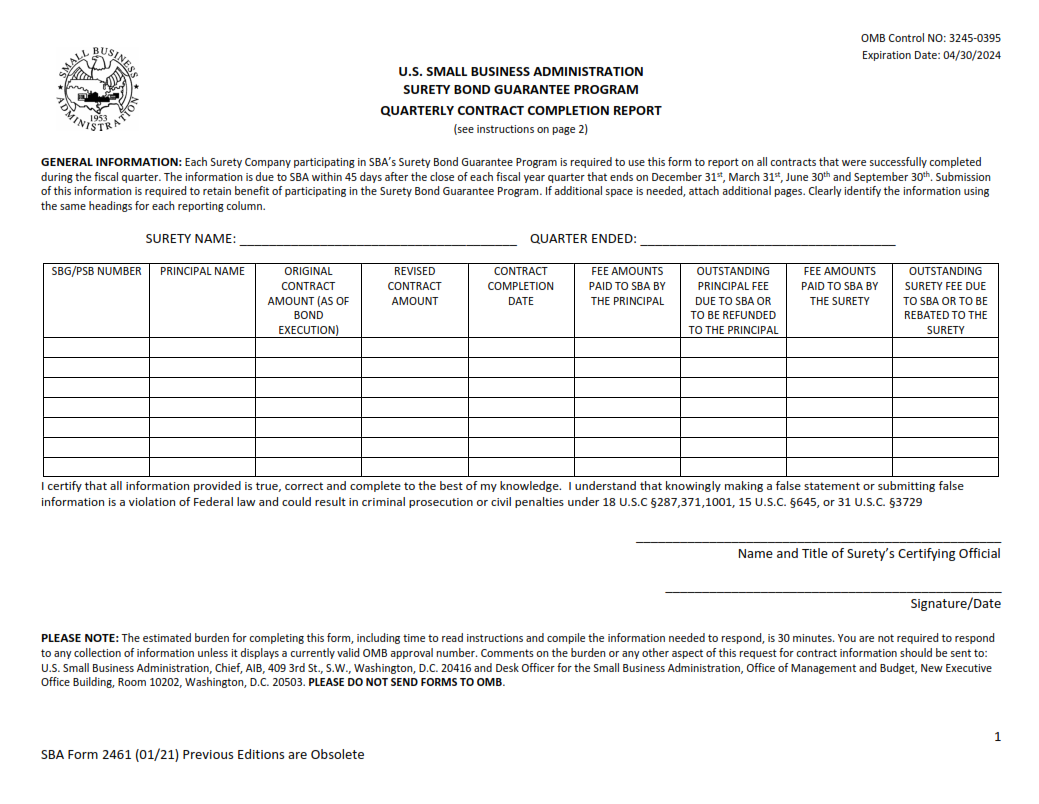

ORIGINFORMSTUDIO.COM – SBA Form 2461 – Quarterly Contract Completion Report – The Small Business Administration (SBA) is an organization that provides support to small businesses in the form of loans and other financial assistance. One important document that all small business owners need to complete is SBA Form 2461—the Quarterly Contract Completion Report. This form provides essential information about a business’s contract performance, helping the SBA determine whether or not they are fulfilling their contractual obligations. It also helps track payments, deadlines, and any changes to the original contract.

Download SBA Form 2461 – Quarterly Contract Completion Report

| Form Number | SBA 2461 |

| Form Title | Quarterly Contract Completion Report |

| File Size | 171 KB |

| Form By | SBA Forms |

What is a SBA Form 2461?

The Small Business Administration (SBA) Form 2461 is a document that must be completed by businesses who are involved in government contracts. The form is used to provide information related to the completion status and other details of contracts that have been awarded under the Small Business Act.

This form is usually submitted quarterly, however the frequency of submission may vary depending on the type of contract and its complexity. The SBA Form 2461 requires contractors to provide detailed financial information, including costs incurred and profits earned, as well as a description of any unusual circumstances or problems encountered during performance of the contract. This information helps federal agencies assess whether small businesses are meeting their contractual obligations and performing adequately under government contracts.

What is the Purpose of SBA Form 2461?

The Small Business Administration (SBA) Form 2461 is used to track the progress of a contract and its completion. It also provides an overview of whether a contractor or subcontractor has met their obligations under the contract, ensuring that all parties have been paid accordingly. This form helps to ensure that contracts are completed in a timely manner while providing transparency into the status of a project.

The purpose of SBA Form 2461 is to collect information regarding the completion of contracts by contractors and subcontractors. This form requires detailed information such as when work on a project began, what tasks have been completed, when payment was made, and any other relevant details. This data can then be used to track progress and ensure compliance with contractual agreements by both parties involved. Additionally, this form serves as documentation for future allocations or potential disputes regarding payment or deadlines related to the contract.

Where Can I Find a SBA Form 2461?

The Small Business Administration (SBA) Form 2461 is an important tool for contractors working on government contracts. The form helps contractors track their progress and ensure they are meeting all contract requirements. It is important to complete the form accurately and submit it on time in order to remain compliant with SBA regulations.

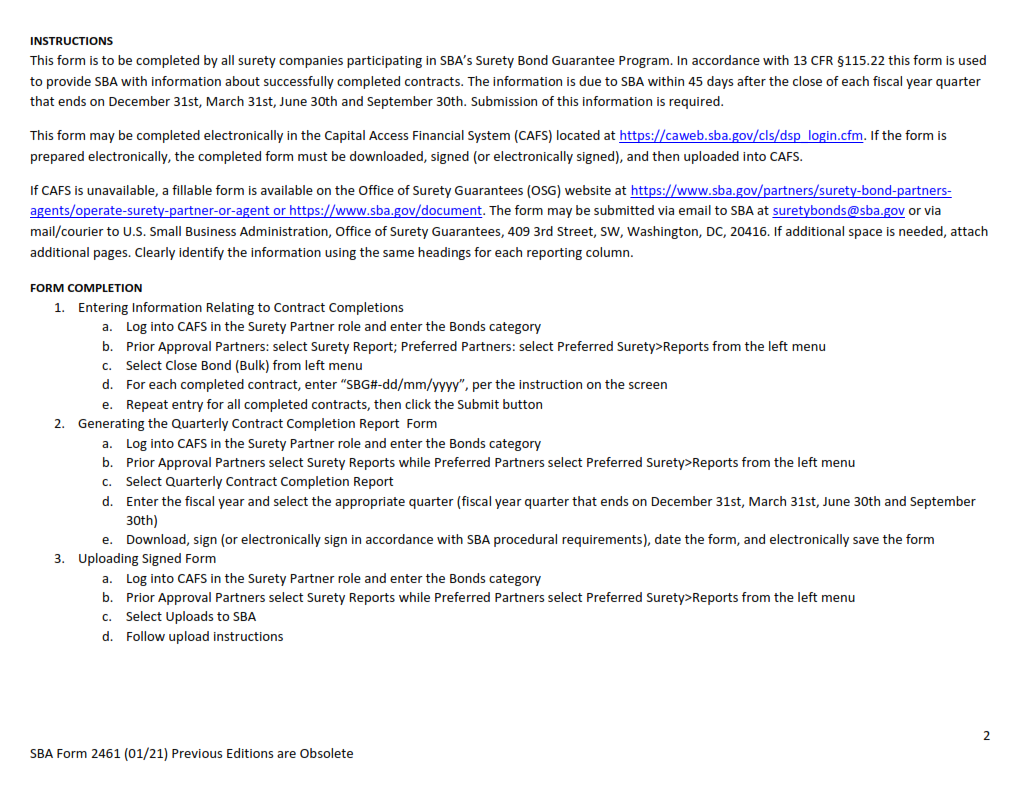

The SBA Form 2461 can be found online or requested from the contracting office of the applicable agency. Additionally, contractors can submit their form electronically through a system provided by the Federal Acquisition Regulation System (FAR). For more detailed instructions on obtaining and completing the form, contractors should refer to guidance from their local Small Business Development Center or review the instructions available on sba.gov. All forms must be signed by both parties before being submitted and must include a statement outlining any changes that were made since submission of the last report.

SBA Form 2461 – Quarterly Contract Completion Report

The U.S Small Business Administration (SBA) Form 2461 is a Quarterly Contract Completion Report used to track the progress of government contracts by contractors and subcontractors. This form is designed to help ensure that all requirements for contract completion are met, and enables the SBA to monitor contractor performance throughout the term of their agreement. The form requires contractors and subcontractors to report on their progress within 90 days after each quarter ends.

Contractors and subcontractors must provide detailed information regarding any progress made on current contracts as well as any new contracts they have entered into during the quarter being reported. Additionally, they must advise of any changes in personnel or materials used in order to complete their contractual obligations. These quarterly reports make it easier for the SBA to hold contractors accountable for meeting deadlines and fulfilling agreements in a timely manner.

SBA Form 2461 Example