ORIGINFORMSTUDIO.COM – PS Form 4615 – PACT Act Application for Business or Regulatory Purposes Exception — Cigarettes and Smokeless Tobacco – The PACT Act is an important piece of regulation for businesses that deal in cigarettes and smokeless tobacco. PS Form 4615 is the application for a business or regulatory purposes exception, allowing for regulated sales within the United States and its territories. This article will provide an overview of this form, what types of businesses should use it, and how to properly fill out and submit it. Filing this form correctly is essential in order to maintain compliance with the PACT Act regulations, ensure continued legal operations, and avoid costly penalties.

Download PS Form 4615 – PACT Act Application for Business or Regulatory Purposes Exception — Cigarettes and Smokeless Tobacco

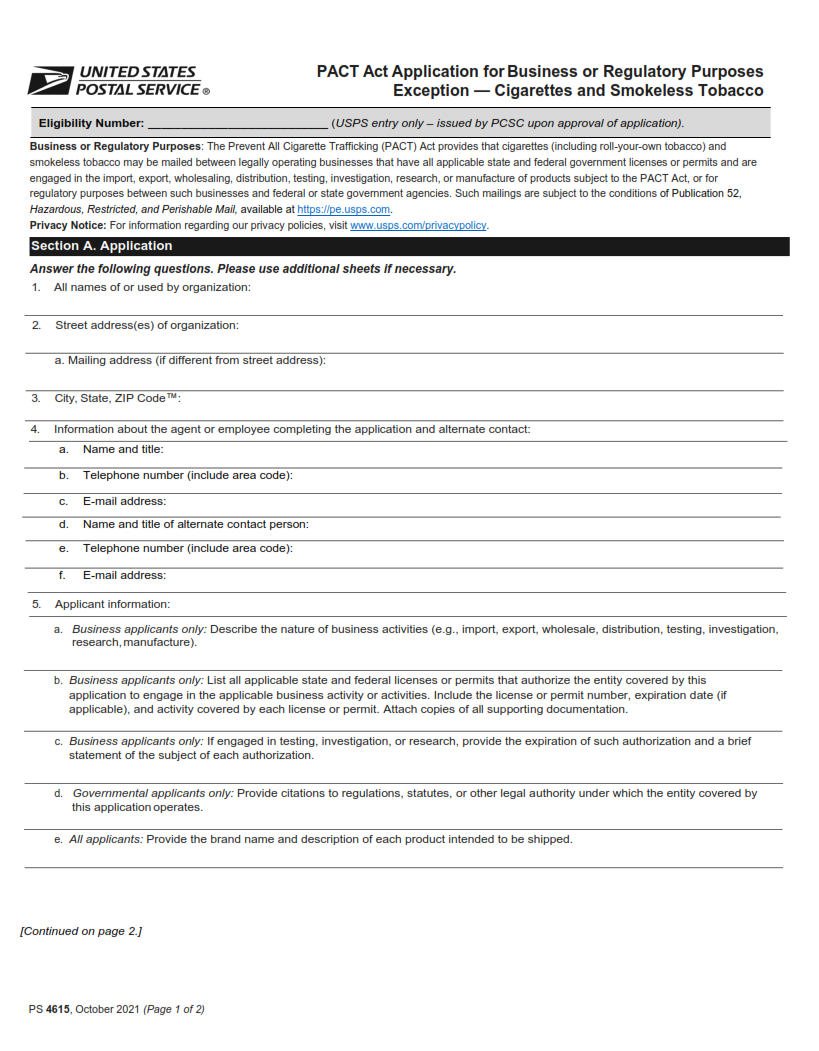

| Form Number | PS Form 4615 |

| Form Title | PACT Act Application for Business or Regulatory Purposes Exception — Cigarettes and Smokeless Tobacco |

| File Size | 148 KB |

| Form By | USPS Forms |

What is a PS Form 4615?

PS Form 4615 is an application form created by the Postal Service to meet requirements under the PACT Act. The Prevent All Cigarette Trafficking (PACT) Act of 2009 is a federal law requiring certain mailers to register with the U.S. Postal Service and pay taxes for shipping cigarettes, smokeless tobacco and other related products through the mail. This form must be used when requesting an exception from these regulations for business or regulatory purposes.

Businesses seeking an exception from the PACT Act should use PS Form 4615, which requires registration information and a statement explaining why an exemption is necessary. Businesses also must provide evidence showing how their activities contribute to public health or safety in order to qualify for this exception. After submitting this form, businesses will receive written notification on whether their request has been approved or denied by the Postal Service.

What is the Purpose of PS Form 4615?

PS Form 4615, or the PACT Act Application for Business or Regulatory Purposes Exception Cigarettes and Smokeless Tobacco, is an application form used by tobacco retailers to apply for an exception from the Prevent All Cigarette Trafficking (PACT) Act. The PACT Act is a federal law that requires all interstate shipments of cigarettes and smokeless tobacco to include proof of compliance with applicable state taxes and laws.

The purpose of PS Form 4615 is to ensure that a qualified retailer can legally obtain the necessary authorization from their local government in order to receive shipments of such products across state lines. This form helps prevent illegal trafficking and smuggling of cigarettes and smokeless tobacco products, as well as preventing under-age use of such products.

Where Can I Find a PS Form 4615?

PS Form 4615 is the application for an exception to the Prevent All Cigarette Trafficking (PACT) Act. This form must be completed by business owners or regulatory agencies who wish to receive an exemption from certain provisions of the PACT Act.

The form can be obtained through the US Postal Service website, where it can be downloaded and printed. Additionally, forms may also be ordered directly from the USPS Business Center, or by calling 1-800-275-8777 (Option #1) and requesting a copy of PS Form 4615. Applicants should ensure that they have all required documents on hand before submitting their application as incomplete and/or incorrect applications will not be accepted for processing.

PS Form 4615 – PACT Act Application for Business or Regulatory Purposes Exception — Cigarettes and Smokeless Tobacco

PS Form 4615 is a form used to apply for an exception from the Prevent All Cigarette Trafficking Act (PACT Act). This form is only applicable to businesses or organizations that use cigarettes or smokeless tobacco products in their regular operations. The PACT Act was created to regulate the sale and distribution of cigarettes and smokeless tobacco products, and it requires sellers and shippers of these goods to register with the federal government, collect state taxes, report sales information, and follow other regulations. By filing PS Form 4615, businesses can be granted an exception from certain provisions of the PACT Act as long as they provide proof that cigarette or smokeless tobacco products are necessary for their business purpose.

PS Form 4615 Example