower Application Form. We will discuss eligibility requirements, how to complete each section of the form correctly, acceptable documents for verification purposes and more.

Download SBA Form 2483 – PPP First Draw Borrower Application Form

| Form Number | SBA Form 2483 |

| Form Title | PPP First Draw Borrower Application Form |

| File Size | 497 KB |

| Form By | SBA Forms |

What is an SBA Form 2483?

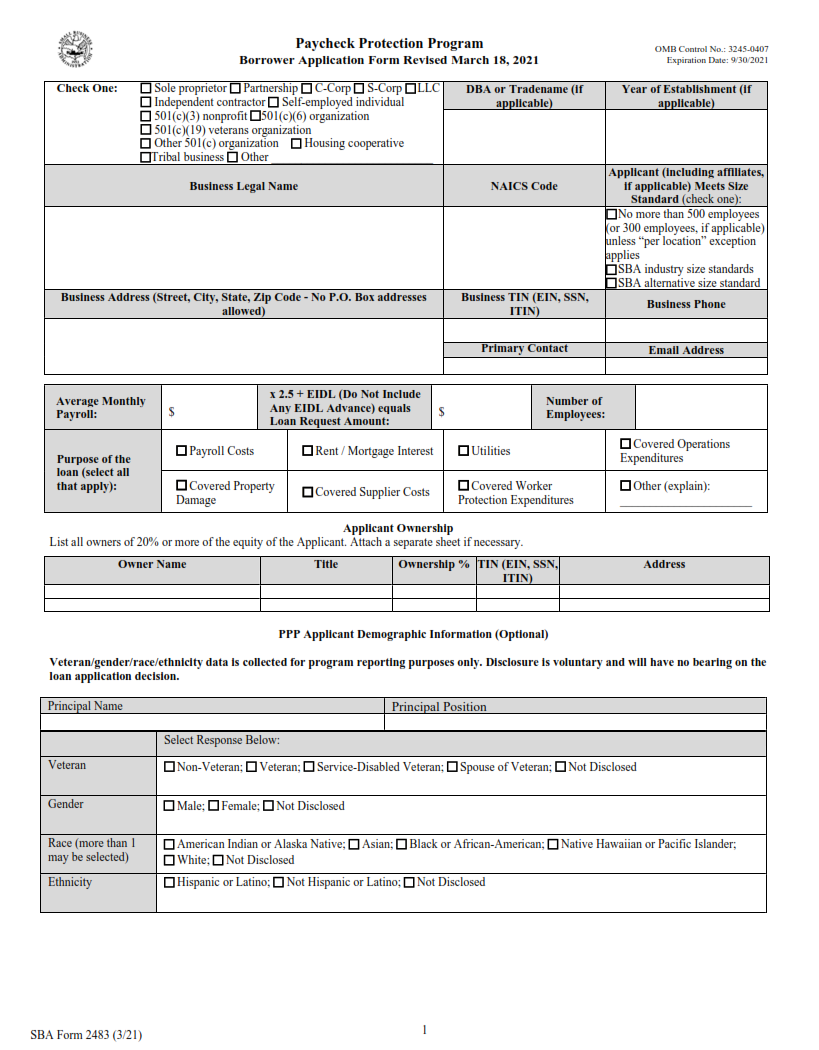

The SBA Form 2483, also known as the Paycheck Protection Program (PPP) First Draw Borrower Application Form, is an application form developed by the Small Business Administration (SBA). This form is used to apply for a loan through the PPP initiative. It provides step-by-step instructions for completing the application process and includes detailed information about required documents and other forms. In order to be eligible for the loan, applicants must submit this form along with relevant financial documentation.

The SBA Form 2483 contains several sections that borrowers need to fill out in order to complete their application. It asks questions about business information such as ownership type, company size, annual revenue, years in business and contact information. Additionally, it requires applicants to provide detailed information regarding employees and payroll costs over a specific period of time prior to applying for the loan.

What is the Purpose of the SBA Form 2483?

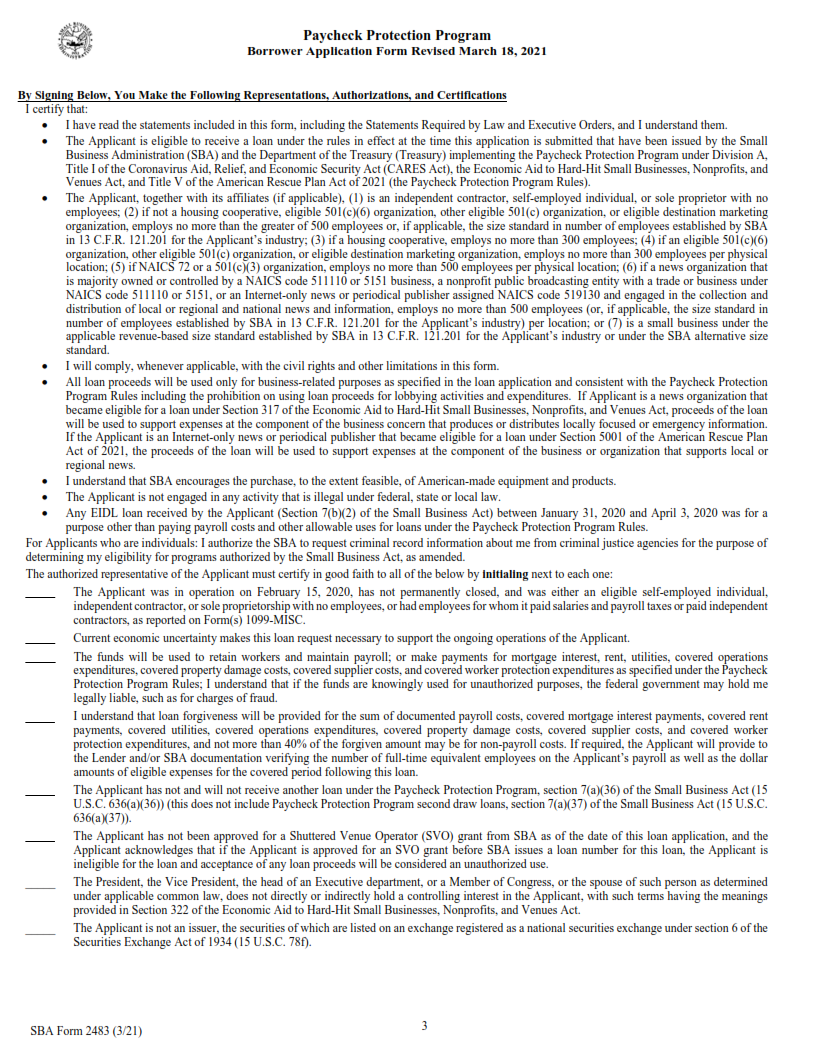

The SBA Form 2483, or the Paycheck Protection Program (PPP) First Draw Borrower Application Form, is an important form used to apply for forgivable loans under the CARES Act. This form is used by businesses that have not yet received a PPP loan and are looking to receive funds from the Small Business Administration (SBA).

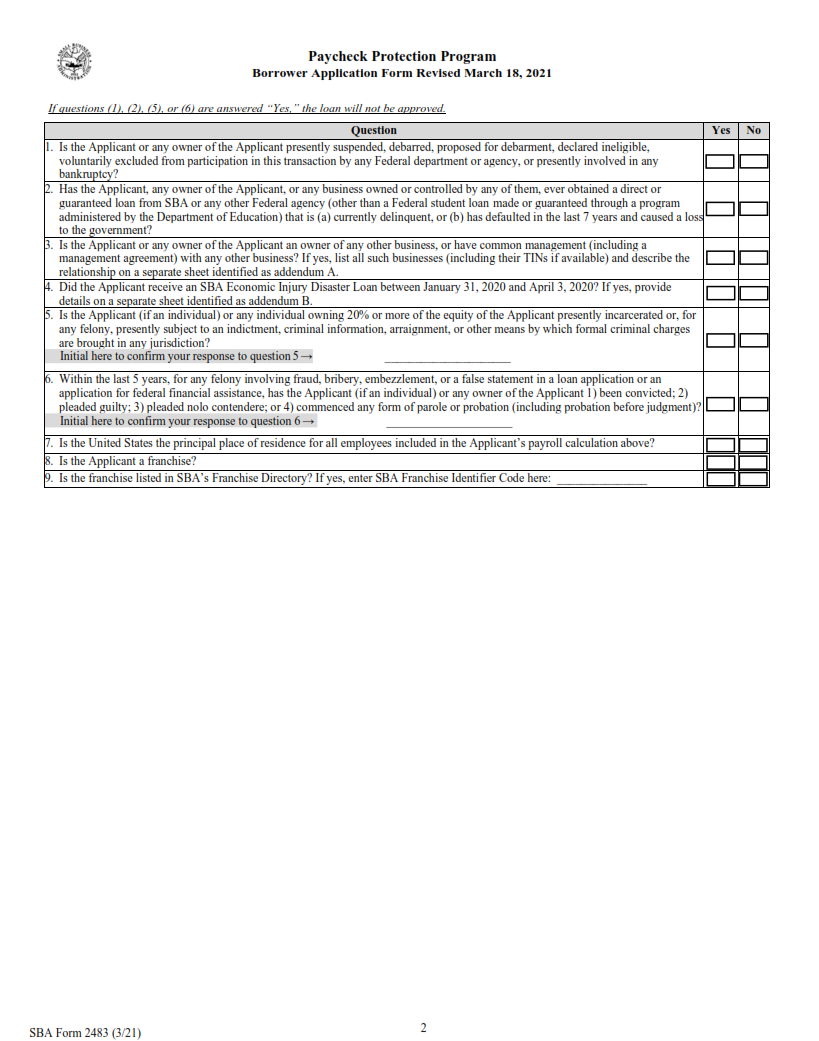

In order to be eligible for a forgivable PPP loan, applicants must provide certain information on this application including details about their business structure, size of payroll costs, number of employees, and amount of money requested. Additionally, applicants must certify that all information provided on the application is true and accurate and that they understand any false statements could result in prosecution.

Once submitted with all required documents included, the SBA Form 2483 serves as proof of eligibility for a PPP loan.

Where Can I Find an SBA Form 2483?

The Small Business Administration (SBA) Form 2483 is the official application form for the Paycheck Protection Program (PPP) First Draw Borrower. Created by the SBA, this form is essential for businesses that are applying for financial assistance through the PPP loan program. The form provides all of the necessary information to help borrowers qualify for a loan under the program.

The SBA Form 2483 can be found on the official website of the US Small Business Administration. All applicants must fill out and submit this form in order to apply for a loan under the PPP First Draw Borrower Program. Once completed, it must be sent either via mail or electronically in order to be processed by an approved lender.

SBA Form 2483 – PPP First Draw Borrower

The Small Business Administration (SBA) Form 2483 is the application form for borrowers who are seeking a Paycheck Protection Program (PPP) First Draw loan. This form allows applicants to provide detailed information about their business, including its size, revenue, and other financial data that will be used to determine eligibility for the loan.

Completion of this form is required in order to apply for a PPP First Draw loan. Information requested on the form includes details about company ownership, banking information, employee numbers and payroll expenses, as well as other financial details such as total revenues and expenses. The SBA also requires detailed descriptions of how the applicant intends to use their PPP funds if approved for a loan.

Once completed, the borrower must submit it to an approved lender or other participating intermediary before they can receive funds from their PPP First Draw loan.

SBA Form 2483 Example