I9 Form 2023 Printable – As an employer, navigating the sea of paperwork and forms can be overwhelming. One essential form is Form I-9, which verifies your employee’s eligibility to work in the United States. This comprehensive guide will cover everything you need to know about I-9 forms, including compliance requirements, instructions, and essential tips for a smooth onboarding process.

Understanding the I-9 Form: Purpose and Basics

The I-9 form serves as a crucial tool for employers to confirm the identity and employment authorization of their workforce. This Department of Homeland Security (DHS) form is mandatory for all new employees, regardless of their citizenship status. Both employer and employee must complete and maintain the form as part of the hiring process.

Compliance Requirements for I-9 Forms

To stay compliant with I-9 form requirements, employers must adhere to specific rules and regulations:

- Maintain an I-9 form for each eligible employee.

- Complete sections two and three, while the employee completes section one.

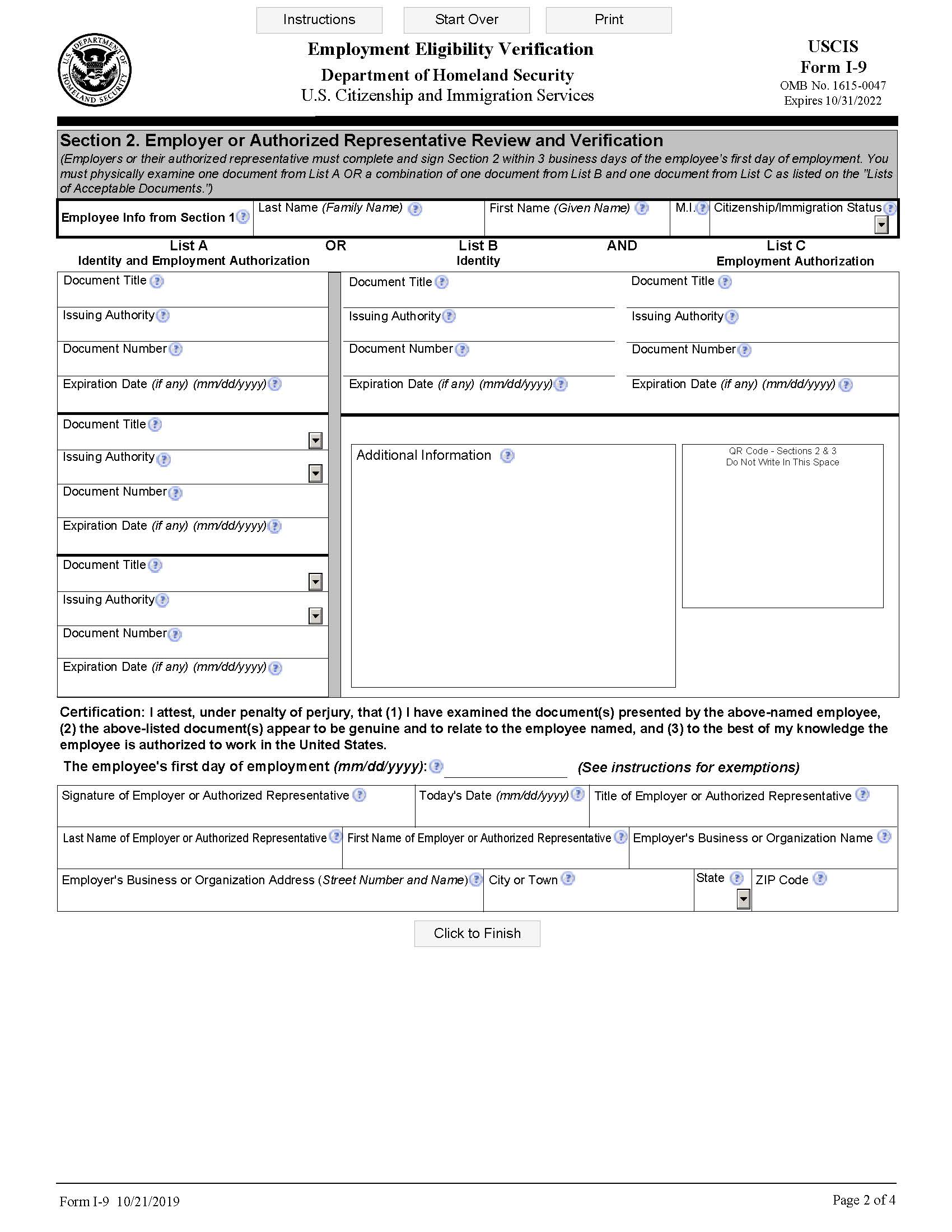

- Verify the employee’s identity using acceptable documents without dictating their choice.

- Retain I-9 forms for three years after the date of hire or one year after employment termination, whichever is longer.

Completing the I-9 Form: A Step-by-Step Guide

To ensure seamless completion of the I-9 form, follow this step-by-step guide:

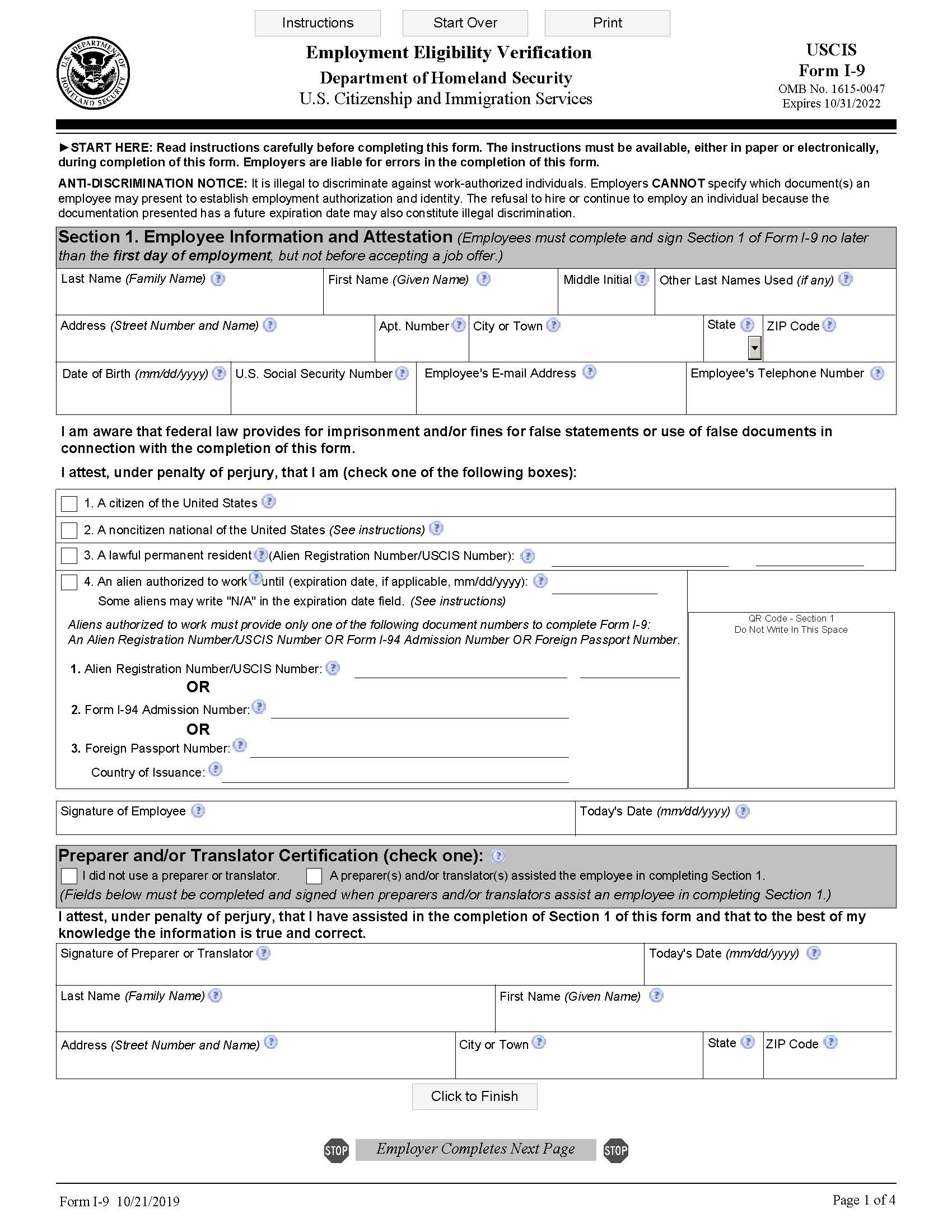

Section 1: Employee Information and Attestation

The employee is responsible for completing this section, which includes providing their current immigration status. They must complete this section no later than their first day of employment.

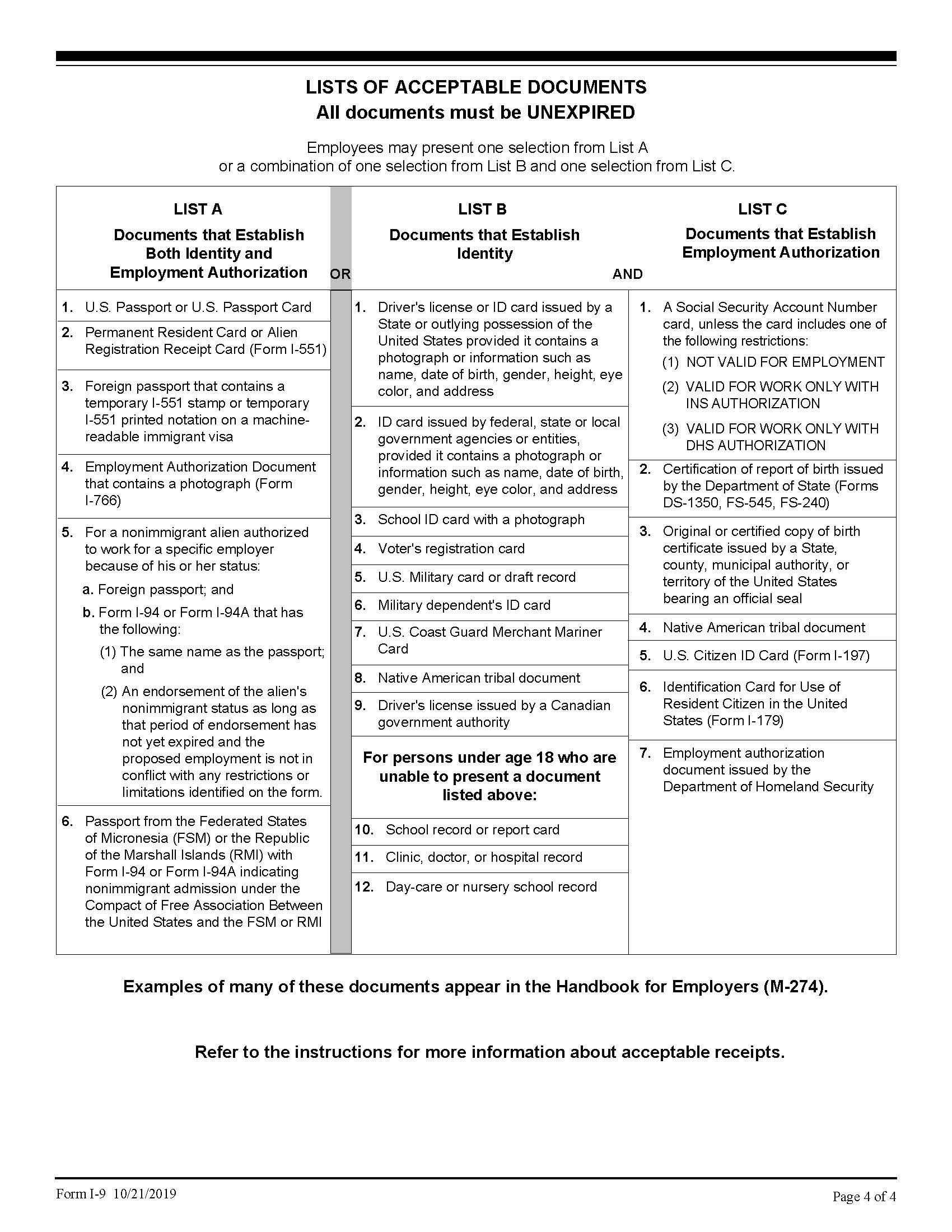

Section 2: Employer Review and Verification

Within three days of starting work, the employee must present specific documents to verify their chosen status. Employers are responsible for reviewing the documents and completing Section 2 accordingly.

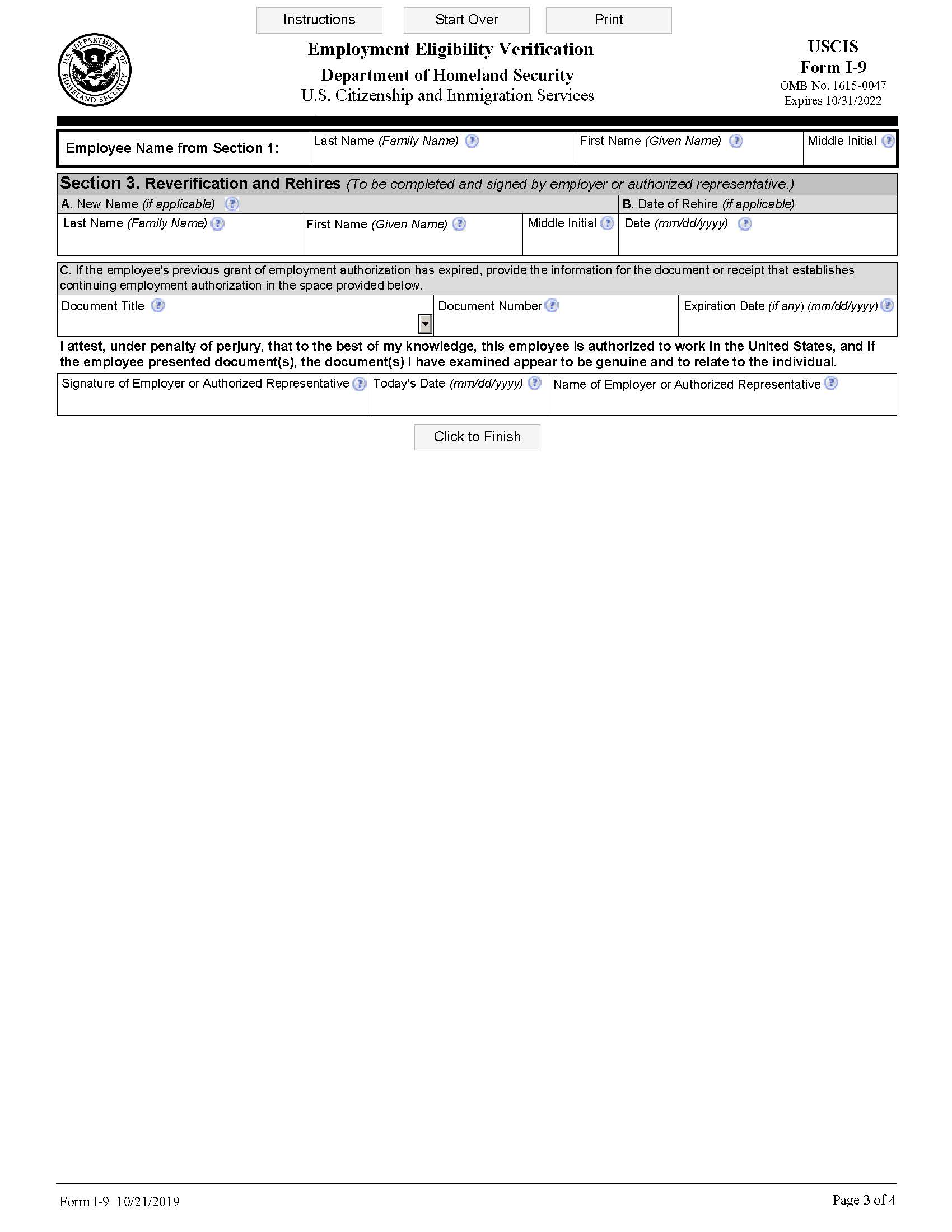

Section 3: Reverification for Rehires

Complete Section 3 only if a former employee is rehired within three years of their original hire date, or if a document used to verify immigration status has expired.

Filing and Retaining the I-9 Form

Unlike other employment forms, the I-9 form is not filed with an outside agency. Employers must retain the form and make it available for inspection by U.S. Government officials if needed. Keep I-9 forms for as long as the employee is employed and at least one year after employment has ended.

Preparing for I-9 Form Audits

With U.S. Immigration and Customs Enforcement (ICE) increasing the frequency of company audits, it’s essential to ensure I-9 forms are filled out accurately and filed on time. Failure to comply may result in steep penalties and fines.

The I-9 form is a critical component of the hiring process. By understanding its purpose, following the compliance requirements, and using this step-by-step guide, employers can confidently navigate the I-9 form and maintain a compliant workforce.

Keeping I-9 Forms Organized and Accessible

To maintain the organization and accessibility of your I-9 forms, consider implementing the following best practices:

- Develop a systematic filing system for all I-9 forms, either in a designated folder or within each employee’s personnel file.

- Regularly audit your I-9 forms to ensure they are accurate, up-to-date, and complete.

- Keep track of expiration dates for employees’ work authorization documents and schedule timely re-verification as necessary.

- Train HR personnel and managers on I-9 form compliance requirements and best practices to ensure consistent execution across your organization.

Utilizing Electronic I-9 Form Solutions

With the advancements in technology, employers can take advantage of electronic I-9 form solutions to streamline the process and improve accuracy. Electronic I-9 systems offer several benefits, such as:

- Automated error checking, which helps to identify and correct common mistakes before submission.

- Integrated E-Verify, allowing for a seamless verification process with the U.S. Citizenship and Immigration Services (USCIS) system.

- Secure storage of digital forms, ensuring easy access and retrieval during audits.

- Real-time alerts for upcoming document expiration dates, allowing for proactive management of employee re-verification.

Understanding Penalties for I-9 Form Noncompliance

Failing to comply with I-9 form requirements can result in severe consequences for employers. Penalties for noncompliance may include:

- Civil fines range from $230 to $2,292 per violation for first-time offenders, with increased penalties for subsequent offenses.

- Criminal penalties, including imprisonment, for engaging in a pattern of hiring unauthorized workers.

- Debarment from government contracts prevents the employer from receiving federal contracts for a specified period.

- Public relations backlash, negatively impacting the employer’s reputation and brand image.

Frequently Asked Questions (FAQs) about I-9 Forms

Q: Can I accept photocopies of documents for I-9 verification purposes?

A: No, employees must provide original documents or certified copies for I-9 verification. Photocopies of documents are not acceptable for this purpose.

Q: Can I specify which documents an employee should present for I-9 verification?

A: No, employers cannot dictate which documents an employee should present for verification. Employees can choose from the list of acceptable documents provided in the I-9 form instructions.

Q: How long do I need to keep I-9 forms on file?

A: Employers must retain I-9 forms for three years after the date of hire or one year after the date of employment termination, whichever is longer.

Q: What should I do if an employee’s work authorization document expires?

A: Employers are responsible for tracking expiration dates of work authorization documents and must reverify the employee’s eligibility by completing Section 3 of the I-9 form before the document expires.

Q: Are there any exceptions to the I-9 form requirements?

A: Independent contractors, employees hired for casual domestic work in a private home on a sporadic basis, and certain individuals employed by foreign governments or international organizations are not subject to I-9 form requirements.

Q: Can I use the Spanish version of the I-9 form?

A: Only employers and employees in Puerto Rico are permitted to complete the Spanish version of the I-9 form. In all other U.S. states and territories, the English version of the form must be used.

Q: What are the penalties for not complying with the I-9 form requirements?

A: Noncompliance with I-9 form requirements can result in civil fines, criminal penalties, debarment from government contracts, and damage to the employer’s reputation.

Q: What should I do if I discover an error on a previously completed I-9 form?

A: If you identify an error on a previously completed I-9 form, you should correct the error, initial and date the correction, and attach a written explanation to the form. It is crucial to maintain accurate records to avoid potential penalties during an audit.