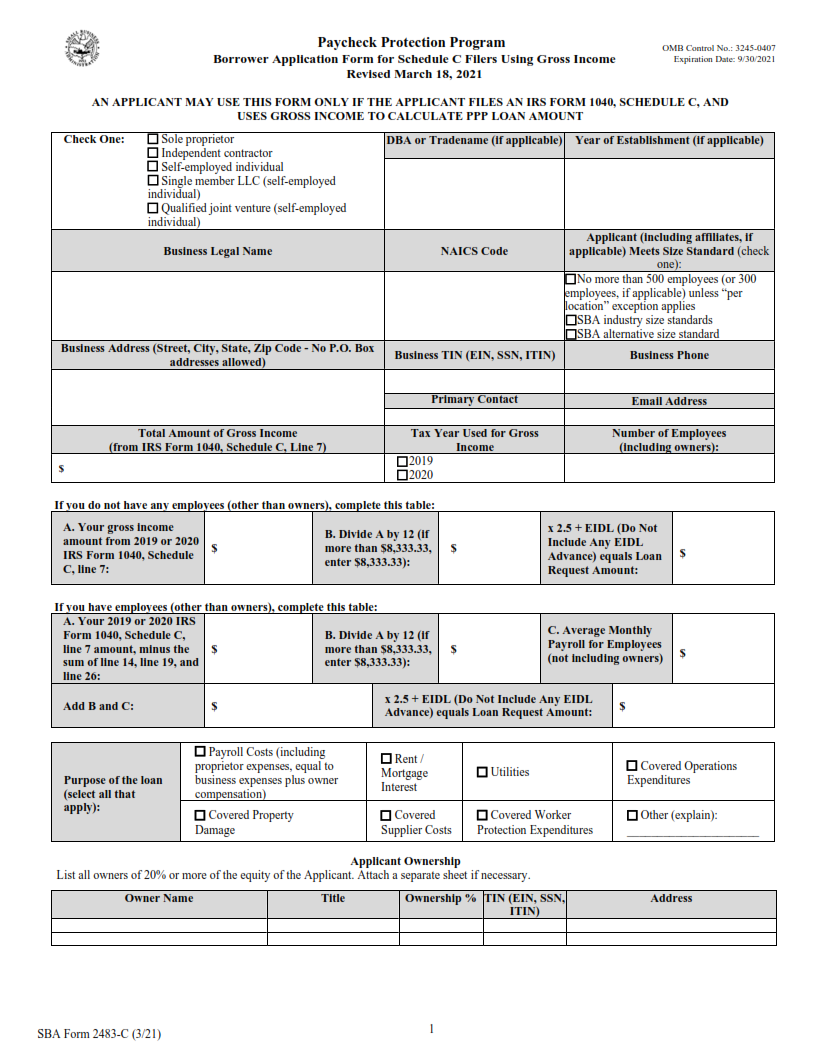

ORIGINFORMSTUDIO.COM – SBA FORM 2483-C – First Draw Borrower Application Form for Schedule C Filers Using Gross Income – The Small Business Administration (SBA) Form 2483-C is a First Draw Borrower Application Form for Schedule C Filers Using Gross Income. It is an important form that small business owners must complete if they are applying for the Coronavirus Aid, Relief, and Economic Security (CARES) Act Paycheck Protection Program (PPP). This article will provide an overview of SBA Form 2483-C, including information about what it covers, who needs to fill it out, and tips for completing it correctly.

Download SBA FORM 2483-C – First Draw Borrower Application Form for Schedule C Filers Using Gross Income

| Form Number | First Draw Borrower Application Form for Schedule C Filers Using Gross Income |

| Form Title | Additional Liens Statement |

| File Size | 471 KB |

| Form By | SBA Forms |

What is a SBA FORM 2483-C?

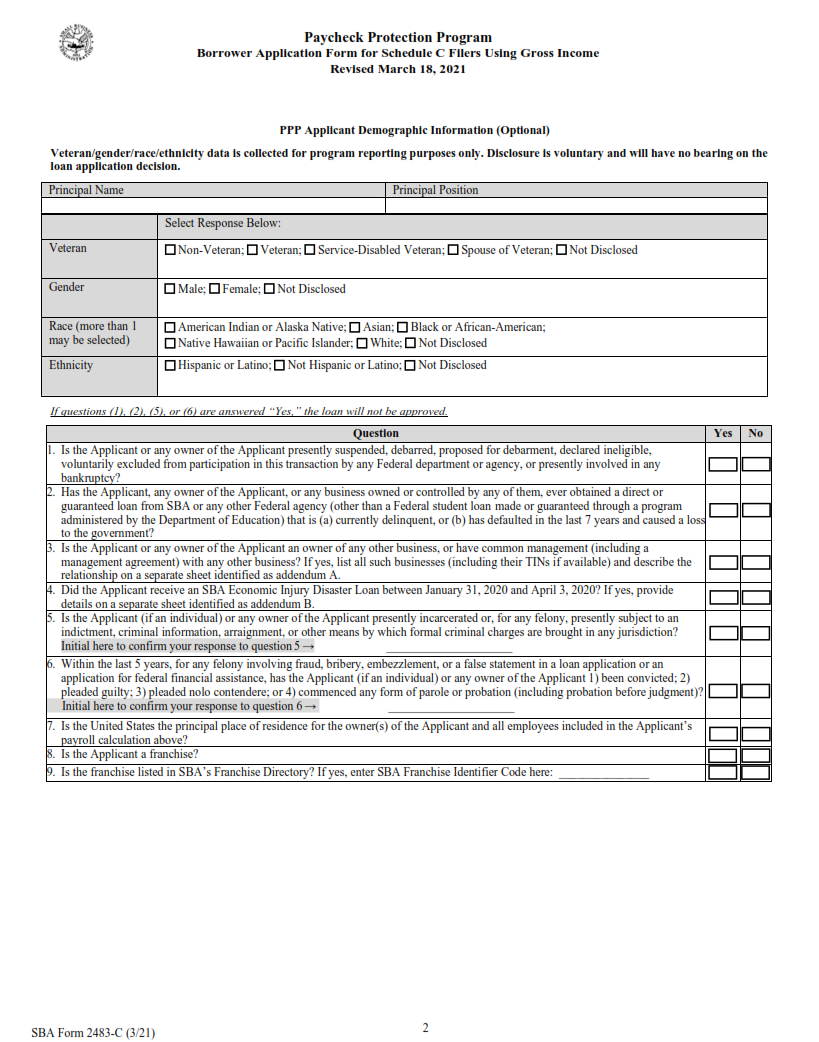

SBA Form 2483-C is the first draw borrower application form for Schedule C filers using gross income to apply for a loan through the Small Business Administration (SBA). This form provides information about the business, its owners, and other financial data necessary to determine eligibility for an SBA loan. It requires detailed financial information from both the business and its owners, including tax returns, balance sheets, income statements, and other documents. The form also includes questions about any existing debt obligations of both the business and its owners.

The purpose of this form is to ensure that potential borrowers are qualified under SBA guidelines before they are approved for an SBA loan. All applicants must complete this form in order to be eligible for an SBA loan. The information provided on this form will be used by lenders to assess risk and decide whether or not to issue a loan.

What is the Purpose of SBA FORM 2483-C?

The Small Business Administration (SBA) Form 2483-C, also known as the First Draw Borrower Application Form for Schedule C Filers Using Gross Income, is an important document for small business owners who need to apply for a Paycheck Protection Program loan. The purpose of this form is to provide information about the borrower’s business and financial situation in order to determine whether they are eligible for a PPP loan.

This form requires that borrowers provide details about their gross income and expenses, such as estimated revenue and costs associated with running their business. This information is used to calculate how much money the borrower can borrow from the government through the PPP program. Additionally, it enables lenders to verify that applicants meet all the eligibility requirements set by SBA in order to receive a loan.

Where Can I Find a SBA FORM 2483-C?

The SBA Form 2483-C is an application form used by businesses that file taxes under Schedule C. It is the first step in applying for a loan from the Small Business Administration (SBA). The form must be completed and submitted to the lender for review and processing of your loan request.

The SBA Form 2483-C can be found on the SBA website, as well as on various other websites devoted to small business lending. Additionally, many lenders will provide their own version of the form for applicants to fill out. Once you have obtained a copy of this form, it should be completed with all necessary information and submitted along with any other required documents to your lender. Be sure to read through all instructions carefully before completing this application so that your information is entered accurately and completely.

SBA FORM 2483-C – First Draw Borrower Application Form for Schedule C Filers Using Gross Income

The SBA FORM 2483-C is a loan application form that must be submitted by self-employed taxpayers who file taxes on Schedule C of the Internal Revenue Service (IRS). This form is used to apply for a first draw Paycheck Protection Program (PPP) loan. It should be completed and submitted along with other relevant documents, including tax returns and proof of payroll costs, to support the borrower’s eligibility for relief under the PPP program.

The SBA FORM 2483-C requires information about both the applicant and their business. It will ask for basic contact details, as well as financial information about the business such as net income or loss from operations, gross receipts or sales, expenses incurred during operations and wages paid to employees.

SBA FORM 2483-C Example