ORIGINFORMSTUDIO.COM – SBA Form 2163 – 5-Yr LMI Debenture Certification Form – The U.S. Small Business Administration (SBA) is a government agency that provides resources, financing and support to small businesses across the country. For those who need assistance with long-term investments, the SBA offers Form 2163 – 5-Yr LMI Debenture Certification Form as part of its suite of services for small business owners. This form helps ensure that investments are made in economically disadvantaged areas and can lead to significant financial rewards for borrowers. In this article, we’ll discuss what SBA Form 2163 is, how it works and who can benefit from it.

Download SBA Form 2163 – 5-Yr LMI Debenture Certification Form

| Form Number | SBA Form 2163 |

| Form Title | 5-Yr LMI Debenture Certification Form |

| File Size | 127 KB |

| Form By | SBA Forms |

What is an SBA Form 2163?

SBA Form 2163, also known as the 5-Year Low-Moderate Income Debenture Certification Form, is a form used by small business owners to certify that their businesses are located in an area of low or moderate income. The purpose of this form is to provide the Small Business Administration (SBA) with evidence that investing in the small business will help stimulate economic activity in an area designated as low or moderate income. This certification is required for businesses seeking SBA financing, such as those applying for SBA 7(a) loans, 504 loans and microloans.

The form must be filled out and signed by either the applicant’s chief executive officer (CEO) or corporate president. It requires information about the company’s location, number of employees and gross revenues.

What is the Purpose of SBA Form 2163?

SBA Form 2163 is a five-year LMI (low and moderate-income) debenture certification form. This form is used by the Small Business Administration (SBA) to ensure that businesses are complying with the requirements of its 7(a) loan program. The purpose of this form is to certify that a business has met all of the eligibility requirements for receiving a loan from the SBA, including having an annual gross revenue that does not exceed $2 million and being located in an economically disadvantaged area.

The completion of this form also certifies that the business has made every effort to expand access to capital, promote economic development, and create job opportunities in low- and moderate-income areas. By providing lenders with this certification, they can be assured that their credit risk will be reduced when considering granting loans through participating financial institutions.

Where Can I Find an SBA Form 2163?

Small Business Administration (SBA) Form 2163 is an important document used to certify the eligibility of a business for a 5-year LMI Debenture. This form must be submitted by all applicants seeking a low-interest loan from the Small Business Administration. It is available directly from the SBA website and can be downloaded as a PDF file or printed copy.

In order to obtain Form 2163, applicants must first register for an SBA account on their website. Once registered, individuals will have access to the form and other resources related to the program. The application should include all relevant documentation such as financial records and other information regarding the applicant’s business structure and background. After completing Form 2163, it should be mailed or emailed back to the SBA along with supporting documents for review and approval.

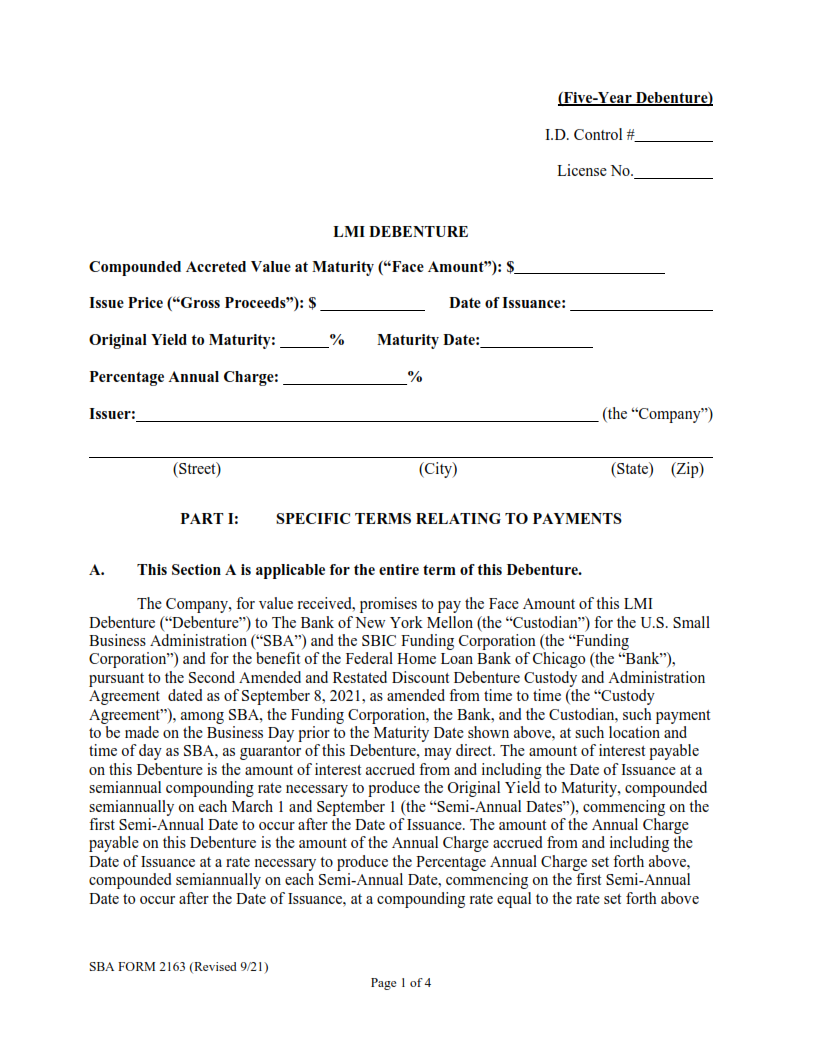

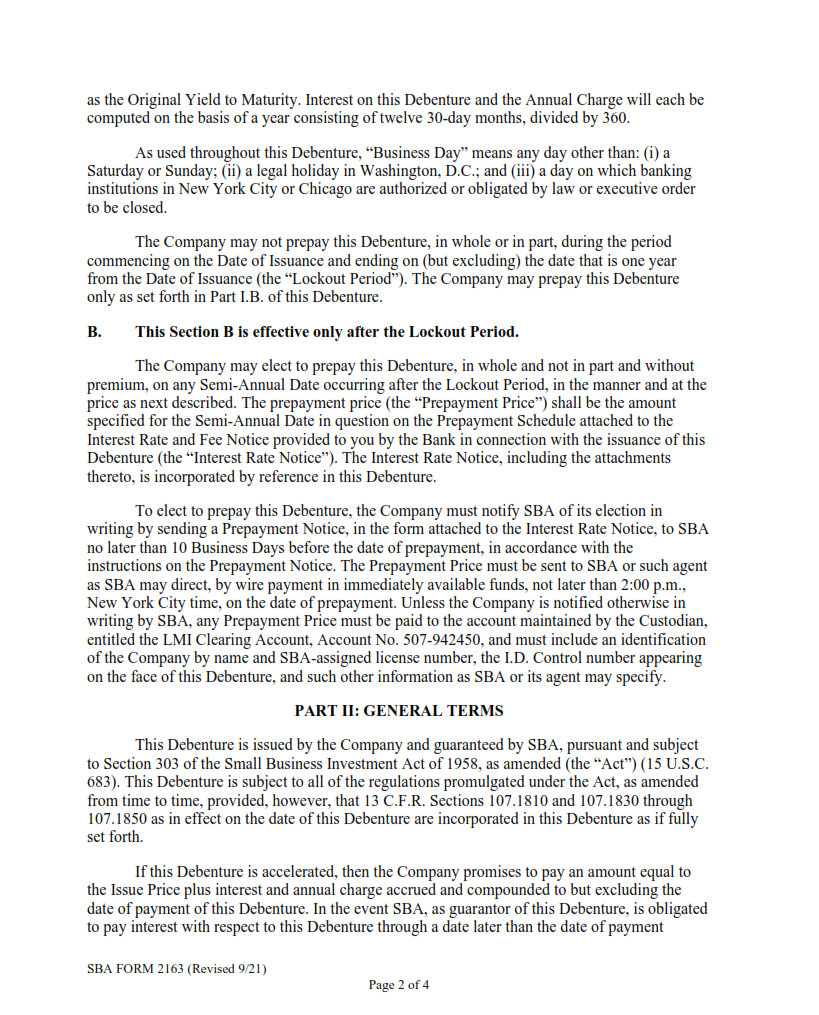

SBA Form 2163 – 5-Yr LMI Debenture Certification Form

The SBA Form 2163 – 5-Yr LMI Debenture Certification Form is an important document for businesses that are seeking financial assistance from the Small Business Administration (SBA). This form must be completed by a lender or other third party to certify that the business qualifies as a low-moderate income borrower. The form includes basic information about the business such as the type of debenture being issued, current financial status and location, as well as a description of how the loan will be used.

The SBA Form 2163 is designed to ensure that small businesses are eligible for funding through SBA loans and other programs. By certifying eligibility through this form, lenders can have confidence in providing capital to borrowers who meet requirements established by the SBA.

SBA Form 2163 Example