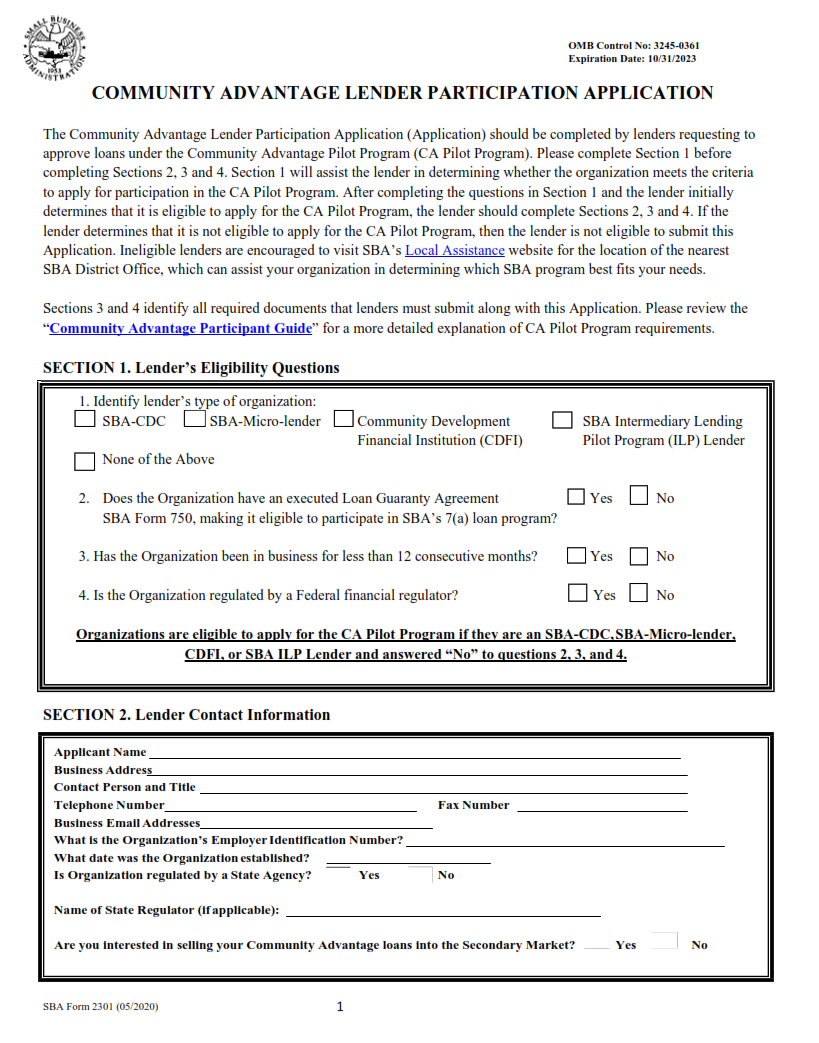

ORIGINFORMSTUDIO.COM – SBA Form 2301 – Community Advantage Lender Participation Application – The SBA Form 2301 is an important document for those looking to take advantage of the U.S. Small Business Administration’s Community Advantage lending program. This form must be completed and submitted by the applicant in order to become an approved SBA lender, providing small business owners with access to capital through the Community Advantage loan program. The application process can seem intimidating at first, but with this article, we’ll provide a comprehensive guide on how to properly fill out and submit the SBA Form 2301.

Download SBA Form 2301 – Community Advantage Lender Participation Application

| Form Number | SBA Form 2301 |

| Form Title | Community Advantage Lender Participation Application |

| File Size | 260 KB |

| Form By | SBA Forms |

What is an SBA Form 2301?

Small businesses may be unfamiliar with SBA Form 2301, which is an application that lenders must complete to become a Community Advantage Lender. This form is designed to ensure that Community Advantage lenders have the necessary resources, expertise, capacity and commitment required by the Small Business Administration (SBA) to provide financial assistance to small business owners in underserved markets.

By becoming a Community Advantage lender, organizations are able to expand their reach into low-income and minority communities, as well as other areas of need. Through this program, lenders can offer up to $250,000 in capital financing at competitive interest rates for larger loan amounts than conventional loans require. To facilitate these loan options for small business owners, SBA Form 2301 serves as the initial step for potential lenders wishing to participate in this program.

What is the Purpose of SBA Form 2301?

Small Business Administration (SBA) Form 2301 is a document that enables individuals or organizations to apply to become an SBA-approved Community Advantage Lender. This type of loan program is designed to assist small businesses in underserved markets and lower-income areas by providing greater access to capital. It allows lenders to offer more flexible terms and lower interest rates than traditional SBA loans, making it easier for entrepreneurs in these communities to start and grow their businesses.

The purpose of SBA Form 2301 is twofold: first, it helps lenders assess whether or not the applicant qualifies for the program; second, it provides the lender with important information about the applicant’s business plan, financials, and credit history.

Where Can I Find an SBA Form 2301?

SBA Form 2301 is an important form that must be filled out for Community Advantage Lender Participation Applications. It is available on the Small Business Administration (SBA) website and can be accessed by selecting the link titled “Lenders: Community Advantage” from the SBA webpage. This will lead to a page with instructions on how to submit the application, including where to download SBA Form 2301. The application can also be found in PDF format directly from the SBA website’s Forms and Publications section.

Another option for obtaining SBA Form 2301 is to call or visit any of your local district offices of the Small Business Administration, where professional staff will help you complete and submit it properly. Additionally, applications are accepted by mail, fax or email as well as in person at most district offices.

SBA Form 2301 – Community Advantage Lender Participation Application

The U.S. Small Business Administration’s (SBA) Form 2301 is used to apply for participation in the Community Advantage Program (CAP). The CAP was created by the SBA to increase access to capital for underserved small businesses and entrepreneurs, particularly those in rural and low-income communities. The program offers loans of up to $250,000 with flexible terms and lower fees than those offered through traditional lending programs.

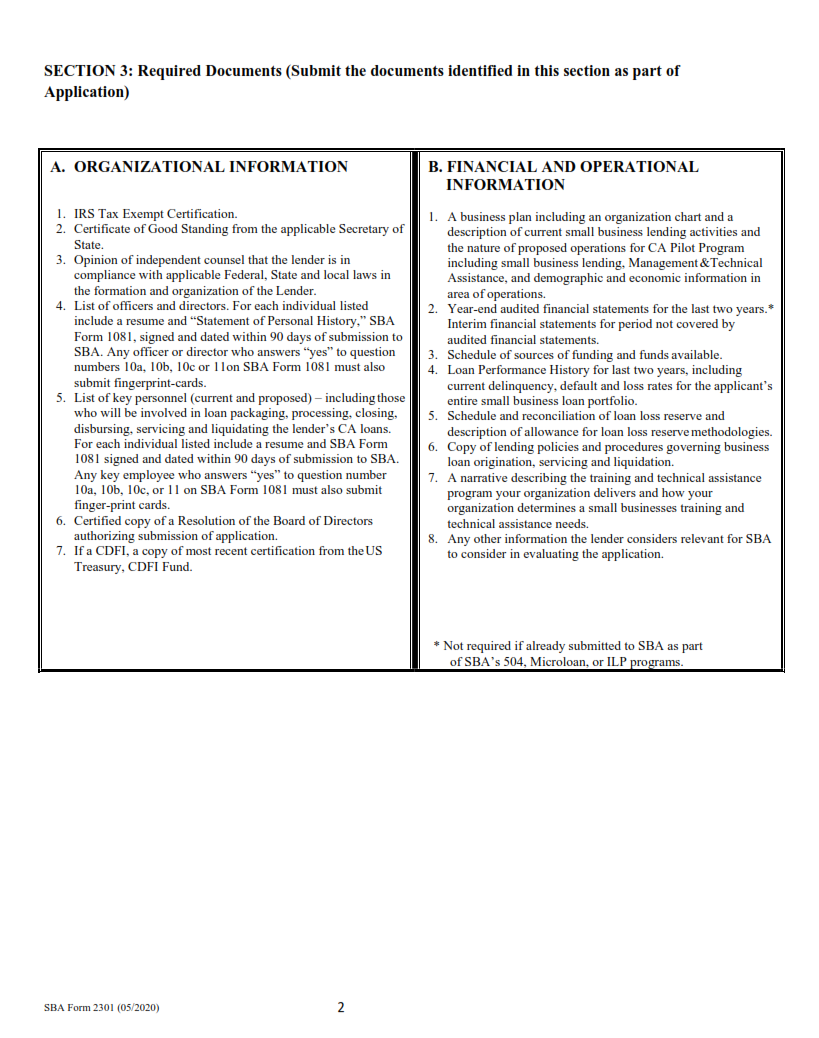

In order to participate in CAP, lenders must complete the SBA Form 2301 application, which requires information about their organization such as its size and assets, as well as its experience working with small business owners. Additionally, lenders must demonstrate an understanding of their local market conditions including an awareness of any special needs or challenges facing potential borrowers in their area.

SBA Form 2301 Example