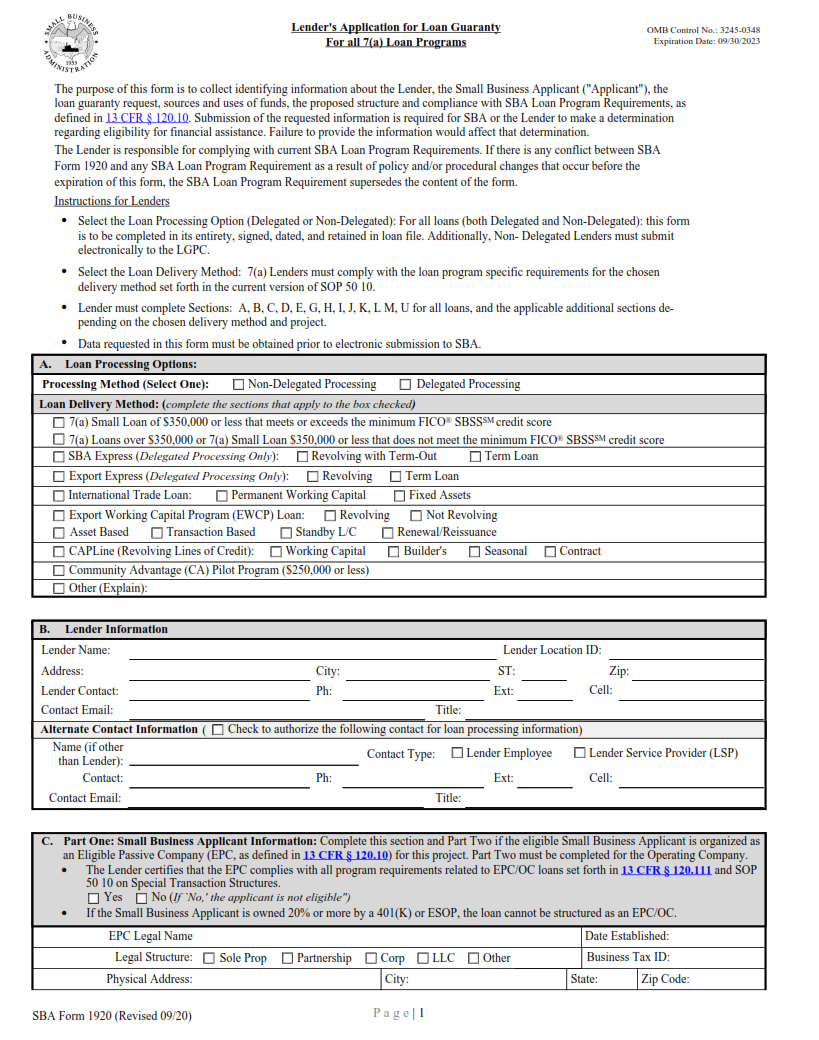

ORIGINFORMSTUDIO.COM – SBA Form 1920 – Lender’s Application for Guaranty – The Small Business Administration (SBA) Form 1920 is a required document for lenders who are seeking an SBA loan guaranty. It is important to understand that this form is used by the lender to apply for a loan guaranty from the government, and should be filled out in its entirety with accurate information. A guaranty from the SBA can provide peace of mind to lenders when making loans to small businesses, as it guarantees repayment of up to 75% of a loan in case of default by the borrower.

Download SBA Form 1920 – Lender’s Application for Guaranty

| Form Number | SBA Form 1920 |

| Form Title | Lender’s Application for Guaranty |

| File Size | 1 MB |

| Form By | SBA Forms |

What is a SBA Form 1920 Form?

The SBA Form 1920 is a necessary document for any lender looking to process an application for an SBA loan guarantee. This form must be completed in its entirety as it serves as the primary source of information used by the Small Business Administration (SBA) to determine whether or not a particular loan request should be approved. Information provided on this form includes details about the applicant’s financial situation, such as their credit history and the amount of money they are requesting from the lender.

The SBA Form 1920 also provides a way for lenders to accurately assess the risk involved with approving each loan request. The form requires detailed information on how much collateral will be used to secure each loan, which helps lenders ensure that they have enough security measures in place before they approve any loans.

What is the Purpose of SBA Form 1920 Form?

The Small Business Administration (SBA) Form 1920, otherwise known as the “Lender’s Application for Guaranty” is a necessary document when applying for an SBA loan. This form serves as a binding agreement between the lender and the borrower, and it outlines all relevant information related to the loan.

The purpose of this form is to provide lenders with assurance that their loans will be backed by an SBA guarantor should borrowers default on payments. It also allows lenders to access funds from the U.S. Treasury in case of borrower delinquency or default. The form includes details like the name of both parties involved, the terms of repayment, and any applicable fees or taxes associated with the loan. Additionally, this form provides documentation of all agreements between lender and borrower for future reference if needed.

Where Can I Find a SBA Form 1920 Form?

The SBA Form 1920, or the Lender’s Application for Guaranty, is an important document that lenders must fill out when applying for a Small Business Administration (SBA) loan. This form requests information about the requested loan and also requires the lender to provide financial statements and other documents to support their application.

The SBA Form 1920 may be obtained directly from the Small Business Administration website for free download in either PDF or Word format. Additionally, local lending offices are likely to have copies of this form available as well. When filling out this form, it is important to make sure all required fields are filled out accurately and completely in order to ensure a successful loan application process. It is also important to remember that certain documents such as profit/loss statements and balance sheets must be attached before submitting the completed SBA Form 1920.

SBA Form 1920 – Lender’s Application for Guaranty

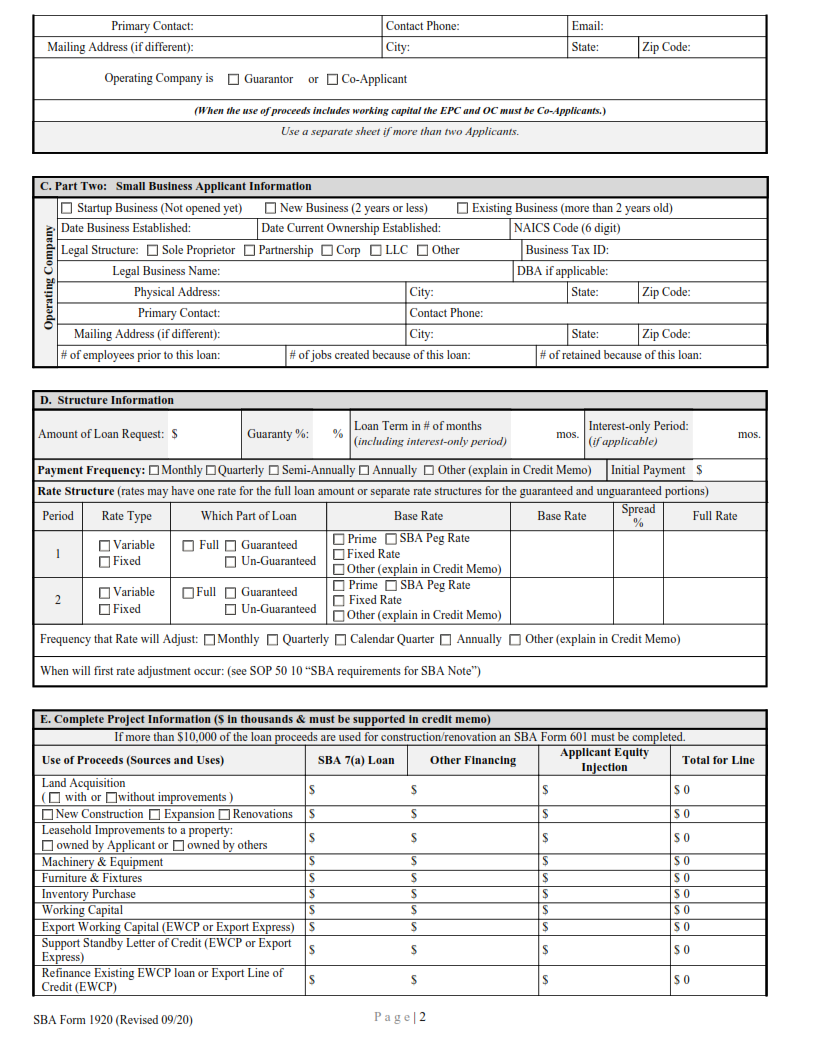

The SBA Form 1920 is an application for lender’s to submit for the Small Business Administration’s (SBA) guaranty. It provides information about the loan, its purpose, and other details necessary to assess the eligibility of a loan request. This form is required when applying for an SBA-backed loan.

The form includes information such as the borrower’s name and address, credit history, business experience and financial statements. The lender must provide proof of their own financial strength by providing documents such as bank statements or tax returns. This form also requires a description of how the borrower will use proceeds from the loan and how they plan to repay it. Additionally, all parties involved in the transaction must sign this form in order to move forward with processing the application.

SBA Form 1920 Example