ORIGINFORMSTUDIO.COM – SBA Form 1368 – Additional Filing Requirements Economic Injury Disaster Loan (EIDL), and Military Reservist Economic Injury Disaster Loan (MREIDL) – Small businesses are the backbone of our economy, and in times of economic hardship they need additional support. In response to the COVID-19 pandemic, the Small Business Administration (SBA) has introduced two emergency loan programs: Economic Injury Disaster Loans (EIDLs) and Military Reservist Economic Injury Disaster Loans (MREIDLs). To apply for these loans, business owners must file Form 1368 with the SBA.

Download SBA Form 1368 – Additional Filing Requirements Economic Injury Disaster Loan (EIDL), and Military Reservist Economic Injury Disaster Loan (MREIDL)

| Form Number | SBA Form 1368 |

| Form Title | Additional Filing Requirements Economic Injury Disaster Loan (EIDL), and Military Reservist Economic Injury Disaster Loan (MREIDL) |

| File Size | 163 KB |

| Form By | SBA Forms |

What is an SBA Form 1368?

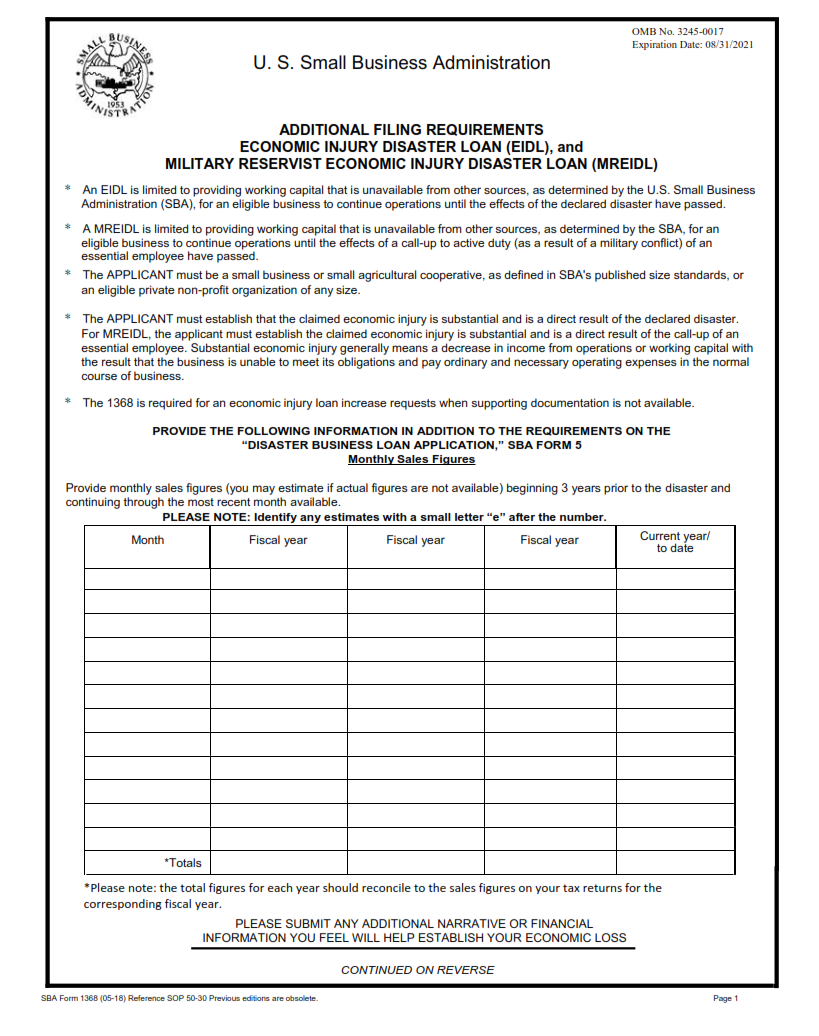

The U.S. Small Business Administration (SBA) Form 1368 is an important filing requirement for businesses impacted by the COVID-19 pandemic. It serves as a request for additional funds from SBA Economic Injury Disaster Loans (EIDL) and Military Reservist Economic Injury Disaster Loan Advance (MREIDLA). This form must be completed when a borrower has received their initial loan amount but is still in need of additional funds to cover operating expenses due to the impact of the disaster or emergency.

Form 1368 requires detailed information about how the business was affected by the disaster, including its reduced income and any other expenses it incurred during that time period.

What is the Purpose of SBA Form 1368?

SBA Form 1368 is an additional filing requirement for Economic Injury Disaster Loan (EIDL) and Military Reservist Economic Injury Disaster Loans (MREIDL). This form must be filed by the applicant to provide the Small Business Administration (SBA) with information about their economic condition before, during, and after the disaster. The purpose of SBA Form 1368 is to help the SBA determine whether a loan can be granted to an applicant who has suffered economic injury as a result of a declared disaster.

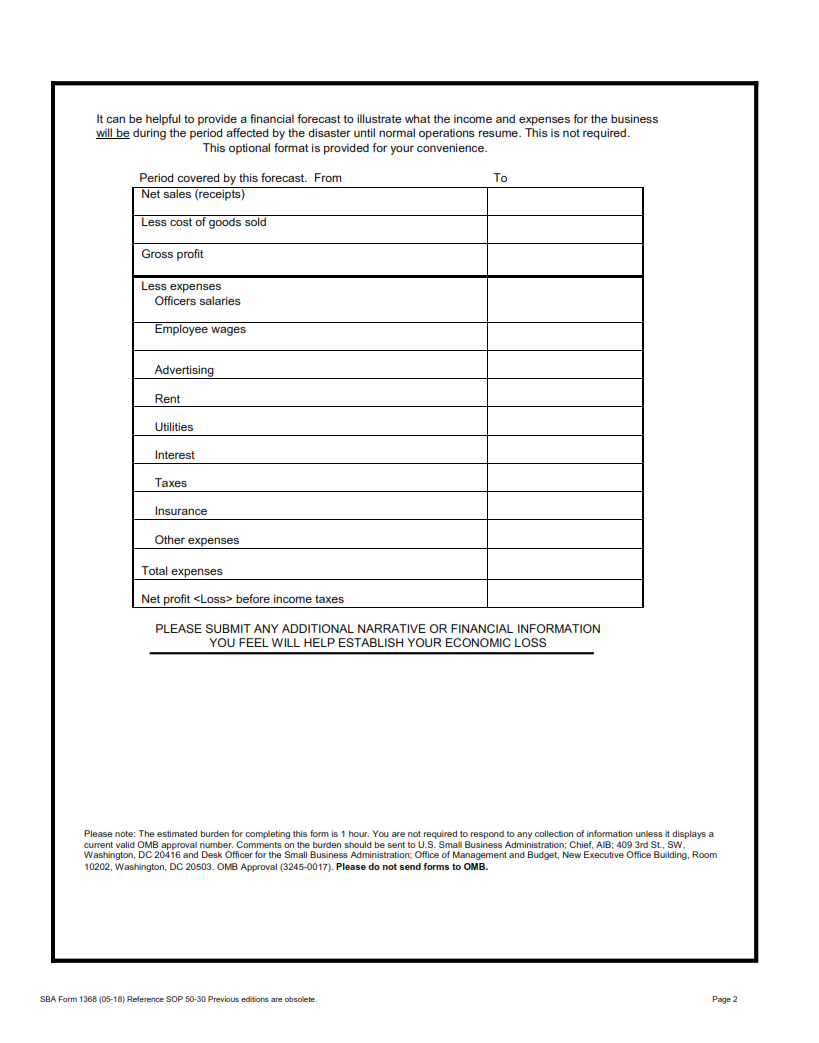

The information provided on this form helps the SBA evaluate each loan application and determine if it will be approved or denied. It includes financial information about a business’s sales revenues, profits, wages paid to employees, and other expenses incurred during the period of time affected by a declared disaster.

Where Can I Find an SBA Form 1368?

An SBA Form 1368 is an important document for businesses applying for the Economic Injury Disaster Loan (EIDL) or Military Reservist Economic Injury Disaster Loan (MREIDL). This form must be completed in order to receive an EIDL or MREIDL. The form helps the Small Business Administration (SBA) accurately assess a business’s financial situation and determine how much of a loan, if any, should be approved.

Business owners and operators can find an SBA Form 1368 on the SBA website under the “Disaster Assistance Forms” section. It is also possible to fill out the form online via electronic signature, which has become increasingly popular due to its convenience and speed.

SBA Form 1368 – Additional Filing Requirements Economic Injury Disaster Loan (EIDL), and Military Reservist Economic Injury Disaster Loan (MREIDL)

SBA Form 1368 is an additional filing requirement for those applying for Economic Injury Disaster Loans (EIDLs). This form must be submitted along with the EIDL application in order to receive funds from the Small Business Administration. The form requires applicants to provide financial information and other details related to the disaster they are facing, such as documenting their losses.

The SBA also offers military reservists additional assistance through their Military Reserve program. This program provides financial support to members of the military reserves who have been impacted by a natural disaster or emergency situation. In addition to providing funding, this program also helps reservists access specialized services such as legal advice and counseling from experienced professionals. To apply for these benefits, military reserve members must submit SBA Form 1368 along with their EIDL application.

SBA Form 1368 Example