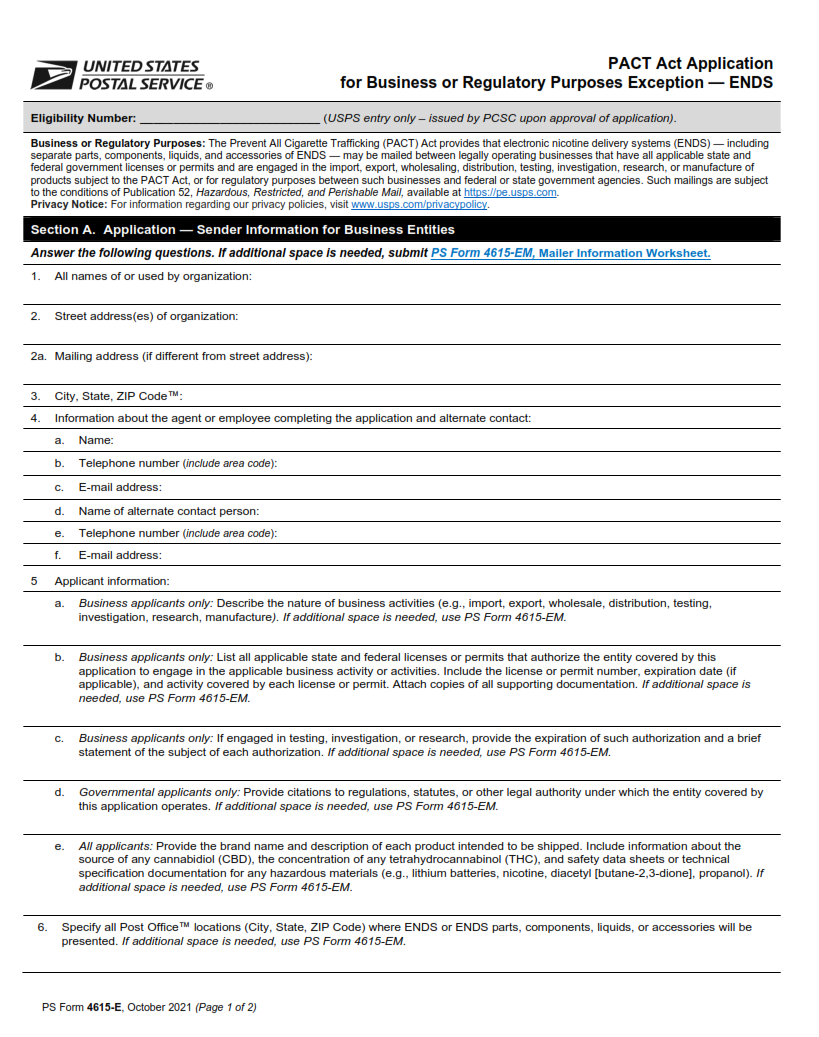

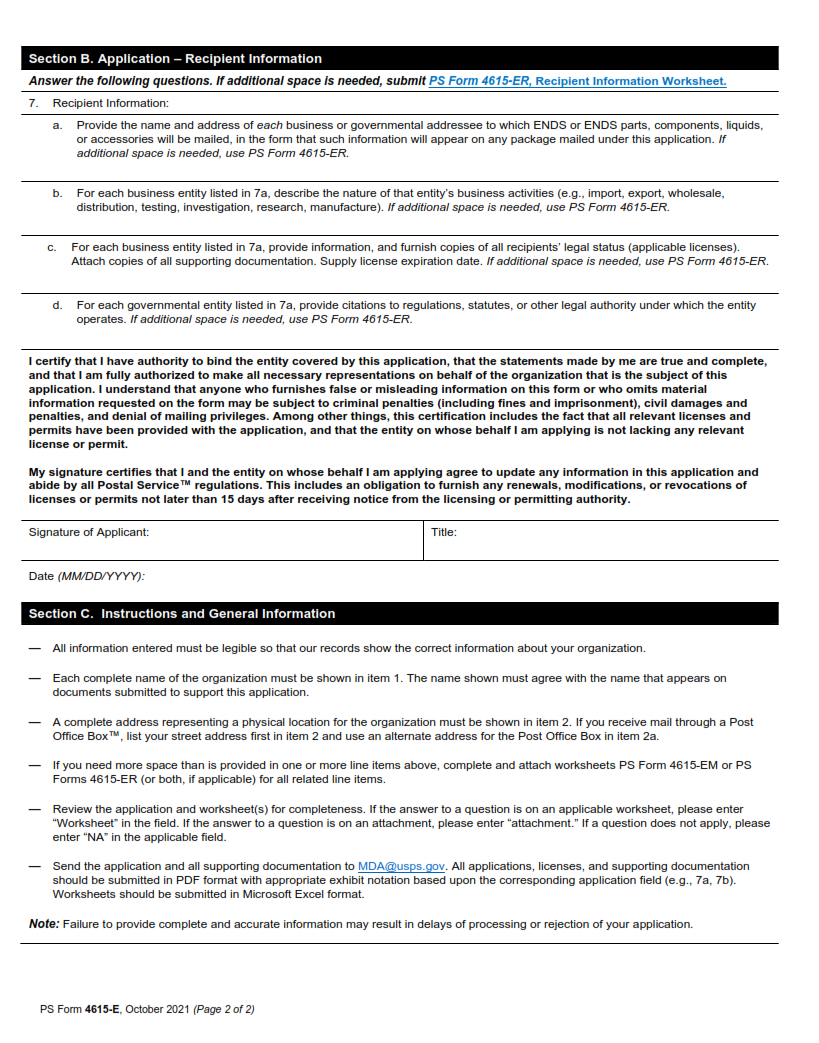

ORIGINFORMSTUDIO.COM – PS Form 4615-E – PACT Act Application for Business or Regulatory Purposes Exception — ENDS – The PACT Act, or Prevent All Cigarette Trafficking Act, is a federal law enacted in 2010 to stop illegal sales of cigarettes and smokeless tobacco products. Businesses must adhere to the guidelines set forth by this act, which include submitting an application for certain exceptions when selling such products. The PS Form 4615-E is the official form used for submitting such applications in order to be granted those exceptions. This article will provide a detailed overview of what the PS Form 4615-E is, who needs to fill it out, and how to properly complete it.

Download PS Form 4615-E – PACT Act Application for Business or Regulatory Purposes Exception — ENDS

| Form Number | PS Form 4615-E |

| Form Title | PACT Act Application for Business or Regulatory Purposes Exception — ENDS |

| File Size | 173 KB |

| Form By | USPS Forms |

What is PS Form 4615-E?

PS Form 4615-E is a United States Postal Service form used to apply for an exception to the Protecting Against Corruption on the Mail (PACT) Act. The PACT Act establishes restrictions and regulations that businesses must follow when sending mail containing alcohol, tobacco, or firearms. Businesses can apply for an exception through PS Form 4615-E if they need to send mail containing any of these items for business or regulatory purposes.

The application requires information about the applicant, including their name and address, type of business, and reason for requesting an exception. The USPS will also require detailed information about the shipment being sent as part of the application process. This includes a description of what is being sent; details on where it is being shipped from and to; a list of all items in the shipment; and verification that all applicable taxes have been collected and paid.

What is the Purpose of PS Form 4615-E?

PS Form 4615-E is a form used by businesses to apply for an exception to the PACT Act, which was enacted in 2009. The purpose of PS Form 4615-E is to enable businesses to send or receive alcohol shipments across state lines legally.

The form must be completed with accurate information and submitted by the business owner along with all required supporting documentation. The application must include detailed information about the business, including contact information and type of entity, as well as details on expected shipping activity. Upon receipt, USPS will review the application and determine whether it meets all requirements outlined in the PACT Act. If approved, USPS will issue a permit that allows businesses to engage in cross-state alcohol shipments without penalty.

In addition to submitting PS Form 4615-E, applicants must also pay an associated fee for their permit application.

Where Can I Find a PS Form 4615-E?

The U.S. Postal Service offers PS Form 4615-E, also known as the PACT Act Application for Business or Regulatory Purposes Exception. This form is used by businesses and organizations in order to obtain an exemption from certain provisions of the Prevent All Cigarette Trafficking (PACT) Act. The PACT Act regulates the delivery of cigarettes and smokeless tobacco products through the mail and requires that all packages containing these items contain a warning label indicating their contents.

PS Form 4615-E can be found on USPS’ website or obtained directly from a local post office branch. In order to complete this form, applicants must provide detailed information about their business, including its name, address, contact information, type of business activity conducted and its compliance with relevant laws and regulations governing the sale of tobacco products.

PS Form 4615-E – PACT Act Application for Business or Regulatory Purposes Exception — ENDS

The PS Form 4615-E, PACT Act Application for Business or Regulatory Purposes Exception (PACE), has ended. The PACE was a part of the Prevent All Cigarette Trafficking (PACT) Act of 2009 and allowed businesses to obtain an exception from the federal requirement to collect state taxes on the sale of certain tobacco products. This form was available for businesses that sold cigarettes or smokeless tobacco directly to consumers via mail, telephone, or internet orders.

The PACE provided a way for businesses to be exempt from collection requirements due to their particular business structure and location. This enabled them to continue selling these products without having to worry about additional taxes or fees associated with complying with state regulations. However, due to changes in federal legislation, the application is no longer available as of October 1, 2020.

PS Form 4615-E Example